Marginal Utilities Definition Types Examples and History

Marginal Utility: Definition, Types, Examples, and History

Andrew Bloomenthal has over 20 years of editorial experience as a financial journalist and services marketing writer.

What Is Marginal Utility?

Marginal utility is the satisfaction a consumer gets from having one more unit of a good or service. Economists use this concept to determine consumer purchasing behavior.

Positive marginal utility occurs when consuming an additional item increases total satisfaction. Negative marginal utility occurs when consuming one more unit decreases overall satisfaction.

Key Takeaways:

– Marginal utility is the satisfaction a consumer gets from having one more unit.

– Economists use this concept to determine consumer purchasing behavior.

– The law of diminishing marginal utility justifies progressive taxes.

– Marginal utility can be positive, zero, or negative.

Understanding Marginal Utility

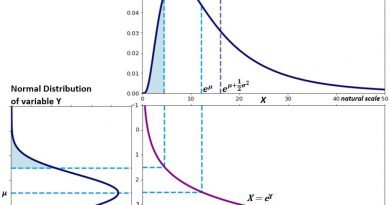

Economists use marginal utility to understand how satisfaction levels affect consumer decisions. The law of diminishing marginal utility describes how the first unit of consumption provides more utility than subsequent units.

Although marginal utility generally decreases with consumption, it may not reach zero depending on the good.

Marginal utility helps explain how consumers maximize their limited budgets. People continue consuming a good as long as the marginal utility surpasses the marginal cost, which equals the price in an efficient market.

Types of Marginal Utility

There are different types of marginal utility:

Positive Marginal Utility:

Having more of an item brings additional happiness. For example, if you enjoy eating cake, a second slice brings you extra joy.

Zero Marginal Utility:

Consuming more of an item brings no additional satisfaction. For instance, after having two slices of cake, a third slice wouldn’t make you feel any better.

Negative Marginal Utility:

Having too much of an item becomes harmful. For example, eating a fourth slice of cake may make you sick after having three slices.

History of Marginal Utility

Economists developed the concept of marginal utility to explain price based on a product’s utility. In the 18th century, economist Adam Smith discussed the "paradox of water and diamonds," which sparked curiosity among economists and philosophers.

In the 1870s, economists William Stanley Jevons, Carl Menger, and Leon Walras independently concluded that marginal utility was the answer to the water and diamonds paradox. Jevons explained in his book, "The Theory of Political Economy," that economic decisions are based on "final" (marginal) utility rather than total utility.

Example of Marginal Utility

David has four gallons of milk and decides to purchase a fifth gallon, while Kevin has six gallons and also buys an additional gallon. David still benefits from not having to go to the store for a few days, so his marginal utility remains positive. Kevin, however, may have bought more milk than he can reasonably consume, resulting in zero marginal utility.

The main takeaway from this scenario is that the marginal utility of a product declines as a consumer acquires more. Eventually, the marginal utility reaches zero, and consumption ends.

Marginal Utility vs. Total Utility

Marginal utility measures the change in satisfaction from consuming one additional unit, while total utility measures the satisfaction obtained from all units. Positive marginal utility increases total utility, while negative marginal utility decreases it.

For example, when attending multiple personal training sessions, the highest level of satisfaction comes from the first session due to novelty and excitement. With each additional session, the marginal utility decreases, but as long as it remains positive, the total utility still increases.

How to Calculate Marginal Utility

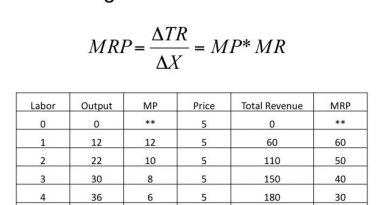

Marginal utility can be calculated by dividing the change in total utility (ΔTU) by the change in the number of units (ΔQ): MU = ΔTU/ΔQ.

Applications of Marginal Utility

Marginal utility is applied by governments, businesses, and consumers in various economic decisions.

Consumers seek products with higher marginal utility as it leads to increased satisfaction. This can foster brand loyalty and positive recommendations.

Businesses can price products higher if they offer higher marginal utility over time or after the first use. Marginal utility guides businesses in creating better products and increasing customer satisfaction.

Governments justify progressive taxes using the law of diminishing marginal utility. Lower-income individuals derive more value from each additional dollar, while higher-income individuals have less value from each additional dollar.

What Is the Formula for Marginal Utility?

The formula for marginal utility is MU = ΔTU/ΔQ, where ΔTU is the change in total utility and ΔQ is the change in the number of units.

What Is the Law of Diminishing Marginal Utility?

The law of diminishing marginal utility states that as consumption increases, the satisfaction from each additional unit decreases. Consumers are willing to pay the most for the first unit but typically resist purchasing additional units without a decrease in price.

What Is Marginal Cost?

Marginal cost measures the change in production cost from making one additional unit. It is calculated by dividing the change in production costs by the change in the quantity produced. If the price per unit exceeds the marginal cost, a business can make a profit. Tracking marginal costs helps achieve economies of scale.

The Bottom Line

Marginal utility refers to the additional satisfaction a consumer gains from having one more unit of a good or service. It is used by businesses to understand customer behavior, set prices, and determine product innovation or upgrades. Marginal utility also justifies progressive taxes, as each additional dollar benefits those with lower incomes more than those with higher incomes.