Modified Book Value Meaning Pros and Cons

Modified Book Value: Meaning, Pros and Cons

Modified book value is a valuation metric that determines a company’s worth based on current market value for its assets and liabilities. It adjusts the value of a company’s assets and liabilities to reflect fair market value. Assets are recorded at their historical cost, so their fair market value may differ significantly. For example, marketable securities may have a market value different from their historical value.

Key Takeaways

– Modified book value determines a company’s worth based on current market value of assets and liabilities.

– Assets are recorded at historical cost, making their fair market value potentially different.

– Modified book value provides a more up-to-date valuation of a company.

Understanding Modified Book Value

Modified book value assumes that a company’s value can be determined by estimating the value of its underlying assets. It’s important to understand a company’s book value before determining its modified book value. Book value is the value of a company’s assets minus its debts and liabilities. Investors use book value to determine if a company is overvalued or undervalued.

Traditionally, the value of assets on a company’s balance sheet is considered when determining book value. However, asset values are recorded based on their original purchase price, or historical cost. In reality, these values can fluctuate and differ from historical cost.

For example, land may increase in value over time, while manufacturing equipment may decrease in value. Modified book value calculates the current value of a company’s assets and liabilities to provide an up-to-date valuation.

Components of Modified Book Value

Assets included in book value and modified book value calculations are fixed assets (physical or tangible) and intangible assets. Examples of fixed assets are equipment, machinery, factories, buildings, and vehicles. Intangible assets include patents, intellectual property (such as trademarks), and copyrights.

Liabilities represent a company’s obligations and can be short-term or long-term. Examples of liabilities include accounts payables (money owed to suppliers), dividends payable (short-term cash payments to investors), long-term debt (borrowed money), and pension benefits.

When Modified Book Value is Used

Modified book value is typically used when a company is facing bankruptcy or financial hardship. Creditors might have loans to the company and require updated values of its assets. Creditors determine the liquidation value of the assets, which is the amount they would receive if they sold all of the assets. If the total asset value is lower than the total liabilities, creditors would likely incur a loss.

How Modified Book Value is Determined

Modified book value provides a more realistic valuation of a company by obtaining the current market value of assets and liabilities. Adjustments may be made to short-term assets like cash and accounts receivables. Real estate and technology assets may have different values compared to their historical costs. Modified book value is calculated by subtracting the total fair market value of assets from the total fair market value of liabilities.

Advantages and Disadvantages of Modified Book Value

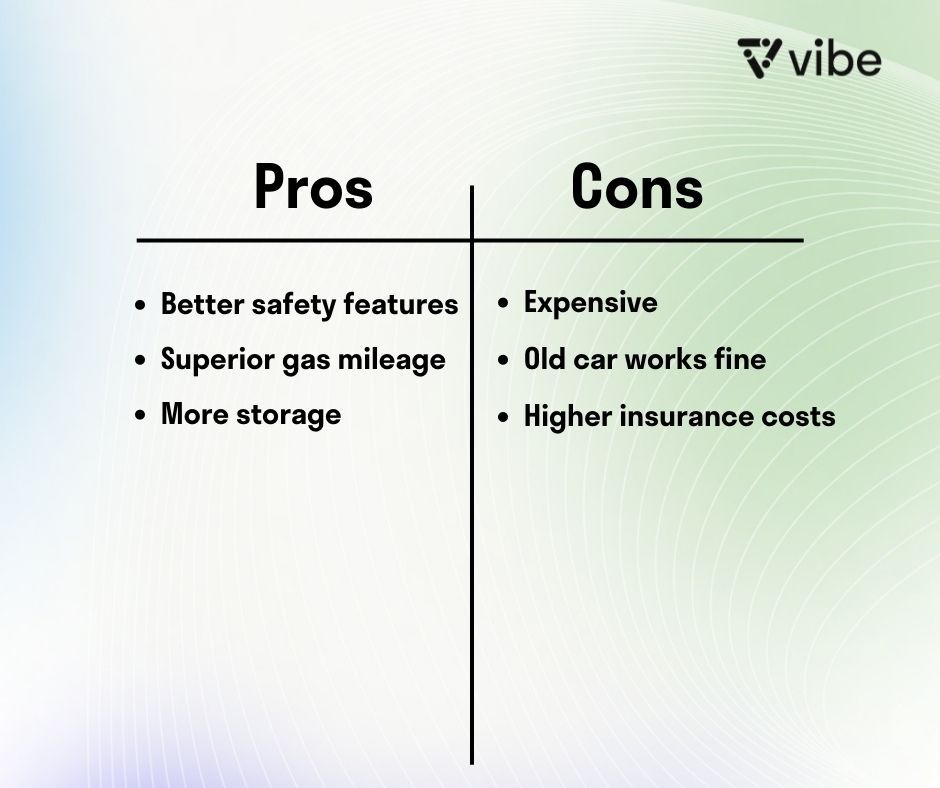

The advantage of modified book value is its in-depth examination of a business. Individual asset valuations provide a clear understanding of where the business generates the most value, aiding in the negotiation process during debt restructuring.

The major disadvantage is the high cost associated with calculating modified book value. Hiring specialized appraisers and the time-consuming process make it less practical than other valuation methods. Additionally, the average investor may not have access to specific assets and their values for a publicly-traded company.

Other Ways to Value Companies

Companies can be valued using methods such as market capitalization, the times revenue method, and discounted cash flow. Hiring firms specializing in business valuations can also determine a business’s value for various purposes like mergers, acquisitions, and financial reporting.