Understanding an OHLC Chart and How to Interpret It

Contents

Understanding OHLC Charts and Interpreting Them

What is an OHLC Chart?

An OHLC chart is a type of bar chart that displays open, high, low, and closing prices for each period. It is useful for showing the four major data points over a period, with the closing price being considered most important.

OHLC charts can indicate increasing or decreasing momentum. When the open and close prices are far apart, it shows strong momentum, while a small gap between open and close suggests indecision or weak momentum. The high and low prices show the full price range of the period, which is useful for assessing volatility. Traders often look for patterns on OHLC charts.

Key Takeaways

- An OHLC chart displays open, high, low, and close prices for a given period.

- It can be applied to any timeframe.

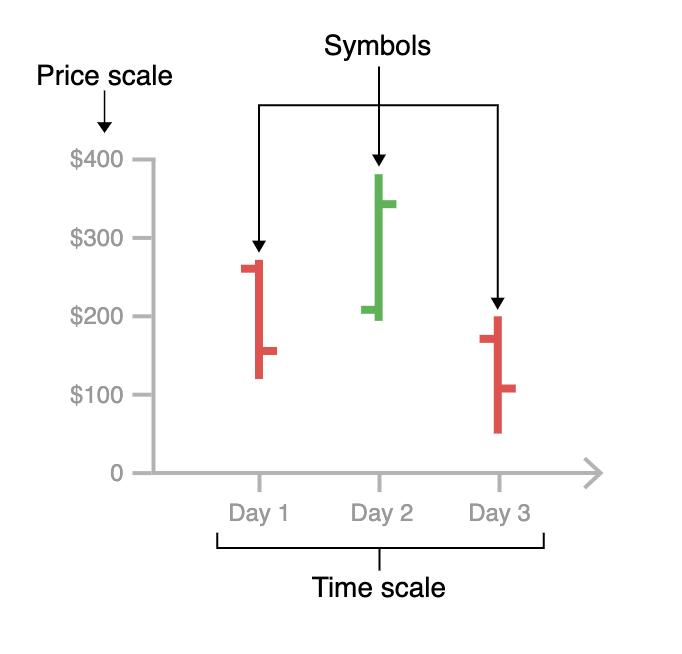

- The vertical line represents the high and low for the period, while the left line indicates the open price and the right line indicates the closing price. This structure is called a bar.

- When the close is above the open, the bar is often black; when the close is below the open, the bar is often red.

Understanding OHLC Charts

OHLC charts consist of a vertical line and two short horizontal lines extending to the left and right. The left line represents the opening price, and the right line represents the closing price. The height of the vertical line represents the intraday range, with the high and low indicated by its upper and lower ends. This structure is called a price bar.

When prices rise, the right line is above the left (indicating a close higher than the open). These bars are usually black. When prices fall, the right line is below the left (indicating a close lower than the open). These bars are typically red.

OHLC charts can be applied to any time frame. For example, a 5-minute OHLC chart shows open, high, low, and closing prices for each 5-minute period. On a daily OHLC chart, it shows the same data for each day.

OHLC charts provide more information than line charts, which only show closing prices connected by a line. OHLC and candlestick charts show the same information but in slightly different ways. While OHLC charts use horizontal lines to represent open and close, candlesticks use a solid body.

Interpreting OHLC Charts

Technical analysts use various techniques to interpret OHLC charts. Here are some guidelines:

Vertical Height: The height of an OHLC bar indicates the period’s volatility. A greater height suggests more volatility and indecision in the market.

Horizontal Line Position: The position of the left and right lines reveals where the asset opened and closed relative to the high and low. If the price rallied but closed significantly lower than the high, it suggests a weakening of the rally. If the price fell but closed much higher than the low, selling pressure may have diminished.

When the open and close are close together, it indicates indecision since the price didn’t make significant progress in either direction. A substantial difference between open and close suggests strong buying or selling during the period.

Bar Color: In an uptrend, more bars are black than red, while in a downtrend, more bars are red than black. Bar color provides information about the trend direction and its strength. A series of large black bars indicates strong upward movement, but further analysis is necessary to make a decision.

Patterns: Traders also look for patterns on OHLC charts, such as key reversals, inside bars, and outside bars. A key reversal in an uptrend occurs when the price opens above the prior bar’s close, makes a new high, then closes below the prior bar’s low. This suggests a shift in momentum and a potential pullback. A key reversal in a downtrend occurs when the price opens below the prior bar’s close, makes a new low, then closes above the prior bar’s high. This indicates a shift to the upside and the possibility of a rally.

Example of an OHLC Chart

Below is an OHLC chart for the S&P 500 SPDR ETF (SPY). Overall rises are marked by more black bars, as seen at the start of October. From mid-November, the price moves mostly sideways with alternating bar colors.

In mid-November, the price starts to rise, with a couple of wider-ranging black bars. At the beginning of the year, the price continues to rise, dominated by black bars. However, at the start of February, there are large red bars, indicating significant selling pressure.