Modified Adjusted Gross Income MAGI Calculating and Using It

Modified Adjusted Gross Income (MAGI): Calculating and Using It

Lea Uradu, J.D. is a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, and Tax Writer.

What Is Modified Adjusted Gross Income (MAGI)?

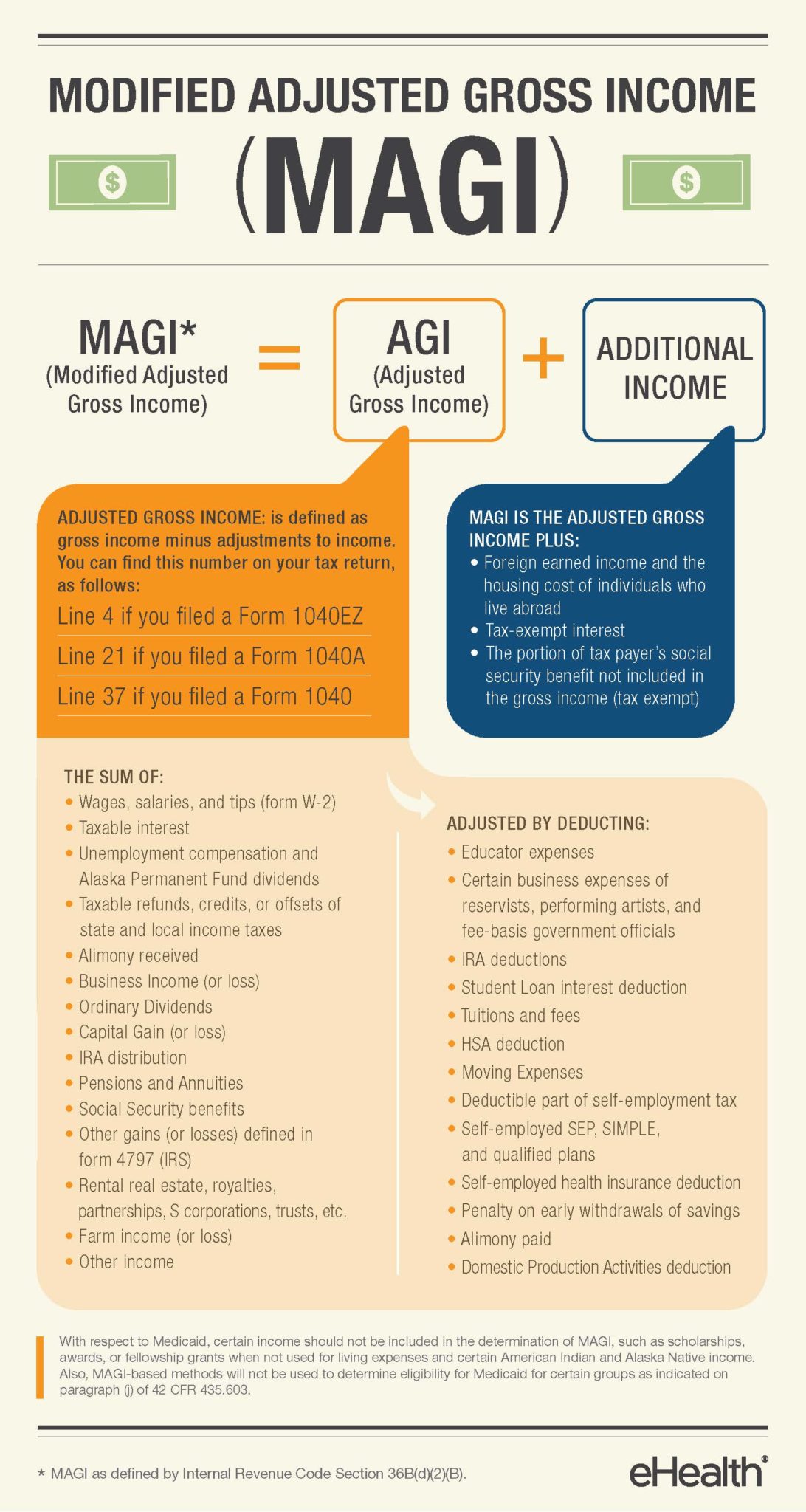

Modified adjusted gross income (MAGI) is an individual’s adjusted gross income (AGI) after considering deductions and tax penalties. Understanding MAGI is important as it is used in various tax concepts.

Key Takeaways

– MAGI is essential in determining taxable income.

– It adjusts AGI for certain deductions and credits.

– Crunch the numbers with tax preparation software to find your MAGI easily.

– MAGI affects eligibility for programs like retirement account contributions and other programs.

Understanding Modified Adjusted Gross Income (MAGI)

Modified adjusted gross income is your household’s AGI after factoring in tax-exempt interest income and specific tax deductions. Knowing your MAGI helps reduce taxable income, determine eligibility for benefits like the student loan interest deduction and the Child Tax Credit, and establish eligibility for income-based Medicaid coverage or health insurance subsidies.

The IRS uses MAGI for determining:

– Eligibility to contribute to a Roth individual retirement account (IRA)

– Deductibility of traditional IRA contributions

– Eligibility for the premium tax credit for health insurance costs

You can contribute to a traditional IRA regardless of income. However, if your MAGI exceeds IRS limits and you have a retirement plan at work, you can’t deduct contributions when filing your tax return.

MAGI and Its Uses

MAGI is not only crucial for understanding taxable income but also for qualifying for tax credits or deductions. Credits and deductions may phase out or disappear based on MAGI exceeding certain thresholds.

MAGI also determines eligibility for healthcare waivers, incentives under the Affordable Care Act (ACA), and state Medicaid programs.

Roth IRAs

MAGI determines eligibility to contribute to a Roth IRA. Contributions to Roth IRAs are made with after-tax dollars and grow tax-exempt. Contribution limits depend on MAGI, with phased-out contributions for higher MAGI.

Traditional IRAs

Excess contributions to traditional IRAs are subject to a tax penalty. The deductibility of traditional IRA contributions depends on MAGI and retirement plans at work. Different income limits apply depending on filing status and plan coverage.

Calculating Your MAGI

Calculating MAGI involves three steps. First, determine your gross income. Then, calculate your AGI. Finally, add back certain deductions to get your MAGI.

Figure Out Your Gross Income

Gross income includes alimony, business income, capital gains, dividends, interest, farm income, rental and royalty income, retirement income, tips, and wages. Alimony payments may be excluded under certain circumstances.

Calculate Your AGI

AGI is calculated before itemized or standard deductions, exemptions, and credits. AGI considers tax-deductible expenses like business expenses, educator expenses, and retirement plan contributions.

Add Back Certain Deductions

To find MAGI, add back deductions for IRA contributions, taxable Social Security payments, student loan interest, tuition and fees, self-employment tax, excluded foreign income, interest from EE savings bonds used for education, partnership or rental losses, and adoption expenses.

Various MAGI Calculations

MAGI calculations vary depending on the context. Different calculations apply to IRA deductions, student loan interest deductions, self-employment tax, excluded foreign income, tax-exempt income, and Social Security benefits.

Strategies to Minimize MAGI

To reduce MAGI, maximize deductions, save for retirement using tax-advantaged accounts, use other tax-advantaged vehicles like municipal bonds or Roth IRAs, harvest capital losses, and monitor rental investments.

What Purpose Does MAGI Serve?

MAGI is used by the IRS to determine eligibility for tax programs and benefits. It affects the allowed amount of Roth IRA contributions and eligibility for government programs like subsidized insurance plans.

Difference Between MAGI and AGI

MAGI is AGI plus additional items like student loan interest, qualified education expenses, passive income or losses, IRA contributions, and foreign income.

Can MAGI and AGI Be the Same?

MAGI and AGI can be the same if deductions related to foreign income, education expenses, or other specific items are not relevant.

The Bottom Line

MAGI is crucial for determining tax obligations. It modifies AGI by considering various exemptions, qualifications, and allowances. MAGI differs from AGI when specific items like foreign income, education expenses, or passive losses are involved.