What Are Commodities and Understanding Their Role in the Stock Market

Commodities are raw materials used to make consumer products. They are inputs for other goods and services, not finished goods sold to consumers.

In commerce, commodities are basic resources interchangeable with other goods of the same type. The quality may differ slightly, but they are essentially uniform across producers. When traded on an exchange, commodities must meet specified minimum standards, also known as a basis grade.

Key Takeaways:

-A commodity is a basic good used in commerce and interchangeable with others of the same type.

-Commodities are mainly used as inputs in the production of goods or services.

-Investors and traders can buy and sell commodities directly or through derivatives like futures and options.

-Hard commodities include energy and metal products, while soft commodities are often agricultural goods.

-Many investors consider allocating commodities as a hedge against inflation.

Commodities are raw inputs used in goods production, including some agricultural staples. The important feature is that commodities have little differentiation regardless of the producer. For example, a barrel of oil or a bushel of wheat are essentially the same product, unlike consumer goods that vary by producer (e.g., Coke vs. Pepsi).

Traditional examples of commodities include grains, gold, beef, oil, and natural gas. Definitions have expanded to include financial products like foreign currencies and indexes.

Commodities can be bought and sold on exchanges as financial assets. Derivatives markets also exist, allowing the purchase of contracts on commodities like oil, wheat, gold, and natural gas. Experts suggest that investors diversify their portfolios with commodities as they are not highly correlated with other assets and can serve as an inflation hedge. Allocating up to 10% of a portfolio to commodities is a common approach.

The sale and purchase of commodities are usually done through futures contracts on exchanges that standardize quantity and quality. For example, the Chicago Board of Trade (CBOT) stipulates that one wheat contract is for 5,000 bushels and specifies the wheat grades accepted for the contract.

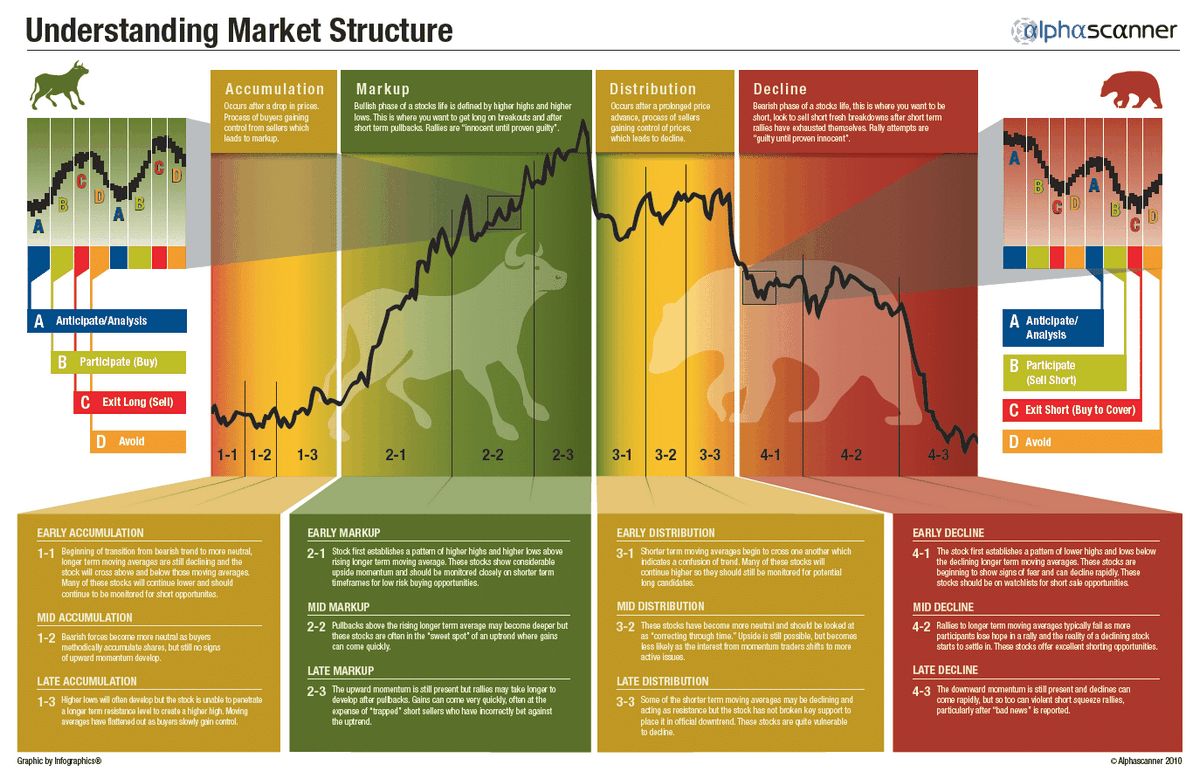

Trades in commodity futures involve two types of traders. The first are buyers and producers who use futures contracts for hedging purposes. They make or take delivery of the actual commodity when the contract expires. For example, a wheat farmer can hedge against the risk of losing money by selling wheat futures contracts when the crop is planted, gaining a predetermined price for the harvested wheat.

The second type of commodities trader is the speculator. These traders profit from price movements and do not intend to make or take delivery of the actual commodity when the contract expires. Futures markets with high liquidity and volatility are popular among intraday traders and are used for risk offsetting by brokerages and portfolio managers. Commodities can effectively diversify investment portfolios as they typically do not trade in tandem with equity and bond markets.

Commodity prices often rise with increasing inflation, attracting investors seeking protection during times of inflation. This increased demand raises prices, causing goods and services prices to match the increase. Commodities are frequently used to hedge against currency value decrease during inflation.

The modern commodities market relies on derivative securities like futures and forward contracts. These allow buyers and sellers to transact without exchanging the physical commodities. Commodity derivatives are commonly used to speculate on price movements, hedge risks, and protect against inflation.

Supply and demand ultimately determine commodity prices. Economic shocks, natural disasters, and investor appetite can impact supply and demand. For instance, a booming economy may increase demand for oil and other energy commodities. Investors may purchase commodities as an inflation hedge, anticipating rising inflation.

Commodities are physical products consumed or used in production, while assets are goods not consumed through use. Securities are financial instruments representing cash flows generated from various activities.

Hard commodities are mined or extracted, including metals, ores, and petroleum products. Soft commodities are grown, such as agricultural products like wheat, cotton, coffee, sugar, and soybeans.

Commodities are traded on major exchanges like ICE Futures U.S., the CME Group, the Chicago Board of Trade (CBOT), the Chicago Mercantile Exchange (CME), the New York Mercantile Exchange (NYMEX), and the Commodity Exchange, Inc. (COMEX). Other significant commodities exchanges are located globally.

Commodities are basic goods and materials widely used and not meaningfully differentiated from one another. Examples include oil barrels, wheat bushels, and megawatt-hours of electricity. While commodities have long been essential to commerce, commodities trading has become increasingly standardized.