Trust Company Definition What It Does and About Its Services

Trust Company: Definition, What It Does, and About Its Services

What Is a Trust Company?

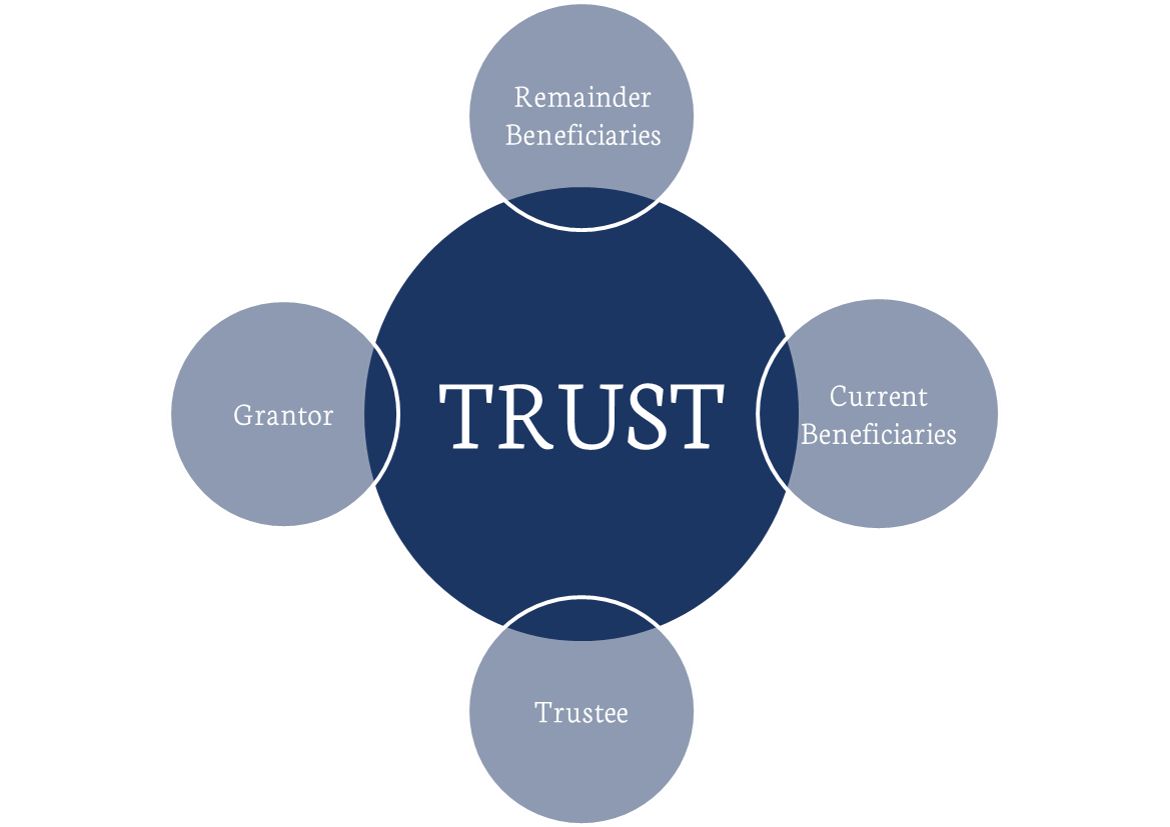

A trust company is a legal entity that acts as a fiduciary, agent, or trustee for the administration, management, and transfer of assets to a beneficial party. It acts as a custodian for trusts, estates, custodial arrangements, asset management, stock transfer, and beneficial ownership registration.

Key Takeaways

– A trust company acts as a fiduciary, agent, or trustee for a trust.

– It is responsible for the administration, management, and transfer of assets to beneficiaries.

– It acts as a custodian for trusts, estates, custodial arrangements, asset management, stock transfer, and beneficial ownership registration.

– Trusts are managed for profit and may take fees annually or upon transfer to the third party.

How Trust Companies Work

Although trusts often have an individual trustee, a trust company can also fulfill this role. A trust company does not own the assets, but it assumes the responsibility of managing them on behalf of other parties.

Trust companies can be divisions or associated companies of commercial banks. They manage trusts and similar arrangements for profit, taking fees annually or upon transfer to the third party.

There are many trust companies to choose from, varying in size and fees. Larger trust companies offer more products and services but may lack the personal touch. Examples of larger trust companies include Northern Trust, Bessemer Trust, and U.S. Trust (now part of Bank of America Corporation). Their fees are usually a percentage of assets, ranging from 0.25% to 2.0% depending on the trust’s size.

What Trust Companies Offer

Trust companies provide a range of services for managing trusts, including:

– Wealth management services, such as investment and wealth preservation.

– Asset management services, including bill pay and check writing.

– Brokerage services with a wide array of investments.

– Financial planning for clients, depending on their needs.

Trust companies are also involved in estate planning matters. They can act as successor trustees when there are no responsible family members. After the grantor’s death, the trust company becomes the new trustee, managing the assets according to the trust terms.

Additionally, trust companies offer estate-oriented services like guardianship, estate settlement, and non-financial asset management.

Benefits of a Trust Company

A trust company acts as a fiduciary, making investment decisions in the client’s best interest. This is beneficial for individuals without financial market expertise. Trust companies are also useful for clients who don’t want to manage their day-to-day finances.

Using a trust company can prevent family conflicts when dealing with inheritances and estate planning. By acting as a neutral third party, a trust company avoids potential squabbles and ensures fair asset distribution.