Management Discussion and Analysis MD A Definition and Example

Management Discussion and Analysis (MD&A) is a section of a company’s annual report or quarterly filing where the company’s management and executives present an analysis of the company’s performance with qualitative and quantitative measures.

Key Takeaways

– MD&A is a section within a company’s annual report or quarterly filing where executives analyze the company’s performance.

– The section can also include a discussion of compliance, risks, and future plans, such as goals and new projects.

– The MD&A section is not audited and represents the thoughts and opinions of management.

– Companies often use the MD&A section to invoke confidence in investors by explaining how and why future plans of the company will be successful.

– However, the MD&A section is less helpful as management does not want to reveal too much of its forward-looking plans in a publicly-available, required filing.

Understanding Management Discussion and Analysis (MD&A)

In the MD&A section of the annual report, management provides commentary on financial statements, systems and controls, compliance with laws and regulations, and actions taken to address challenges the company is facing. Management also discusses the upcoming year by outlining future goals and approaches to new projects. The MD&A is an important source of information for analysts and investors who want to review the company’s financial fundamentals and management performance.

The MD&A is included in a public company’s annual report to shareholders. The SEC mandates 14 items to be included in the 10-K report, with the MD&A section being item #7.

The MD&A section is not audited and includes the opinions of management.

Requirements for MD&A

MD&A should provide a balanced presentation that includes both positive and negative information about the topics discussed. These statements must be based on fact, and there must be an attempt to paint a balanced picture of the company’s future prospects.

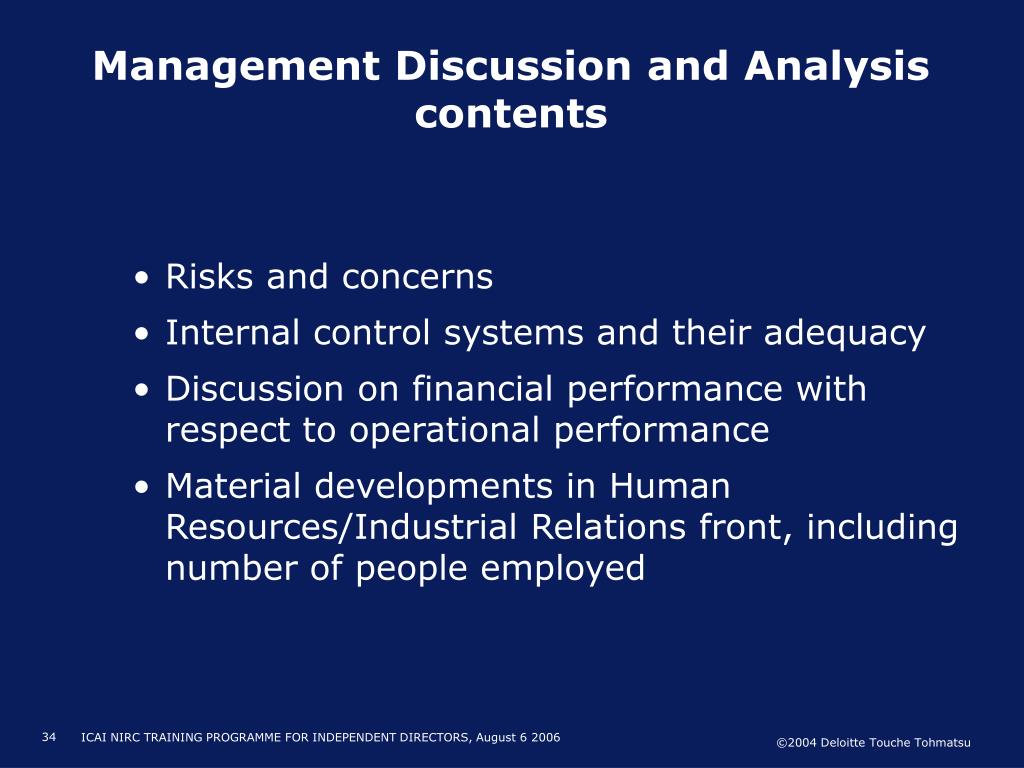

What Is Covered in MD&A?

The MD&A section often includes an "Overview and Outlook" section to explain the future of the organization. Management also discusses liquidity, solvency, and capital resources. This section explains the results of operations, unusual events, material transactions, and successes. It also reveals management’s estimates used for accounting practices.

Limitations of MD&A

The MD&A section primarily uses words to explain a financial position instead of numbers, allowing management to use language to manipulate financial performance. The section is subject to management interpretation and may not materialize as expected.

Example of MD&A

Amazon’s 2021 10-K filing provides a forward-looking projection and overview of operations. The wording in this section is vague to protect intellectual property and strategic plans.

Is Management Discussion and Analysis Part of the Financial Statements?

Yes, the MD&A section is included in the notes to the financial statements.

Is MD&A Mandatory?

Yes, the MD&A section is a standard piece of financial statements.

What Is the Purpose of Management Discussion and Analysis?

The purpose of MD&A is to shed light on the company’s financial position, performance, and future plans. It promotes confidence and conveys the company’s financial strategy.

Why Is the Management Discussion & Analysis Section Important?

The MD&A section allows management to explain unusual events or material considerations and future plans that are not conveyed in backward-looking financial statements.

The Bottom Line

The MD&A section of financial statements explains how the company performed and will perform. It contains an overview, forward-looking projection, and explanation of management’s judgments.