Up-and-In Option What it Means How it Works

Contents

Up-and-In Option: Meaning and Mechanics

What Is an Up-and-In Option?

Up-and-in options are exotic options offered to high-end clients in the over-the-counter (OTC) markets. These options have a strike price and a barrier level. The buyer benefits when the underlying price rises enough to reach (knock-in) the designated barrier level.

Key Takeaways

- These exotic options are usually available to institutional investors on stocks or forex.

- They have both a strike price and a barrier level.

- An up-and-in option pays out when the underlying reaches the barrier level before expiration.

How an Up-and-In Option Works

Up-and-in options are a type of barrier option, which is a more complex form of exotic option. Barrier options can be knock-in options or knock-out options, with different payout structures. They may also include a rebate provision.

Barrier options are often offered in a customized manner in OTC markets. Retail investors rarely have access to these options. The payout structure depends on the variety and the liquidity of the underlying asset, which can either be forex or stocks.

Knock-In Options

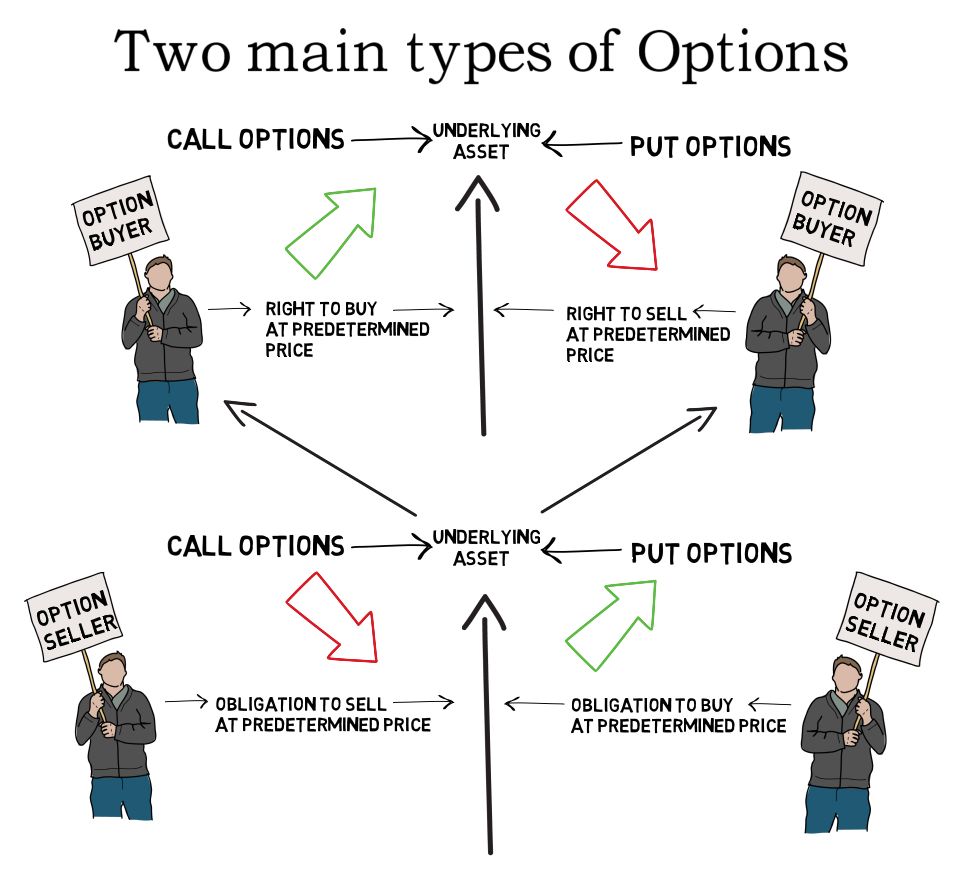

Knock-in options can be up-and-in or down-and-in. The barrier price determines when the option becomes exercisable. An up-and-in option becomes exercisable when the barrier level is reached or exceeded, depending on the structure.

A down-and-in option becomes exercisable when the underlying asset’s price falls to or below a certain barrier level. Up-and-in options use call options for benefiting from rising prices, while down-and-in options use put options for benefiting from falling prices.

Knock-Out Options

Knock-out options are the inverse of knock-in options. These options become defective when a price is reached but remain viable until the barrier level is crossed. Up-and-out options become defective when a price is reached or exceeded, while down-and-out options become defective when a price falls to or below the barrier level.

Rebate Barrier Options

Both knock-in and knock-out options can include a rebate provision, known as rebate barrier options. The holder receives a rebate if the option is non-exercisable at expiration.

Barrier Option Provisions

Barrier options have various structures, including American options with flexible exercise dates. Some options become effective or defective when a specific barrier price is reached, while others require the value of the security to move through the price. Barrier options can also include modified touch provisions, such as one touch or multiple touches. They can also have provisions for two or more barriers.