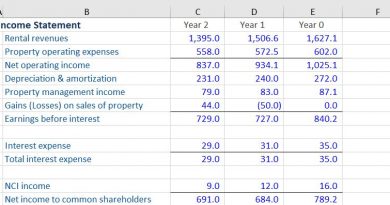

Money-Weighted Rate of Return Definition Formula and Example

Money-Weighted Rate of Return: Definition, Formula, and Example

What Is the Money-Weighted Rate of Return?

The money-weighted rate of return (MWRR) measures the performance of an investment. It is calculated by finding the rate of return that will set the present values (PV) of all cash flows equal to the value of the initial investment.

The MWRR is equivalent to the internal rate of return (IRR) and can be compared with the time-weighted return (TWR), which removes the effects of cash flows.

Key Takeaways

-The MWRR calculates investment performance by considering the size and timing of deposits or withdrawals.

-It is calculated by finding the rate of return that makes the present values of all cash flows equal to the initial investment.

-The MWRR is equivalent to the IRR.

-The MWRR sets the initial investment value equal to future cash flows, including dividends, withdrawals, deposits, and sale proceeds.

Understanding the Money-Weighted Rate of Return

Several methods can measure asset returns, making it crucial to understand which method is used to review asset performance. The MWRR takes into account the size and timing of cash flows, effectively measuring portfolio returns.

The MWRR determines the rate of return needed to start with the initial investment amount, factoring in all changes to cash flows, including the sale proceeds.

Calculating the Money-Weighted Rate of Return

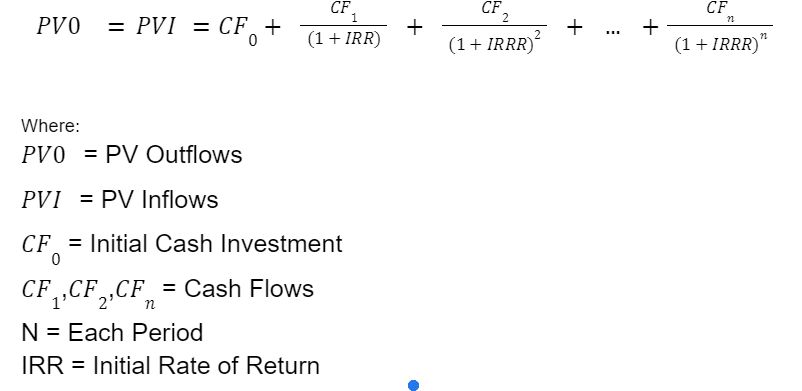

The formula for MWRR is as follows:

PVO = PVI = CF0 + CF1(1 + IRR) + CF2(1 + IRR)^2 + CF3(1 + IRR)^3 + … + CFn(1 + IRR)^n

Where:

PVO = PV Outflows

PVI = PV Inflows

CF0 = Initial cash outlay or investment

CF1, CF2, CF3, …, CFn = Cash flows

IRR = Initial rate of return

Using a Spreadsheet

Due to the complexity and trial-and-error nature of the MWRR formula, it is recommended to use a spreadsheet or calculator to estimate returns. Let’s use a spreadsheet to illustrate how to calculate it.

Assume you buy one share of stock for $50, receiving an annual $2 dividend. After three years, you sell it for $65. You receive two dividends before selling the stock.

The initial outlay of $50 in year one is negative. Each year after the purchase, you gain $2 until you sell it for $65 in year three after the dividend. Most spreadsheet applications’ IRR function will calculate the MWRR for you, as shown below.

Year 1: ($50)

Year 2: $2

Year 3: $2

Year 3 sale price: $65 = IRR(B2:B5) = 11.73%

The IRR function requires values and an optional rate guess:

= IRR ( cashflow values, rate guess )

To use the function, highlight the cells containing cashflow values so that the column and cell numbers are entered into the field between the parentheses, skip the rate guess, and press enter.

Cash Flows and the Money-Weighted Rate of Return

The MWRR is conceptually identical to the IRR. It is the discount rate where the net present value (NPV) is equal to 0, or the present value of inflows equals the present value of outflows.

To identify cash flows in and out of a portfolio, including asset or investment sales, it is essential to consider some cash flow examples, such as the cost of investments, reinvested dividends or interest, withdrawals, proceeds from investment sales, dividends or interest received, and contributions.

The Difference Between Money-Weighted Rate of Return and Time-Weighted Rate of Return

The MWRR and TWRR have distinct differences. The TWRR measures the compound rate of growth in a portfolio, often used to compare investment managers’ returns as it eliminates the distorting effects of inflows and outflows.

Determining an investment portfolio’s earnings can be challenging due to deposit and withdrawal distortions. The TWRR breaks up the return into intervals based on the presence of cash flows, while the MWRR considers investor behavior through the impact of inflows and outflows. Cash flows can affect the MWRR, but if there are no cash flows, both methods should produce similar or identical results.

Limitations of Using Money-Weighted Rate of Return

The MWRR considers all cash flows, including withdrawals, which can penalize fund managers for cash flows beyond their control. Large contributions before a portfolio’s performance rises can be seen as positive actions, while withdrawals before performance surges can be seen as negative actions.

Advantages of MWRR

MWRR allows you to assess if your investment generates consistent returns with an interest rate. If the rate is inconsistent, the rate of return begins to decline.

Should I Use Money Weighted or Time Weighted?

The choice between MWRR and TWRR depends on what you want to evaluate. MWRR shows how your changes impact your investment, making it less useful as a comparison tool. TWRR shows how investment performs without your changes, allowing for comparison with similar investments.

What Is Better, Time Weighted or Money Weighted?

Neither method is better or worse as they both demonstrate investment performance while accounting for different actions. They can be used together or separately to assess performance.

The Bottom Line

The money-weighted rate of return is a measurement of investment performance. It allows you to evaluate performance while considering your actions such as adding capital through contributions or reinvesting dividends.