Mega Cap Companies With Market Caps Above 200 Billion

Contents

Mega Cap: Companies With Market Caps Above $200 Billion

What Is a Mega Cap?

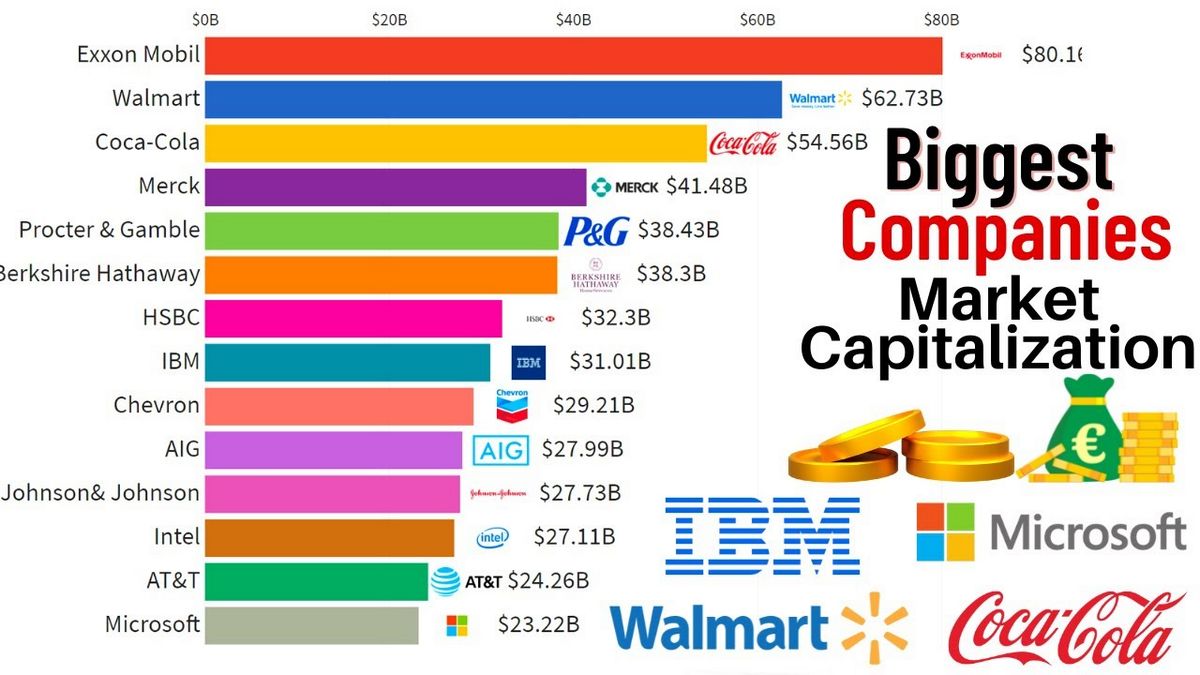

Mega cap is a designation for the largest companies in the investment universe, measured by market capitalization. While the thresholds change with market conditions, mega cap generally refers to companies with a market capitalization above $200 billion. Many of the companies have strong brand recognition and operate in major global markets, such as Apple (AAPL), Amazon (AMZN), and Meta (META), formerly Facebook.

Key Takeaways

- Mega cap companies have market values above the rest of the market, with valuations over $200 billion.

- Mega-cap stocks can lift or drop entire indices based on their performance.

- Mega cap stocks have been in the energy or transportation sectors, but now many are tech companies like Tencent and Amazon.

- Mega-cap stocks have limitations, like any stock.

- Mega-cap stocks are not limited to Japan, Europe, and the United States; they also have steady growth in emerging markets.

Understanding Mega Caps

Mega-cap stocks wield significant influence in different industries due to their size and volume of sales. For instance, Apple holds a market cap above $2 trillion as of December 2021, driven by strong iPhone sales, while Amazon reached new highs with its retail operations and web services.

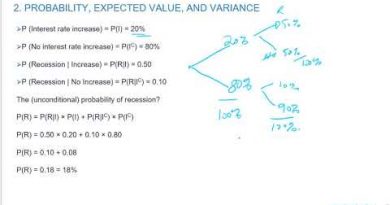

About a dozen companies traded in the United States hold capitalizations over $300 billion, mostly in the technology sector. In the past, blue-chip companies like ExxonMobil (XOM) and General Electric (GE) dominated, delivering consistent dividends and returns.

In the 21st century, technology innovation and disruption elevated the entire sector and many of its constituents.

Mega-cap stocks are no longer limited to the U.S., Europe, and Japan. Emerging markets now have a greater representation, with China being home to companies like Tencent and Alibaba (BABA).

In the early 2000s, the commodity boom led to energy and resource companies achieving mega-cap status. On the other hand, the 2008 credit crisis dragged some of the biggest banks below mega-cap status. The largest U.S. companies now have ties to cutting-edge technology and significant returns.

Limitations of Mega Cap Stocks

The stock market, as measured by the S&P 500, is led higher by a handful of mega-cap tech stocks. This concentrated leadership concerns investors, fearing another tech bubble. A sustained downturn in these stocks could significantly impact the broader market. This trend reflects investors’ tendency to pile into one market corner instead of following basic investing strategies.