Market Basket Definition How It s Used in Investing and Example

Market Basket: Definition, How It’s Used in Investing and Example

What Is a Market Basket?

A market basket is a selected group of products or assets designed to track the general performance of a specific market segment. This is sometimes referred to as a basket of goods.

Market basket economics focuses on the Consumer Price Index (CPI), which tracks consumer goods and uses their price levels to estimate inflation. However, for investors, a market basket relates to financial securities and is the principle idea behind index funds.

"Baskets" can also be found in securities markets, where program traders may enter into multiple positions in stocks or currencies simultaneously.

Key Takeaways

– A market basket is a selected mix of goods and services that tracks the performance of a specific market or segment.

– A popular market basket is the Consumer Price Index (CPI), which estimates inflation based on the average price change of a specific basket of goods and services over time.

– The CPI uses over 200 categories, including education, housing, transportation, and recreation, as an economic measure.

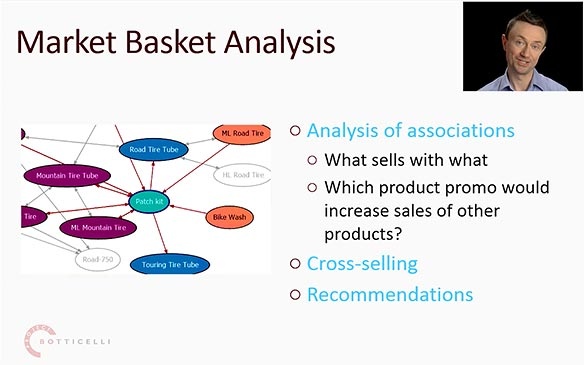

– Market basket analysis is used by retail stores to predict and increase impulse purchases based on groups of items.

How a Market Basket Works

A market basket refers to a selection of goods and services consistently purchased and sold throughout an economic system. Economists, politicians, and financial analysts use market baskets to track price changes over time and determine inflation levels. The most well-known and widely used market basket is the CPI, which helps economists predict consumer purchase trends. This basket is used to track inflation in a specific market or country.

The financial system uses market baskets like the S&P 500 and index funds, which are broad samples of stocks, bonds, or other securities in the market. This provides investors with a benchmark to compare their investment returns.

Special Considerations

Market basket analysis is generally used in retail to predict customer purchases. It is based on the idea that most purchases are impulse buys and attempts to predict what else a customer might buy if presented with the opportunity. Analysts use this information to determine store layout, customer demographics, peak purchase times, and seasonal spending patterns, among other considerations.

Market basket analysis can also be used to predict credit card purchases, phone calling patterns, insurance fraud, and more.

Types of Market Baskets

The CPI is an economic measure that looks at the average price change for a specific basket of goods and services over time. It serves as a macroeconomic indicator, deflating tool, and a way to adjust monetary values over time. The CPI is not a cost of living index; instead, it measures spending patterns and price levels for urban consumers and urban wage earners. The index takes into account the unemployed and the retired.

The market basket used for the CPI is derived from consumers’ spending habits. Over 200 consumption categories within the CPI structure are analyzed to create a mix of goods and services that represents average purchases. Each selected category is given a weight based on its proportion to the basket of goods. Categories in the CPI’s market basket include housing, transportation, recreation, apparel, and education.

The CPI’s market basket also includes components outside of consumer goods and services. This includes government fees for public goods like water and sewage, as well as taxes on the products and services already included. However, financial products like stocks and bonds are not part of the market basket. Essentially, the market basket represents all goods and services bought and sold by the population represented by the CPI.

Real World Example of a Market Basket

From 2020 to 2021, the CPI in the United States increased from 1.2% to 4.7%, the fastest rate of increase since 2017. The government attributed this increase to rising gas prices, medical care costs, housing, and rent prices. The increase in the CPI indicated inflation as prices in the basket of goods rose.

Monitoring the CPI and inflation allows governments and central banks to set monetary policies. Central banks of developed economies, including the Federal Reserve in the United States, generally aim to keep the inflation rate around 2%. After a long period of low interest rates, the Federal Reserve raised interest rates four times in 2018 to address a strong economy and inflation. In June 2022, with the U.S. experiencing the highest inflation in 40 years, the Fed raised rates by 75 basis points to 1.50%–1.75%.

Overall, market baskets provide valuable insights into price changes, inflation, and consumer spending patterns, allowing economists, investors, and businesses to make informed decisions.