Treasury Inflation-Protected Securities TIPS Explained

Ariel Courage is an experienced editor, researcher, and former fact-checker who has worked for top finance publications like The Motley Fool and Passport to Wall Street.

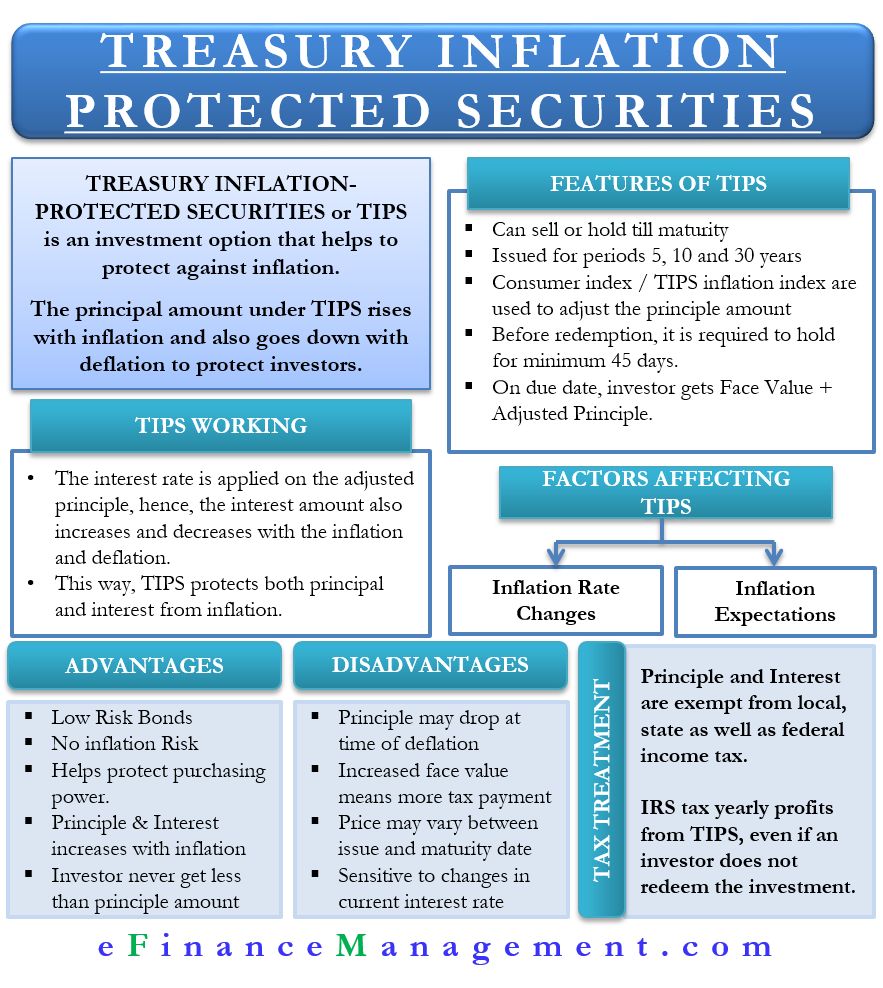

Treasury Inflation-Protected Securities (TIPS) are a type of Treasury security issued by the U.S. government. TIPS protect investors from declining purchasing power by adjusting their price to maintain real value, rather than increasing their yield as inflation rises. The interest rate on TIPS is fixed at issuance but adjusts with inflation based on the adjusted principal amount.

Key Takeaways:

– TIPS are Treasury bonds that protect against declining purchasing power due to inflation.

– The principal value of TIPS rises with inflation, while the interest payment varies with the adjusted principal value.

– The principal amount is always protected and will not decrease from the original investment.

Understanding TIPS:

– The principal value of TIPS increases with inflation, as measured by the Consumer Price Index (CPI).

– TIPS pay interest every six months based on a fixed rate determined at the bond’s auction. The interest payment amounts can vary based on the adjusted principal.

– TIPS have maturities of five, 10, and 30 years and are considered low-risk due to government backing.

– TIPS can be purchased directly from the government or through mutual funds or ETFs.

TIPS’ Price Relationship to Inflation:

– TIPS combat the risk of inflation eroding fixed-rate bond yields.

– The principal value of TIPS increases with inflation and decreases with deflation.

– Interest payments increase with inflation and decrease with deflation.

– TIPS protect the principal amount when held to maturity.

How to Buy TIPS:

– TIPS can be purchased directly from the U.S. Treasury’s website or through a bank or broker.

Advantages and Disadvantages of TIPS:

– TIPS have lower yields compared to other government or corporate securities.

– TIPS interest and inflation adjustments are exempt from state and local taxes but are taxable income for federal purposes.

– The principal increases with inflation, and investors are paid the inflation-adjusted principal at maturity.

– The interest rate offered on TIPS is usually lower than fixed-income bonds without inflation adjustments.

Example of TIPS:

– The 10-year TIPS and 10-year Treasury note had different interest rates in a historical example.

How TIPS Performed in 2022:

– TIPS fell in value along with the bond market due to rising interest rates, despite their connection to inflation.

How to Buy Treasury Inflation-Protected Securities (TIPS):

– TIPS can be purchased directly from the U.S. Treasury or through a broker. Several funds also invest in TIPS.

Can I Buy TIPS for My Individual Retirement Account (IRA)?

– TIPS can be included in an IRA but not directly through the TreasuryDirect service.

What Yields Do TIPS Have?

– Yields on TIPS can be negative, and their principal value increases with inflation.

Why Does the Treasury Issue TIPS?

– TIPS were created in response to demand for inflation-linked government securities, despite being more expensive to issue than traditional Treasuries.

What Maturities Do TIPS Come in?

– TIPS are issued with maturities of five, 10, and 30 years.

In summary, TIPS are Treasury securities that protect against declining purchasing power due to inflation. They adjust in price to maintain real value and have various advantages and disadvantages. TIPS can be purchased directly from the government or through brokers or funds.