Marginal Profit Definition and Calculation Formula

Marginal Profit: Definition and Calculation Formula

What Is Marginal Profit?

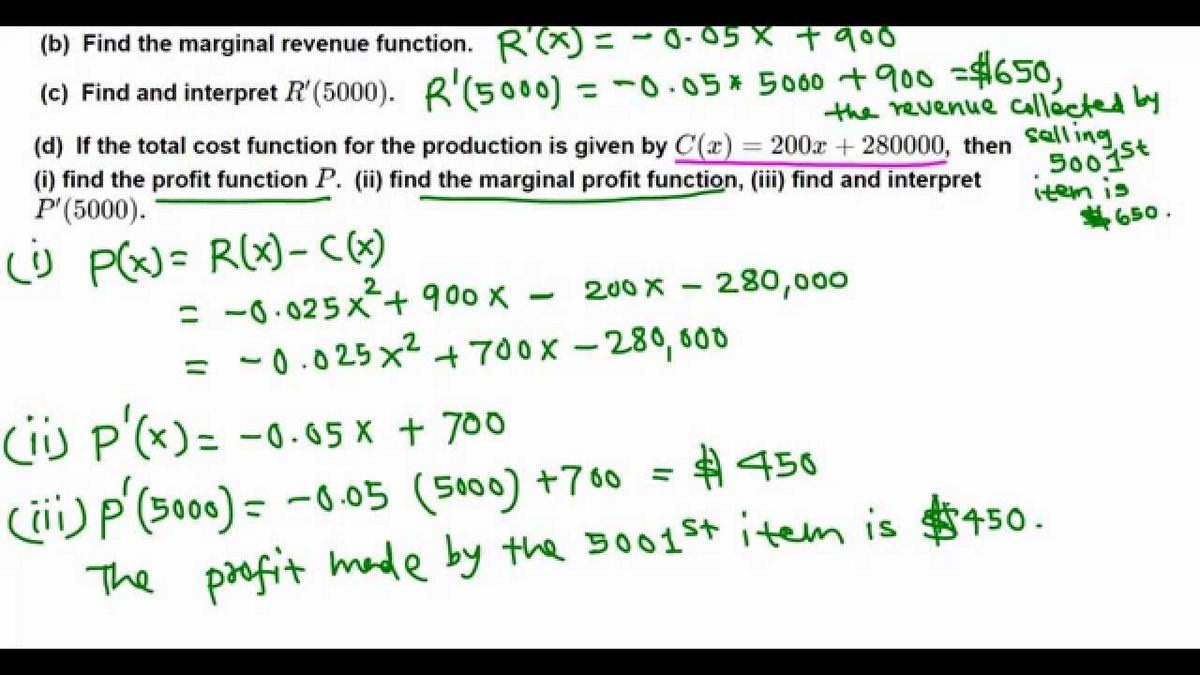

Marginal profit is the profit earned when one additional unit is produced and sold. It refers to the added cost or profit earned with producing the next unit. Marginal product is the additional revenue earned while marginal cost is the added cost for producing one additional unit.

Marginal profit is the difference between marginal cost and marginal product. It is useful for managers in deciding whether to expand or slow down production, also known as a shutdown point.

Key Takeaways

– Marginal profit is the increase in profits resulting from the production of one additional unit.

– Marginal profit is calculated by taking the difference between marginal revenue and marginal cost.

– Marginal profit analysis helps determine whether to increase or decrease the level of output.

Understanding Marginal Profit

Marginal profit looks at the money to be made on producing one additional unit. It accounts for the scale of production because as a firm gets larger, its cost structure changes, and profitability can either increase or decrease as production ramps up.

Economies of scale refer to the situation where marginal profit increases as the scale of production is increased. At a certain point, the marginal profit will become zero and then turn negative as scale increases beyond its intended capacity.

Companies will increase production until marginal cost equals marginal product, which is when marginal profit equals zero. If the marginal profit turns negative, management may decide to scale back production or halt production temporarily.

How to Calculate Marginal Profit

Marginal profit is calculated by subtracting the marginal cost from the marginal revenue.

Marginal profit (MP) = Marginal revenue (MR) – marginal cost (MCMC)

In perfect competition, firms produce until marginal cost equals marginal revenue, resulting in zero marginal profit.

Special Considerations

Marginal profit only provides the profit earned from producing one additional item, not the overall profitability of a firm. A firm should stop production when producing one more unit begins to reduce overall profitability.

Variables that contribute to marginal cost include labor, cost of supplies or raw materials, interest on debt, and taxes.

Fixed costs should not be included in the calculation of marginal profit since these expenses do not alter the profitability of producing the next unit.

Sunk costs, such as building a manufacturing plant or buying equipment, are not included in marginal profit analysis. However, the tendency to include fixed costs can lead to misguided decisions.

Many markets do not approach perfect competition, and managers often make production decisions based on hindsight and estimates of future costs.

Why Do Firms Care About Their Marginal Profit?

Firms aim to maximize profits while considering the increase in production costs. When marginal profit is zero, that level of production is optimal. If marginal profit turns negative, production should be scaled back.

When Should a Business Shut Down Considering Marginal Profit?

If marginal profit is negative at all levels of production, the firm should cease all production temporarily rather than continue at a loss.

What Are Economies of Scale?

Economies of scale refer to situations where ramping up production decreases marginal cost and increases marginal profit.