Lowball Meaning Example and Consequences

Contents

Lowball: Meaning, Example, and Consequences

Alexandra Twin has 15+ years of experience as an editor and writer, covering financial news for both public and private companies.

What Is Lowballing?

A lowball offer is a slang term for an offer significantly below the seller’s asking price, or a deliberately lower quote. Lowballing can be used as a tactic to start negotiations, rather than expecting the seller to accept the offer.

Key Takeaways

- A lowball offer refers to an offer far below the seller’s asking price, used to initiate negotiations.

- To lowball also means to throw out an intentionally low estimate to test the seller’s response.

- Lowball offers are often used to incentivize sellers to lower prices quickly, especially if they need immediate funding.

Understanding Lowball Offers

Lowball offers are commonly used to pressure sellers who need to liquidate assets quickly. They can also serve as a starting point for negotiating the fair value of an asset.

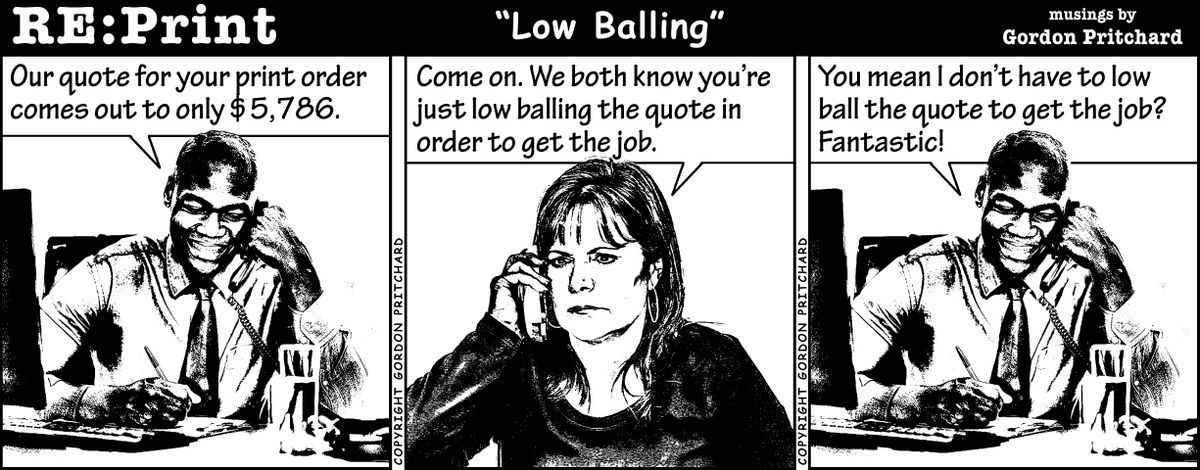

Additionally, lowball offers can be a deceptive sales tactic. This involves quoting a low price, then claiming it was a mistake and demanding a higher price. Some customers may view this as a bait-and-switch, while others may still accept the higher price due to their prior intention to make the purchase.

For example, lowballing can be effective when buying a home in a buyer’s market. A potential buyer may deliberately offer 15% below the asking price to initiate negotiations and ultimately secure a price 5% below the original asking price.

Lowballing works best when the buyer has the upper hand in the negotiation. In a tight housing market with limited availability, attempting to lowball the price is unlikely to yield favorable results for the buyer.

Example of Lowballing

In the 2008 LIBOR scandal, banks such as Barclays, Lloyds Banking Group, and Royal Bank of Scotland artificially kept LIBOR rates low by "lowballing" their LIBOR submissions.

This false estimate not only generated profits for the banks but also made them appear more creditworthy than they truly were. The practice of lowballing allegedly contributed to the failure of multiple American banks.