Merger Definition How It Works With Types and Examples

Merger: Definition, How It Works, Types, and Examples

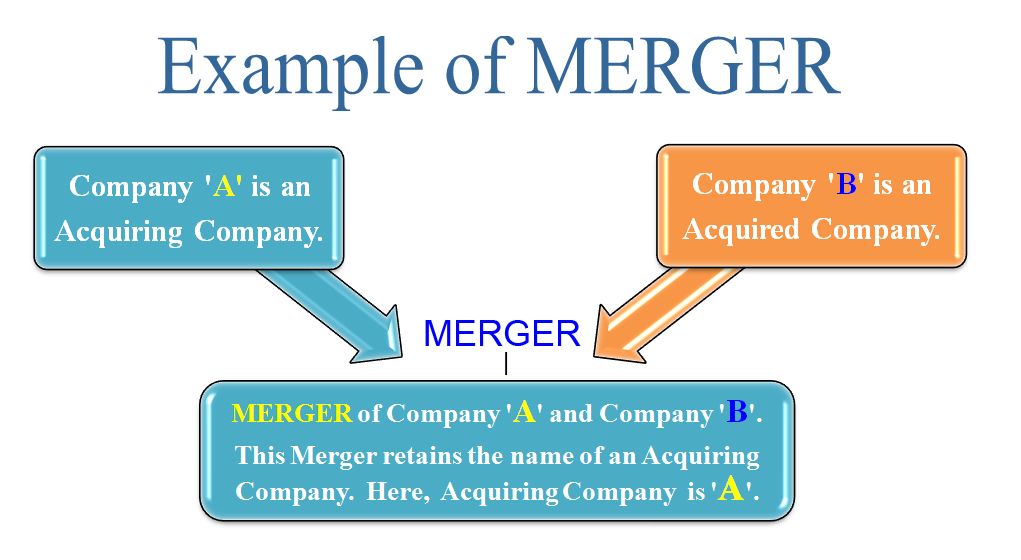

A merger is an agreement that unites two companies into one. There are different types of mergers with various reasons behind them. Mergers and acquisitions (M&A) are commonly done to expand a company’s reach, enter new segments, or gain market share. All of these actions aim to increase shareholder value. During a merger, companies may have a no-shop clause to prevent other purchases or mergers.

Key Takeaways:

– Mergers expand companies’ reach, enter new segments, or gain market share.

– A merger is the voluntary fusion of two companies into one new entity.

– The five major types of mergers are conglomerate, congeneric, market extension, horizontal, and vertical.

How a Merger Works:

A merger is the voluntary fusion of two companies into one new entity. The merging firms are similar in terms of size, customers, and scale. Acquisitions, on the other hand, involve one company purchasing another.

Mergers are often done to gain market share, reduce operational costs, expand to new territories, unite products, increase revenues, and boost profits. After a merger, shares of the new company are distributed to existing shareholders.

The total value of mergers and acquisitions for 2022 reached $2.6 trillion.

Types of Mergers:

There are various types of mergers based on companies’ goals. Technology, healthcare, retail, and financial sectors frequently undergo mergers. Here are some common types:

Conglomerate:

This merger joins companies engaged in unrelated businesses. They may operate in different industries or regions. A pure conglomerate involves unrelated firms, while a mixed conglomerate involves organizations seeking product or market extensions. The merger between The Walt Disney Company and the American Broadcasting Company (ABC) in 1995 is an example of a conglomerate merger.

Congeneric:

A congeneric merger combines companies in the same market or sector with overlapping factors such as technology, marketing, production processes, and research and development (R&D). It expands product lines and market share. Citigroup’s 1998 merger with Travelers Insurance is an example of a congeneric merger.

Market Extension:

This merger occurs between companies selling the same products in different markets. It aims to gain access to a larger client base. Eagle Bancshares and RBC Centura merged in 2002 to extend their markets.

Horizontal:

A horizontal merger takes place between companies in the same industry. It consolidates competitors offering similar products or services. Daimler-Benz and Chrysler’s 1998 merger is a prominent example of a horizontal merger.

Vertical:

A vertical merger combines companies that produce parts or services for a product. It occurs at different levels within the same industry’s supply chain. These mergers increase synergies and cost reduction. AOL’s merger with Time Warner in 2000 is an example of a vertical merger.

Examples of Mergers:

Anheuser-Busch InBev is an example of multiple mergers combining companies in the beverage market. It involved the merger of Interbrew, Ambev, and Anheuser-Busch. This horizontal merger and market extension broadened the reach of the combined company’s brands.

The largest mergers in history exceeded $100 billion each. Vodafone acquired Mannesmann in 2000 for $190 billion. AOL and Time Warner merged vertically in a $164 billion deal in 2000. Verizon Communications bought out Vodafone’s stake in Vodafone Wireless for $130 billion in 2014.

What Is a Horizontal Merger?

A horizontal merger is when competing companies that sell the same products or services merge. The T-Mobile and Sprint merger is an example of this.

What Is an SPAC Merger?

A special-purpose acquisition company (SPAC) merger occurs when a publicly traded SPAC raises capital through public markets to buy an operating company. The operating company then becomes publicly listed.

What Is a Reverse Merger?

A reverse merger happens when a private company buys a publicly traded company. An example is the New York Stock Exchange’s reverse merger with Archipelago Holdings in 2006.

The Bottom Line:

Mergers occur when companies combine to form a larger entity, usually for strategic reasons. This grants them larger market share and other advantages.