Luhn Algorithm Uses in Identity Verification for Credit Cards

Contents

Luhn Algorithm: Identity Verification for Credit Cards

What Is the Luhn Algorithm?

The Luhn Algorithm, also known as the "Modulus 10 Algorithm," is a formula used to determine the accuracy of an identification number provided by a user. It is widely used to validate credit card numbers and other number sequences, such as Social Security Numbers (SSNs).

Today, the Luhn Algorithm is an essential component in the electronic payments system and is used by all major credit cards.

Key Takeaways

- The Luhn Algorithm is a mathematical formula developed in the late 1950s.

- It is widely used to validate identification numbers.

- In finance, it has helped increase electronic payments processing by rapidly identifying mis-entered credit card numbers.

How the Luhn Algorithm Works

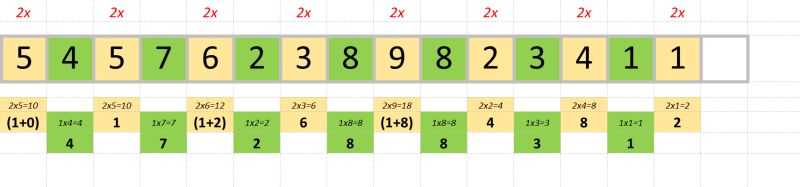

The Luhn Algorithm applies a series of computations to the credit card number provided by the user. It adds up the results of these computations and checks whether the resulting number matches the expected result. If the numbers match, the credit card number is considered valid. If not, the algorithm rejects the credit card number, indicating an input error by the user.

From a customer’s perspective, the Luhn Algorithm is used often without awareness. When placing orders online or using a merchant’s point of sale terminal, computer systems can quickly identify mistakes in the inputted information. Incorporating the Luhn Algorithm into these systems’ programming enables quick identification of user errors and speeds up transactions.

Real-World Example of the Luhn Algorithm

The Luhn Algorithm employs "check digits" as a crucial concept. These digits are inserted into the number sequence to verify the authenticity of the whole number.

For credit cards, the check digit is a single digit printed at the end of the credit card number. Instead of being chosen by the credit card company, the Luhn Algorithm automatically determines the check digit based on the preceding numbers in the sequence. Payment processing software uses the Luhn Algorithm to detect the accuracy of the specified number, including the check digit, during transactions.

Today, the Luhn Algorithm is integrated into popular programming languages and code libraries, simplifying the inclusion of Luhn-based identification number verification in new software applications.