Unit Benefit Formula What It Means How It Works

Contents

Unit Benefit Formula: Meaning and Function

What Is the Unit Benefit Formula?

The unit benefit formula calculates an employer’s contribution to an employee’s defined benefit plan or pension plan based on years of service. While it can reward employees for long-term commitment, it can also be costly for employers.

Key Takeaways

- The unit benefit formula calculates an employer’s contribution to an employee’s pension plan based on years of service.

- The unit benefit formula means the company pays a percentage of the employee’s salary, ranging from 1.25% to 2.5%.

- A retirement plan that uses the unit benefit formula compensates employees for their tenure at the company.

How Does the Unit Benefit Formula Work?

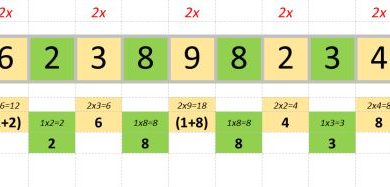

A unit benefit plan is an employer-sponsored pension plan that provides retirement benefits based on a dollar amount or a percentage of the employee’s earnings for each year of service. The unit benefit formula entails the company paying a percentage of the employee’s salary for each year of service.

Typically, a unit benefit plan relies on a percentage ranging from 1.25% to 2.5%. When the employee retires, their years of service are multiplied by the percentage and the career average salary to calculate the annual retirement benefit.

While a unit benefit formula rewards longer tenures, it necessitates the involvement of an actuary, resulting in higher costs for the employer.

Defined Benefit Plan

A defined benefit plan is an employer-sponsored retirement plan that calculates employee benefits using factors such as length of employment and salary history. The company manages portfolio management and investment risk, with restrictions on fund withdrawal without penalties.

Defined benefit plans, including pension plans, provide a predetermined formula for calculating retirement benefits. They differ from other pension funds that depend on investment returns for payout amounts.

If poor returns cause a funding shortfall, employers tap into the company’s earnings to close the gap. The employer assumes all investment risk as they make investment decisions and manage the plan’s investments.

A tax-qualified benefit plan shares similarities with a pension plan, but it offers additional tax incentives for both employers and beneficiaries.

Qualified Retirement Plan

A qualified retirement plan meets the requirements of Internal Revenue Code Section 401a and qualifies for specific tax benefits. Employers establish this type of retirement plan for their employees.

Qualified retirement plans provide employers with tax breaks for their contributions. Plans that allow employees to defer part of their salaries into the plan also reduce present income-tax liability. They also aid in employee retention.

Contribution Limits for Qualified Plans

The Internal Revenue Service (IRS) has set annual contribution limits for employees enrolled in qualified plans, such as 401(k)s. In 2024, the maximum contribution limit for a 401(k) is $23,000. Employees aged 50 or older can make an additional catch-up contribution of $7,500.

The IRS has also established annual limits for total contributions from both employees and employers to a defined contribution retirement plan. In 2024, the total annual contributions to an employee’s account cannot exceed $69,000, or $76,500 with catch-up contributions.