Marginal Propensity to Invest MPI Definition and Calculation

Marginal Propensity to Invest (MPI): Definition and Calculation

Marginal Propensity to Invest (MPI) is the ratio of change in investment to change in income. It shows how much of one additional unit of income will be used for investment purposes. People typically invest only a portion of their income, and investment increases along with income, resulting in a positive ratio between 0 and 1. The greater the MPI, the larger the proportion of additional income is invested rather than consumed.

Key Takeaways:

– MPI is the proportion of an additional increment of income that is spent on investment.

– MPI is one of several marginal rates used by Keynesian economists to model changes in income and spending.

– The larger the MPI, the more additional income gets invested.

– Investment directed by MPI may have positive effects on the economy via a multiplier effect, but this effect might be negative if crowding out occurs.

Understanding the Marginal Propensity to Invest (MPI):

The MPI is derived from Keynesian economics. According to this theory, whatever is not consumed is saved. Changes in income levels prompt individuals and businesses to take action with their available money.

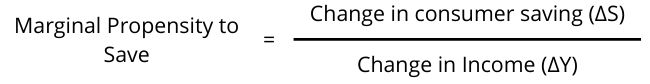

The MPI forms part of other marginal rates in Keynesian economics, such as the marginal propensity to consume (MPC), the marginal propensity to save (MPS), and the marginal propensity for government purchases (MPG).

Calculation:

MPI = ΔI/ΔY, representing the change in value of the investment function (I) divided by the change in value of the income function (Y). It determines the slope of the investment line. For example, if a $5 increase in income results in a $2 increase in investment, the MPI is 0.4 ($2/$5). In practice, the MPI is usually much lower, especially when compared to the MPC.

MPI’s Value Over Time:

MPI holds significant value when compared over time. Governments can measure the impact of a policy change by comparing the MPI before and after implementation.

How MPI Impacts the Economy:

While consumption is primarily affected by increases in income, the MPI plays a role in the multiplier effect and affects the slope of the aggregate expenditures function. The larger the MPI, the larger the multiplier. Business income can increase due to reduced taxes, changes in costs, or changes in revenue.

According to Keynesian theory, increased investment spending immediately employs people in the investment goods industry and has a multiplied effect by employing additional people in the economy. However, this effect is limited to the output at full employment. Overspending can result in increased prices, especially in capital goods or financial assets.

Factors that Impact MPI:

– Prevailing Expected Rate of Return: Influences the psychology of investing. Higher anticipated returns encourage more investment.

– Interest Rates: Lower rates make borrowing for investments more attractive, potentially increasing the MPI.

– Access to Financing: Availability of financing options and capital resources influences the MPI.

– Tax Incentives and Policy: Government policies and tax incentives can raise the MPI.

– Technological Advancements: Innovations can drive the MPI, as firms invest in new technologies.

– Risk Appetite: Higher risk appetite leads to more investment in riskier projects.

Users of MPI:

Economists and policymakers rely on MPI to assess and fine-tune fiscal and monetary policies. Central banks use MPI to gauge the impact of interest rate changes on investment decisions. MPI influences investment decisions at both the micro and macro levels, allowing businesses to allocate capital effectively and individuals to decide on investing their disposable income.

MPI vs. MPC:

MPC represents the proportion of additional income spent on consumption. While MPI focuses on firms and investors’ behavior, MPC primarily analyzes households and individuals. A high MPC suggests higher immediate consumption while a high MPI indicates greater investment for long-term growth.

MPI’s Importance in Macroeconomics:

MPI is crucial for understanding the influence of income changes on investment decisions. It aids economists and policymakers in predicting investment spending in response to economic changes.

Implications of a High MPI:

A high MPI implies that a significant portion of additional income is directed towards investment rather than immediate consumption. This indicates a preference for saving and investing.

Implications of a Fluctuating MPI:

A fluctuating MPI can have implications for economic stability and policy effectiveness. A consistently high MPI contributes to steady economic growth, while a volatile MPI creates uncertainty.

Government Spending’s Influence on MPI:

Government spending affects MPI by influencing the overall level of income and investment in the economy. Increased government spending can stimulate investment by providing higher income to businesses and individuals.

In conclusion, MPI is an essential concept that measures the change in investment resulting from changes in income. It helps understand investment behavior and plays a role in economic analysis, policymaking, and forecasting.