Unilateral Extended Reporting Period Provision

Contents

Unilateral Extended Reporting Period Provision

What is Unilateral Extended Reporting Period Provision

A unilateral extended reporting period provision is an insurance contract provision that allows the insured to extend coverage if the insurer cancels or does not renew the contract. This provision is also known as "tail coverage."

Understanding Unilateral Extended Reporting Period Provision

A unilateral extended reporting period provision, also known as a one-way tail extended reporting provision, is for individuals and business that have claims-made liability insurance policies. If the policy is not renewed, canceled, or replaced, this provision allows the insured to extend the coverage period.

Key Takeaways

- A unilateral extended report period provision allows the insured or insurer to extend the coverage time period for a claims-made insurance contract.

- If coverage is extended by the insurer, the insured can purchase the contract after one, three, five, or ten years.

- Bilateral extended report period provisions are preferable.

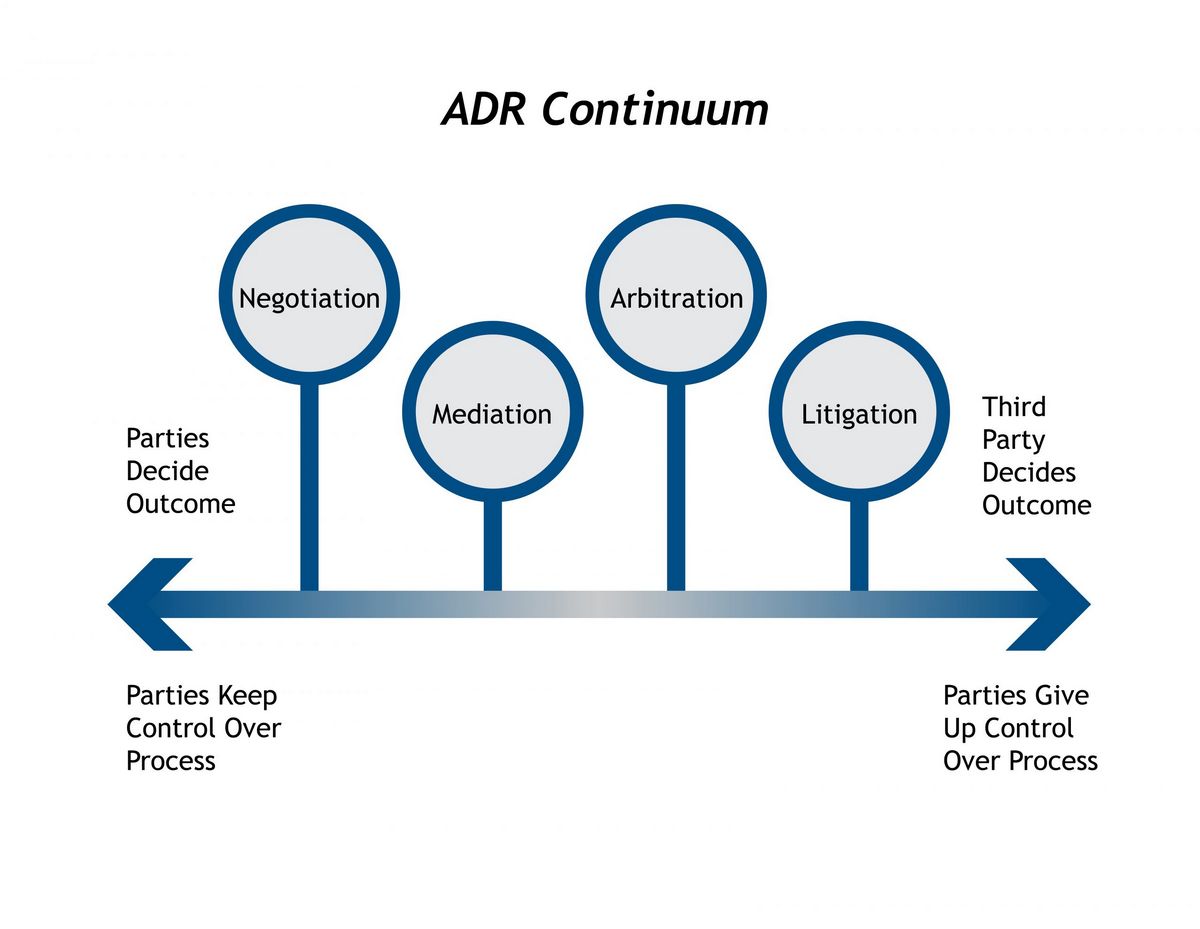

Many claims-made policies may have an extended reporting period provision required by regulators. In some cases, the insurer can add this provision if they cancel or do not renew the policy. This is referred to as a one-way tail or unilateral extended provision. If both the insurer and insured can add basic extended reporting period coverage, it is referred to as a two-way tail or bilateral extended provision.

Unilateral vs. Bilateral Extended Reporting Period Provisions

Unilateral extended reporting period provisions are less desirable because coverage can only be extended if the insurer ends the contract. The insured does not have the option to extend coverage without the insurer taking action first.

Most professional liability policies offer bilateral extended reporting period provisions with varying lengths. The insured can purchase these provisions or the insurer can include them in the policy. The extended reporting period can be for one, three, five, or ten years. The cost is based on the last annual policy premium and the selected time period.

Example of Extended Reporting Provision

In a situation where Jonathan has been laid off, his previous employer can provide him with medical insurance for three months using unilateral extended reporting provisions. Jonathan must find a job within that time period to continue having medical insurance.