Unearned Discount Meaning Calculation Example

Contents

Unearned Discount: Meaning, Calculation, Example

What Is an Unearned Discount?

An unearned discount is interest or a fee collected on a loan by a lending institution but not yet recognized as income. Initially, it is recorded as a liability. As the loan progresses, portions of the collected fee or interest are removed from the liability side of the balance sheet and counted as income. If the loan is paid off early, the unearned interest must be returned to the borrower.

An unearned discount is also known as unearned interest.

Key Takeaways

- Unearned discount refers to loan interest collected but not yet recognized as income.

- An unearned discount is recorded as a liability that gradually becomes income as the loan matures.

- Unearned discount is more commonly known as unearned interest.

Understanding Unearned Discounts

An unearned discount account recognizes interest deductions before being classified as income throughout the term of the debt. Over time, the unearned discount increases the lender’s profit and decreases liability.

Not all interest received by a lender is classified as "earned" because lenders often schedule regular payments to be made at the beginning of each month. However, the interest paid by the borrower at the beginning of the month applies to the entire month’s borrowing cost and is therefore unearned by the lender.

For example, a homeowner obtains a mortgage requiring a monthly payment of $1,500, with $500 in interest. However, this $500 is prepaid and unearned on the 1st. As the month progresses, a pro-rata amount of that interest is credited to the bank’s earnings while the unearned discount liability decreases.

Calculating an Unearned Discount

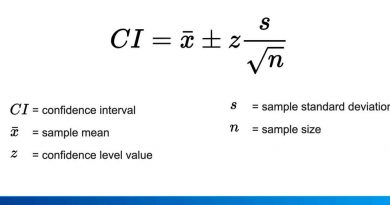

Unearned discounts can be estimated using the Rule of 78, a method for loans with precomputed finance charges. The Rule of 78 calculates the unearned discount as follows:

Unearned discount = F [k (k + 1) / n (n + 1)]

- F = total finance charge, equal to (n x M – P)

- M = regular monthly loan payment

- P = original loan amount

- n = original number of payments

- k = number of remaining payments on the loan after the current payment

Example of Unearned Discount

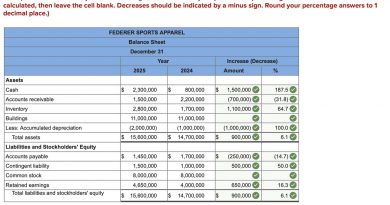

Snuffy’s Bank and Trust loans money to Ernie’s Brokerage. As part of the loan costs, Ernie pays a financing charge of 6% of the total loan amount. The loan amount is $10,000, repaid over 5 years in monthly installments. Ernie pays $600 in finance charges up front.

Initially, Snuffy’s Bank and Trust record the $600 unearned discount as a liability, recognizing income as Ernie makes each of the 60 loan payments. 1/60th of the $600 is removed from the liability and recognized as income.