Trust-Owned Life Insurance TOLI Pros and Cons Example

Contents

Trust-Owned Life Insurance (TOLI): Pros and Cons, Example

Anthony Battle is a CERTIFIED FINANCIAL PLANNER™ professional. He earned the Chartered Financial Consultant® designation for advanced financial planning, the Chartered Life Underwriter® designation for advanced insurance specialization, the Accredited Financial Counselor® for Financial Counseling and both the Retirement Income Certified Professional® and Certified Retirement Counselor designations for advance retirement planning.

What Is Trust-Owned Life Insurance (TOLI)?

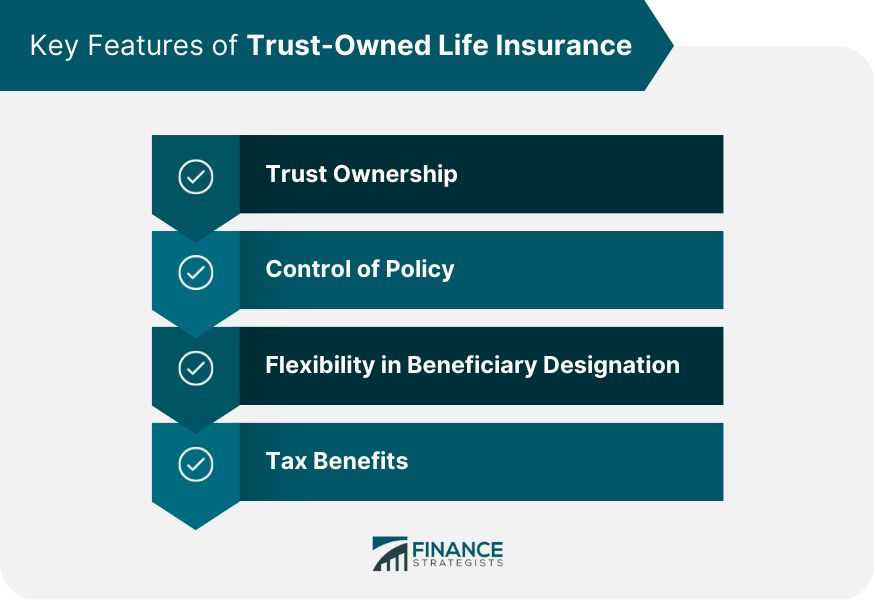

Trust-owned life insurance (TOLI) refers to a type of life insurance policy that resides within a trust. Policyholders establish a trust and transfer or take out a policy for it, making regular premium payments. This insurance is commonly used as an estate planning tool, especially by high-net-worth individuals (HNWIs) who use it to avoid estate taxes.

Key Takeaways

- Trust-owned life insurance is a type of life insurance housed inside a trust.

- TOLI is commonly used for estate planning purposes.

- Assets housed within the trust can sidestep tax obligations.

- TOLI policies require regular reviews to ensure they meet the trust’s current needs.

- Establish the trust before purchasing or transferring a policy.

Understanding Trust-Owned Life Insurance (TOLI)

TOLI is a life insurance policy owned by a trust for estate planning purposes. It is a suitable option for anyone who wants to ensure responsible distribution of assets, reduce estate taxes, or meet charitable objectives.

To establish the trust, an estate planner’s assistance is required. If you do not have a policy, the trust will seek coverage for you. If you already have a policy, you need to transfer it to the trust and name it as a beneficiary. Premium payments are the responsibility of the trustee.

You can name any beneficiary for the policy, but the tax implications depend on the recipient. Estate taxes can be avoided if the spouse is the beneficiary. However, if you pass away within three years of asset transfer, estate taxes cannot be avoided. To avoid this, the trust should directly take out the policy from the insurer.

Special Considerations

Regular reviews of trust-owned insurance policies are necessary to ensure they meet current needs. Newer insurance products may be more cost-efficient and offer better options and features. However, newer products should be carefully assessed as costs tend to increase with age.

If the value of your estate is expected to exceed the exemption amount or the calculation is unpredictable, establishing an irrevocable life insurance trust (ILIT) may be wise. ILITs remove insurance proceeds from the estate, making them income and estate tax-free. Gifts made to ILITs reduce estate value and associated tax burdens.

Advantages and Disadvantages of TOLI

Advantages

Ownership by an individual’s ILIT allows assets housed within the trust to bypass federal estate taxes. ILITs provide flexibility for loans to spouse’s estates or to purchase assets to pay estate taxes.

ILITs also enable charitable donations while protecting inheritances through a death benefit that replaces the value of charitable gifts.

Disadvantages

The main disadvantage is the loss of control as the grantor relinquishes ownership of the life insurance policy to the trustee.

If a life insurance policy is transferred to a trust within three years of the insured individual’s death, the policy proceeds become part of the estate and subject to taxation.

- Estate taxes can be avoided

- Loans can be made to spouse’s estates or to purchase assets

- Donations to charity can be made while protecting assets for heirs

- Control is relinquished when policy is housed in a trust

- The three-year look-back rule applies to policies transferred within three years of death

Example of TOLI

Assume you’re a 50-year-old married individual with two children under the age of 16. You and your spouse have a combined annual income of $100,000. You have savings and want to leave something behind for your family in case of unexpected death.

For this, you decide to set up your estate using an estate planner or legal representative, naming your spouse as the heir. This entity will purchase the policy on your behalf and be named as the beneficiary. If you pass away, the estate receives the policy proceeds and passes them on to your spouse.