What Does Tax Deductible Mean and What Are Common Deductions

Tax Deductible: Definition and Common Deductions

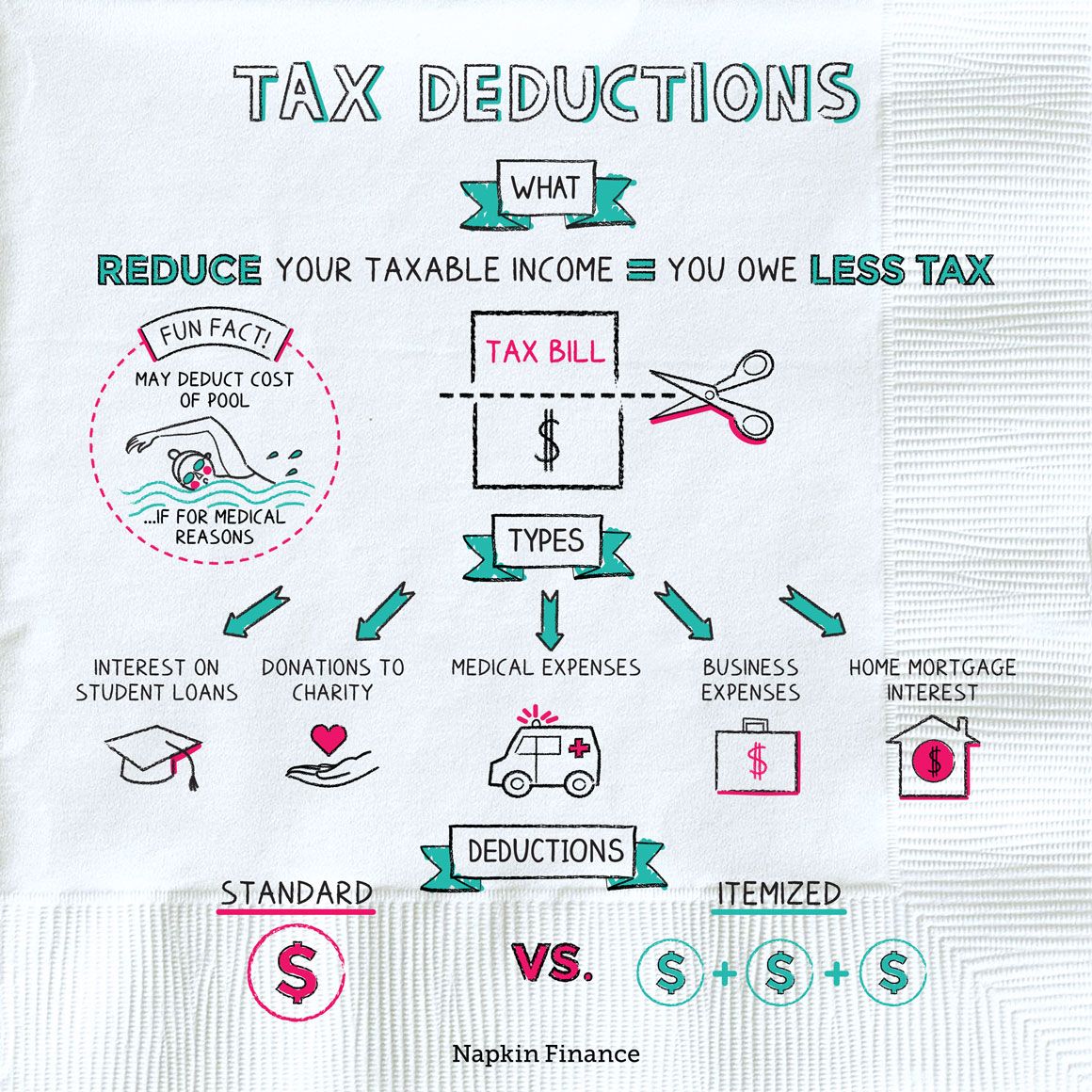

A tax deductible is an expense that individuals or businesses can subtract from their adjusted gross income (AGI) to reduce their taxable income and lower the amount of taxes owed.

Some key points to remember about tax deductibles include:

– They serve as incentives provided by governments to encourage specific behaviors.

– Governments want to promote actions that are beneficial to individuals and society as a whole.

– Common deductions for individuals include student loan interest, self-employment expenses, charitable donations, and mortgage interest.

– Business deductions include payroll, utilities, rent, and other operational costs.

Advantages and Disadvantages of Tax Deductibles

Tax deductibles offer advantages such as incentivizing desired behaviors, providing financial relief, and promoting fairness within the tax system. However, they also have downsides including complexity, potential economic distortions, and the potential for income inequality.

Standardized Deduction vs. Itemized Deduction

Individual taxpayers can choose between taking the standard deduction or itemizing their deductible expenses. The standard deduction is simpler and used by the majority of taxpayers, while itemizing requires more record-keeping and documenting of expenses.

Business Deductibles

Business deductibles are more complex than individual deductibles and require detailed record-keeping. Examples of business deductibles include payroll, utilities, rent, leases, and other operational costs.

Retirement Contributions

Certain retirement accounts offer tax benefits, and contributions to these accounts can be tax-deductible. The IRS sets annual contribution limits for retirement accounts, which vary depending on the type of account and age.

Tax Credit vs. Tax Deduction

Tax credits and tax deductions both help reduce taxes owed, but there are distinct differences. Tax credits directly subtract from the tax bill, while tax deductions lower taxable income.

Calculating Tax Deductibles

All tax deductibles are subtracted from gross income to arrive at adjusted gross income (AGI), which is the amount subject to taxes. Taxpayers who itemize deductions must fill out a Schedule A form to list their expenses.

Standard Tax Deduction

The standard deduction is a specific dollar amount that taxpayers can use to reduce their taxable income if they choose not to itemize deductions.

Impact on Refund

Tax deductions lower taxable income and can result in a refund if taxes were overpaid during the year.

Choosing between Standard Deduction and Itemized Deductions

Taxpayers should choose between the standard deduction and itemized deductions based on which option results in a lower tax bill. Record-keeping of deductible expenses is necessary for itemizing deductions.

In summary, tax deductibles are expenses that can be subtracted from taxable income to reduce the amount of taxes owed. They serve as incentives, offer advantages and disadvantages, and can be claimed through the standard deduction or itemizing deductions.