Uninsured Motorist Coverage UM How It Works Requirements

Uninsured Motorist Coverage (UM): How It Works, Requirements

What Is Uninsured Motorist Coverage (UM)?

Uninsured motorist (UM) coverage is a part of auto insurance that provides coverage when you’re in an accident with a driver who does not have insurance. If you have UM coverage, it pays for injuries to you and your passengers, and in some instances for damage to your vehicle. Some states require that auto insurance policies include uninsured motorist coverage, while in other states, UM is an optional endorsement you can add to your policy.

Key Takeaways

– Uninsured motorist coverage (UM) is car insurance that pays for injuries and damages caused by an uninsured driver.

– Hit-and-run drivers are also considered uninsured motorists.

– UM coverage is required in many states and available as an optional add-on to your car insurance policy in others.

How Uninsured Motorist Coverage Works

Most state laws mandate that motorists carry automobile liability insurance coverage, and these requirements vary. New Hampshire is the only U.S. state that does not require a minimum amount of auto insurance coverage, and Virginia lets drivers opt out for a fee.

Despite these laws, about one in every eight U.S. drivers does not have insurance, according to the Insurance Research Council. The organization’s most recent report, released in 2021, found that Mississippi had the highest proportion of uninsured drivers, at 29.4%, followed by Michigan, Tennessee, New Mexico, and Washington. The state with the lowest percentage of uninsured motorists was New Jersey, with 3.1%.

Because of the risk posed by a potential collision with an uninsured driver, about half of states plus Washington, D.C. require that auto insurance policies include uninsured motorist coverage. Several other states require it in certain situations, such as if you choose a liability limit higher than the state minimum.

If you’re involved in an accident and the other driver is at fault but doesn’t have insurance, your uninsured motorist coverage can cover the resulting vehicle repairs or medical bills. A hit-and-run driver would also be considered an uninsured motorist, so UM coverage can help pay for repairs after this type of accident, too. But if you don’t have uninsured motorist coverage, you may not receive any payments, even if the other person is at fault or it was a hit-and-run.

There are two types of uninsured motorist coverage: Uninsured motorist bodily injury covers medical bills related to a crash, while uninsured motorist property damage pays for damage to your car. In some states, only UM bodily injury coverage is available.

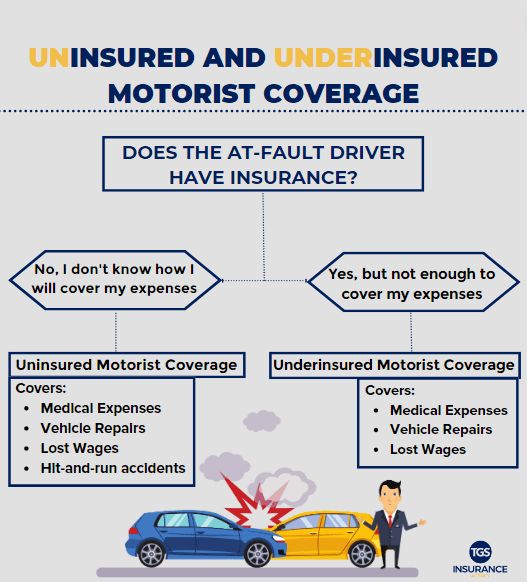

Uninsured Motorist vs. Underinsured Motorist Coverage

Some drivers have insurance, but their policy limits may not be enough to cover the full cost of a claim if there’s an accident. While most states require drivers to have minimum levels of at least liability coverage, a driver who’s hoping to save on their car insurance might opt for the lowest mandatory amounts, which could lead to financial consequences for other drivers if they’re involved in an accident.

It’s important to be aware of this distinction, since uninsured motorist coverage is not the same as underinsured motorist coverage (UIM), which would cover a situation in which the at-fault driver has some insurance, but not enough to fully cover your damages. Some states that require UM coverage also require UIM coverage, but not all—check with your state’s department of motor vehicles if you’re not sure.

Note: Some states and insurers allow you to "stack," or combine coverage limits, for UM/UIM bodily injury coverage when you have multiple vehicles listed on the same policy. For example, if you have two vehicles on a policy and each has a $30,000 UM coverage limit, you can stack them to create a limit of $60,000 after an accident.

What Do You Need to File a UM Coverage Claim?

After an accident, first check for injuries and call 911 if necessary. Then, call the police to respond to the accident. If they don’t come, or if it’s a hit-and-run, try to gather as much information as possible. Ask for names, addresses, and phone numbers of potential witnesses. If possible, get the license plate number of the other car and take photographs of the accident scene.

As soon as possible, file a claim with your insurance company, providing all the information you may have. Some insurance providers will have a limit on how long you can wait before you file your uninsured claim. You’ll typically need to submit bills from all medical care received and any automobile repair that resulted from the accident.

Where Is Uninsured Motorist Coverage Required?

UM coverage is required in Connecticut, Illinois, Kansas, Maine, Maryland, Massachusetts, Minnesota, Missouri, Nebraska, New York, North Carolina, North Dakota, Oregon, South Carolina, South Dakota, Vermont, West Virginia, Wisconsin, and the District of Columbia. It’s also required in New Hampshire and Virginia if you choose to purchase car insurance. You’ll need it in Rhode Island if you choose a liability coverage limit higher than the state minimum, too. New Jersey requires UM coverage if you choose a standard auto policy, but not a basic policy.

What Is Covered by Uninsured Motorist Insurance?

UM coverage has two parts: bodily injury and property damage. UM bodily injury typically pays for medical expenses for you and your passengers, and may also pay for lost wages. UM property damage generally pays to repair or replace your car and other items damaged by the accident. The exact coverage terms depend on your state laws and insurance policy, so make sure to read the fine print.

The Bottom Line

Uninsured motorist insurance covers medical expenses for you and your passengers and damage to your car after an accident with a driver who doesn’t have insurance. It’s required in some states and available as an optional coverage in others. Uninsured motorist coverage also protects you after hit-and-run accidents.