Mandatory Binding Arbitration Definition Examples and FAQ

Contents

- 1 Mandatory Binding Arbitration: Definition, Examples, and FAQ

Mandatory Binding Arbitration: Definition, Examples, and FAQ

Mitchell Grant, a self-taught investor with over 5 years of experience as a financial trader, is a financial content strategist and creative content editor.

What Is Mandatory Binding Arbitration?

Mandatory binding arbitration is a proceeding to settle disagreements between two parties. It requires the parties to use an arbiter to hear their arguments and accept the arbitrator’s decision; the outcome of the arbitration hearing is "binding."

In the financial world, arbitration is a common mechanism for resolving disputes between clients and their financial institutions, investors and brokers, or between brokers.

Key Takeaways

- Mandatory binding arbitration is a private proceeding to settle disagreements between two parties.

- Parties to a contract agree to have their case reviewed by a third party—an arbitrator—and to be bound by the arbitrator’s decision.

- Mandatory binding arbitration often requires the parties to waive specific rights, like the right to sue and the right to appeal any decision.

- Arbitrations tend to be faster, less formal, and less costly than court trials.

- Mandatory binding arbitration has been criticized for denying consumers their rights and for being biased towards corporate defendants.

Understanding Mandatory Binding Arbitration

When one party in a contract believes that the other party has not upheld the terms of the agreement, it typically has the right to sue, seeking damages in court. If the case goes to trial, the court system may award the plaintiff with monetary damages if it finds that the defendant has violated the contract, causing harm to the plaintiff.

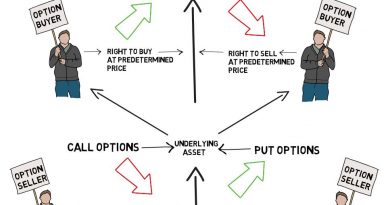

Arbitration is an alternative form of dispute settlement in which the parties agree to have their case reviewed by a third party—an arbitrator—other than a judge. It’s set up by a contract provision that requires two parties to resolve disputes via arbitration rather than through the court system.

Mandatory binding arbitration often requires the parties to waive specific rights. The provision removes or limits a party from suing if they feel wronged—they must go to arbitration instead. It also takes away their right to appeal any decision. The proceeding means the arbitrator’s judgment is final.

Arbitrations tend to be less formal and faster than court trials. However, in cases involving large financial sums or with significant impact, an arbitration may be heard and decided by a committee or tribunal that functions similarly to a jury.

Criticism of Mandatory Binding Arbitration

Contracts, loans, and other agreements created by banks, credit card issuers, and cell phone companies often contain mandatory binding arbitration clauses to prevent customers from joining class-action lawsuits. These provisions may be buried in the fine print of a contract, and many people are unaware that, by signing, their rights have become significantly curtailed, including their ability to sue.

An additional critique of mandatory binding arbitration is that the customer usually has no say or power in the choice of an arbiter. The clause often states they must agree to an arbiter selected by the other party. Companies can use this to their advantage, engaging an arbiter who may seem impartial but who actually has ties to the firm or industry. As a result, their judgment is based on acquaintances, instead of on the objective merit of each side.

Finally, arbitrators are not bound to follow legal precedent or obey any rules of legal procedure. Arbitrations are usually conducted in private, and the outcome is typically kept quiet.

Binding Arbitration vs. Non-Binding Arbitration

Arbitration proceedings can either be binding or non-binding. The former means the decision is final and enforceable, while the latter means the arbitrator’s ruling is advisory and can only be applied if both parties agree to it. Each party maintains the right to reject the decision of the arbitrator and request a formal trial.

Example of Mandatory Binding Arbitration

Most brokerages require their clients to agree to mandatory binding arbitration to settle potential disputes, rather than going to court. These proceedings are overseen by the Financial Industry Regulatory Authority (FINRA) through its dispute resolution forum.

When an investor has a specific dispute with a broker (presumably one registered with FINRA), they may file a claim—within six years of the incident—with the authority that states the alleged misconduct and the amount of money they are seeking in damages. FINRA will appoint a single arbitrator or a panel of three financial industry professionals who are not employed in the securities industry to eliminate partisanship and conflicts of interest, but a party may request a change if they suspect bias.

The size of the claim determines how the arbitration process works.

- For disputes involving less than $50,000, in-person hearings are not necessary; both parties submit written materials to a single arbitrator who decides the case in a "simplified arbitration process."

- For disputes ranging from $50,000 to $100,000, in-person hearings with a single arbitrator are common.

- For disputes over $100,000, in-person hearings with three arbitrators are standard. A majority of the three-arbitrator panel—two people—is necessary for a decision. Arbitrators are not required to explain their decision.

16 months

The maximum amount of time it can take to reach a decision and determine an award in a FINRA arbitration case.

Binding Arbitration FAQs

What Does a Binding Arbitration Clause Typically State?

At their most basic, binding arbitration clauses state the conditions under which arbitrations occur. Something like:

Arbitration. All claims and disputes arising under or relating to this Agreement are to be settled by binding arbitration in the state of [insert state in which parties agree to arbitrate] or another location mutually agreeable to the parties. An award of arbitration may be confirmed in a court of competent jurisdiction.

But clauses can get more detailed:

Arbitration. All claims and disputes arising under or relating to this Agreement are to be settled by binding arbitration in the state of [insert state in which parties agree to arbitrate] or another location mutually agreeable to the parties. The arbitration shall be conducted on a confidential basis pursuant to the Commercial Arbitration Rules of the American Arbitration Association. Any decision or award as a result of any such arbitration proceeding shall be in writing and shall provide an explanation for all conclusions of law and fact and shall include the assessment of costs, expenses, and reasonable attorneys’ fees. Any such arbitration shall be conducted by an arbitrator experienced in [insert industry or legal experience required for arbitrator] and shall include a written record of the arbitration hearing. The parties reserve the right to object to any individual who shall be employed by or affiliated with a competing organization or entity. An award of arbitration may be confirmed in a court of competent jurisdiction.

Who Pays for Binding Arbitration?

A typical arbitration provision specifies that each party pays the costs of its representative and witnesses. The party bringing the claim usually pays the filing fees. The parties split the cost of the arbitrator’s fees, expenses, and administrative fees. In rare cases, the agreement between the parties may specify a different distribution of the cost, including provisions like “loser pays the cost of the arbitrator.”

Arbitrators usually have the right to make the losing person pay the costs of the arbitration or divide the costs.

How Much Does Arbitration Cost?

Arbitration costs can vary greatly depending on the jurisdiction, the time it takes, and the complexity of the proceedings.

Potential costs include: