Mortgage Insurance What It Is How It Works Types

Contents

- 1 Mortgage Insurance: What It Is, How It Works, Types

- 1.1 What Is Mortgage Insurance?

- 1.2 How Mortgage Insurance Works

- 1.3 Private Mortgage Insurance (PMI)

- 1.4 Qualified Mortgage Insurance Premium (MIP)

- 1.5 Mortgage Title Insurance

- 1.6 Mortgage Protection Life Insurance

- 1.7 How Long Do I Need To Pay Mortgage Insurance?

- 1.8 What Does Mortgage Insurance Cover?

- 1.9 How Can I Avoid Paying Mortgage Insurance?

- 1.10 The Bottom Line

Mortgage Insurance: What It Is, How It Works, Types

What Is Mortgage Insurance?

Mortgage insurance protects a mortgage lender or titleholder if the borrower defaults on payments, passes away, or is unable to meet the obligations of the mortgage. It can refer to private mortgage insurance (PMI), qualified mortgage insurance premium (MIP), or mortgage title insurance. These all provide coverage in specific loss scenarios.

Mortgage life insurance, on the other hand, protects heirs if the borrower dies with outstanding mortgage payments. It may pay off the lender or heirs according to the policy’s terms.

Key Takeaways

- Mortgage insurance protects lenders or titleholders if borrowers default on payments, pass away, or fail to meet mortgage obligations.

- There are three types of mortgage insurance: private mortgage insurance, qualified mortgage insurance premium, and mortgage title insurance.

- It should not be confused with mortgage life insurance, which protects heirs in case of the borrower’s death.

How Mortgage Insurance Works

Mortgage insurance has two payment options: pay-as-you-go or a lump-sum payment at mortgage origination. Homeowners required to have PMI can cancel it after paying off 20% of the principal balance.

Here are the three types of mortgage insurance:

Private Mortgage Insurance (PMI)

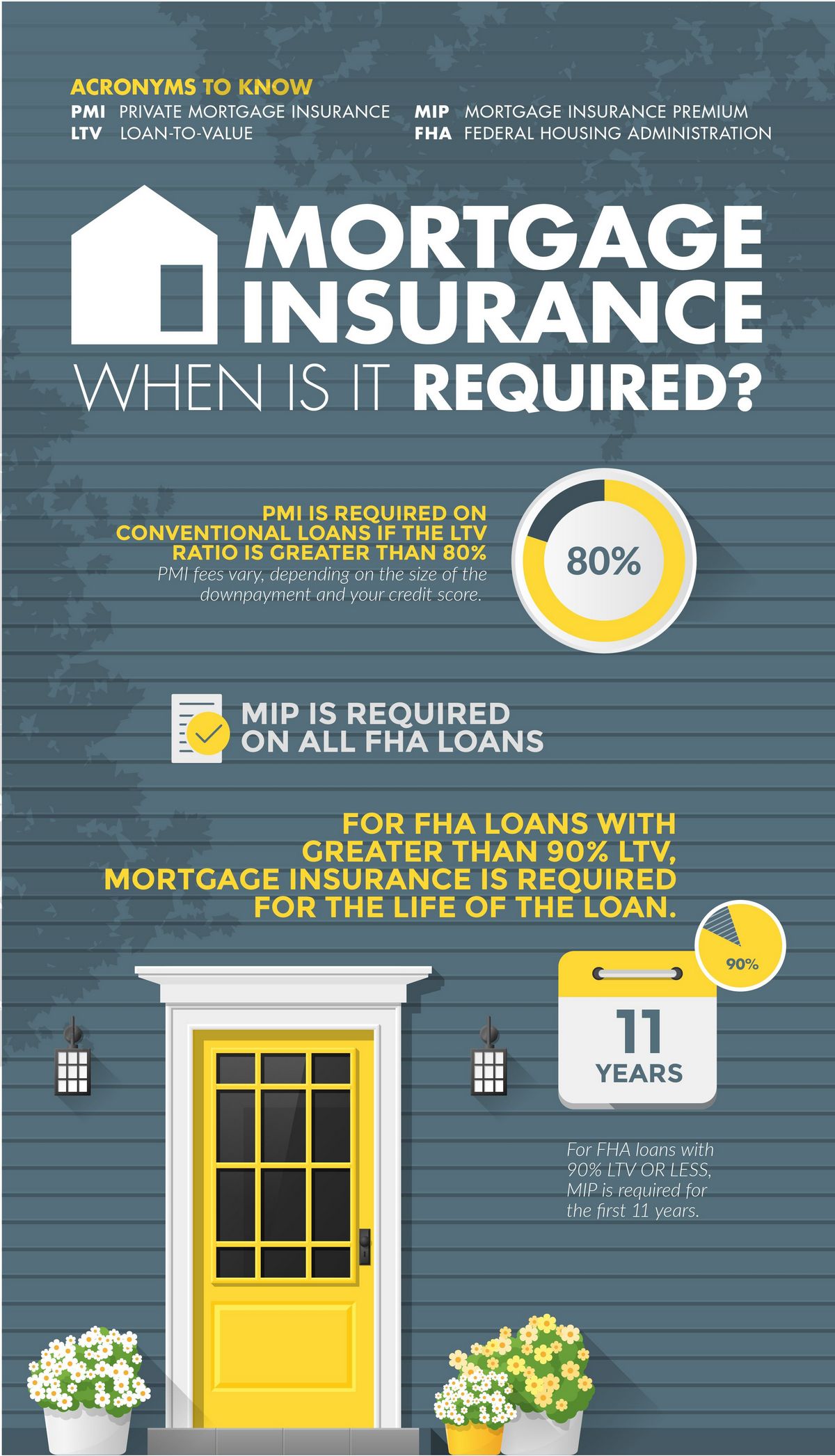

Private mortgage insurance (PMI) is required for conventional loans with a down payment of less than 20%. It protects the lender and is arranged by them through private insurance companies. PMI is also necessary for refinancing with a conventional loan if equity is less than 20% of the home value.

Qualified Mortgage Insurance Premium (MIP)

Qualified mortgage insurance premium is required for U.S. Federal Housing Administration (FHA)-backed mortgages. All borrowers with an FHA mortgage must purchase this insurance, regardless of their down payment size.

Mortgage Title Insurance

Mortgage title insurance protects beneficiaries if a sale is later invalidated due to title problems or ownership disputes. Before mortgage closing, a representative, like a lawyer or title company employee, performs a title search to identify any liens or ownership issues. However, important evidence can be missed if information is not centralized.

Mortgage Protection Life Insurance

Borrowers may be offered mortgage protection life insurance when applying for a mortgage. It can be declined, but signing forms and waivers to confirm understanding of the risks associated with a mortgage is necessary. Payouts for this insurance can be declining-term or level, with the recipient being the lender or the borrower’s heirs.

How Long Do I Need To Pay Mortgage Insurance?

For conventional loans, mortgage insurance payments are required until at least 20% equity is reached. For FHA loans, mortgage insurance premiums (MIP) must be paid until the mortgage is paid off or refinanced.

What Does Mortgage Insurance Cover?

Mortgage insurance protects the lender, not the borrower, from any loss if the borrower is unable to make payments. It does not prevent the borrower from losing their house if they default on the loan.

How Can I Avoid Paying Mortgage Insurance?

To avoid paying private mortgage insurance, a down payment of at least 20% is necessary. Some lenders may allow borrowers to avoid PMI by choosing a mortgage with a higher interest rate. However, loans like FHA loans require mortgage insurance premiums, regardless of equity in the home.

The Bottom Line

Mortgage insurance protects lenders in case borrowers cannot fulfill their mortgage obligations. For conventional loans, PMI can be dropped once there is sufficient equity. However, for government-backed FHA loans, mortgage insurance premiums must be paid for the duration of the loan’s life.

Mortgage insurance protects lenders in case borrowers cannot fulfill their mortgage obligations. For conventional loans, PMI can be dropped once there is sufficient equity. However, for government-backed FHA loans, mortgage insurance premiums must be paid for the duration of the loan’s life.