Mortgage Interest Deduction Overview Examples FAQ

Contents

- 1 Mortgage Interest Deduction: Overview, Examples, FAQ

- 1.1 Mortgage Interest Deduction

- 1.2 How a Mortgage Interest Deduction Works

- 1.3 Qualifications for a Full Mortgage Interest Deduction

- 1.4 Examples of the Mortgage Interest Deduction

- 1.5 Can You Deduct Property Taxes and Mortgage Interest?

- 1.6 Can Co-Owners Deduct Mortgage Interest?

- 1.7 Can You Deduct Mortgage Interest After Refinancing?

- 1.8 The Bottom Line

Mortgage Interest Deduction: Overview, Examples, FAQ

Lea Uradu, J.D. is a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, and Tax Writer.

Mortgage Interest Deduction

The mortgage interest deduction is a common itemized deduction that allows homeowners to deduct the interest they pay on any loan used to build, purchase, or make improvements upon their residence, from taxable income. This deduction can also be taken on loans for second homes and vacation residences with limitations.

The amount of deductible mortgage interest is reported each year by the mortgage company on Form 1098, offered as an incentive for homeowners.

Key Takeaways

- The mortgage interest deduction helps homeowners lower their tax owed.

- These deductions are reported on Form 1098 and Schedule A or Schedule E, depending on the type of deduction.

- The Tax Cuts and Jobs Act (TCJA) of 2017 reduced the maximum eligible mortgage principal for the deduction to $750,000 (from $1 million).

- Some homeowners, under legacy clauses, are not subject to the new limits.

- Many taxpayers forgo claiming the mortgage interest deduction in favor of the larger standard deduction.

How a Mortgage Interest Deduction Works

Introduced in 1913, the mortgage interest tax deduction has become the favorite deduction for millions of U.S. homeowners.

Home mortgage interest is reported on Schedule A of the 1040 tax form. The interest paid on rental properties is deductible and reported on Schedule E. Interest from home equity loans also qualifies as home mortgage interest.

The TCJA passed in 2017 reduced the maximum eligible mortgage principal to $750,000 for new loans. The nearly doubled standard deductions have made it unnecessary for many taxpayers to itemize.

As a result, most taxpayers forgo the mortgage interest tax deduction. In the first year following the TCJA, an estimated 135.2 million taxpayers were expected to opt for the standard deduction.

In 2022, only 18.5 million taxpayers were expected to itemize, with 14.2 million claiming the mortgage interest deduction. This suggests that the majority of homeowners receive no benefit from the deduction.

Mortgage deductions can also be taken on loans for second homes and vacation residences, with limitations.

Qualifications for a Full Mortgage Interest Deduction

In 2017, the TCJA limited how much interest homeowners could deduct from taxes. Instead of deducting mortgage interest on the first $1 million ($500,000 for married filing separately), homeowners can now only deduct interest on the first $750,000 ($375,000 for married filing separately).

However, some homeowners can deduct the entirety of their mortgage interest paid, as long as they meet certain requirements based on the mortgage date, mortgage amount, and use of proceeds.

Mortgages issued before Oct. 13, 1987, have no limits. Mortgages issued between Oct. 13, 1987, and December 16, 2017, and homes sold before April 1, 2018, can deduct mortgage interest on the first $1 million ($500,000 for married filing separately). The sales contract must have been executed by Dec. 15, 2017, with a closing conducted before April 1, 2018.

The mortgage interest deduction can only be taken if the homeowner’s mortgage is a secured debt.

Examples of the Mortgage Interest Deduction

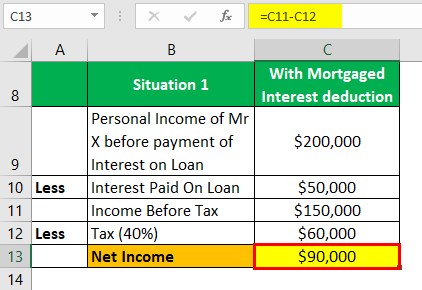

Under the TCJA of 2017, the mortgage interest deduction limits have decreased. Despite these changes, the deduction can still prove valuable for some taxpayers.

When the Mortgage Interest Deduction Is Beneficial

For example, a married couple in the 24% income tax bracket who paid $20,500 in mortgage interest wonders if itemizing deductions would yield a larger tax break than the standard deduction of $27,700. After totaling their qualified deductions, including the mortgage interest, they arrive at $32,750 that can be deducted. Since this exceeds the standard deduction, it offers a greater benefit: $7,860 ($32,750 x 24%) vs. $6,648 ($27,700 x 24%).

When the Mortgage Interest Deduction Is Not Beneficial

A single taxpayer in the 24% tax bracket wonders if itemizing taxes would result in a lower tax liability. With only $11,200 in total itemized deductions and a standard deduction of $13,850, it does not benefit the taxpayer to itemize for the tax year.

Essentially, the homeowner receives no benefit for the paid interest, and the mortgage interest deduction goes unclaimed.

Can You Deduct Property Taxes and Mortgage Interest?

Homeowners who itemize taxes and meet the qualification for deducting mortgage interest can deduct property taxes and mortgage interest.

Can Co-Owners Deduct Mortgage Interest?

Co-owners of a property can deduct mortgage interest to the extent that they own the home, subject to limits.

Can You Deduct Mortgage Interest After Refinancing?

The mortgage interest deduction can be taken after refinancing a home if the refinance is on a primary or secondary residence and the money was used for a capital home improvement.

The Bottom Line

The mortgage interest deduction allows homeowners who itemize taxes to claim a tax deduction for interest paid on their mortgage. The limits decreased to $750,000 under the TCJA of 2017. However, some homeowners benefit from legacy clauses that exempt them from the new rules.