Medium Term Definition in Investment Time Periods

Contents

Medium Term: Definition in Investment Time Periods

What Is Medium Term?

Medium term is an intermediate holding period or investment horizon. The exact period depends on the investor’s preference and the asset class.

In the fixed-income market, bonds with 2 to 10-year maturities are considered medium-term.

Key Takeaways

- Medium term is an intermediate holding period or investment horizon.

- The exact period depends on the investor’s preference and the asset class.

- In the fixed-income market, bonds with 2 to 10-year maturities are considered medium-term.

A day trader who seldom holds positions overnight may consider a stock held for a couple of weeks as a medium-term position, while a long-term investor might define medium term as one to three years. Similarly, homeowners may regard anything less than 10 years as a medium-term horizon in real estate.

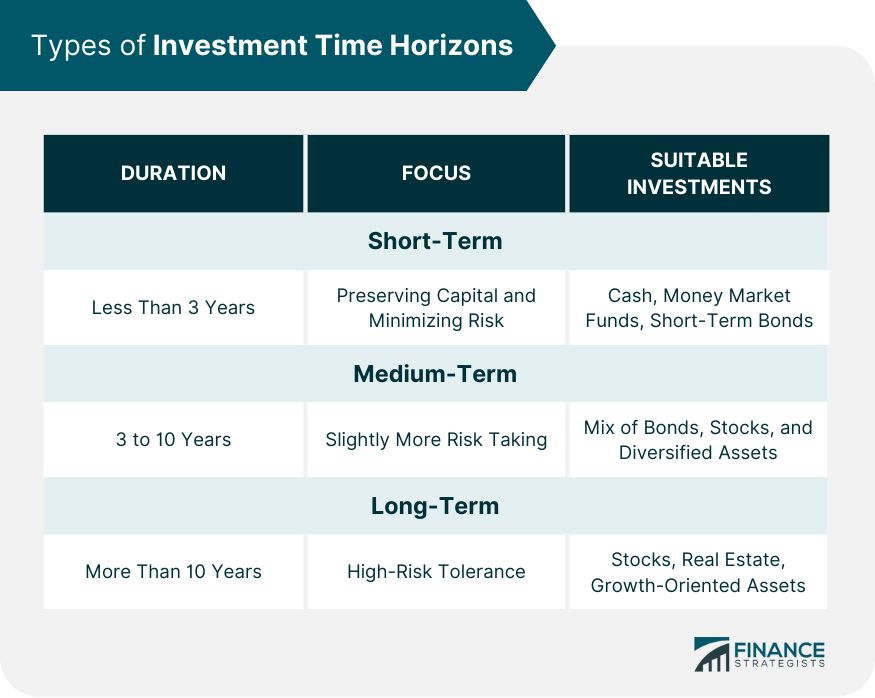

Medium term can be contrasted with short term (less than a year or two) and long term (over 10 years).

Understanding Medium Term

Determining an investment’s time horizon, also called its term, is usually based on the intention or goal behind the investment, rather than the nature of the investment itself. An investor might consider when the funds will be used for other goals, or whether a lump sum or an income stream is the desired result. The most common terms are short, medium, and long.

Though the term does not necessarily denote a specific length of time, many consider anything below two years as short-term, two to ten years as medium term, and anything beyond 10 years as long term. Since these timeframes are flexible and open to interpretation, a medium-term investment for one person might be a long-term investment for another.

An investor’s risk tolerance is influenced by the investment’s term. For example, if you intend to purchase a car within the next two years, it’s wise to invest conservatively. You might consider a traditional savings account or a CD (assuming the appropriate time until maturity). Volatility in higher-risk markets may prevent your goals from being reached.

When saving for longer-term goals, such as retirement in 20 years, you can generally afford to take on more risk for higher returns in the early stages. As retirement approaches, the time horizon may shift from long-term to medium-term, prompting a move toward more conservative investments.

If your goals are medium-term, seek a balance between risk and returns—act more conservatively than for long-term goals but opt for more risk than for short-term options. Examples of medium-term investments are bonds (with maturity dates between three and 10 years), income funds, or growth funds.

If your goals are medium-term, seek a balance between risk and returns—act more conservatively than for long-term goals but opt for more risk than for short-term options. Examples of medium-term investments are bonds (with maturity dates between three and 10 years), income funds, or growth funds.