Loss Given Default LGD Two Ways to Calculate Plus an Example

Loss Given Default (LGD): Two Ways to Calculate, Plus an Example

Loss given default (LGD) is the estimated amount of money a bank or financial institution loses when a borrower defaults on a loan. LGD is depicted as a percentage of total exposure at the time of default or a single dollar value of potential loss. A financial institution’s total LGD is calculated after reviewing all outstanding loans using cumulative losses and exposure.

Key Takeaways

– LGD is an important calculation for financial institutions projecting expected losses due to borrower default.

– The expected loss of a loan is calculated as LGD multiplied by the probability of default and the exposure at default.

– Exposure at default is the total value of the loan when a borrower defaults.

– Cumulative expected losses on all outstanding loans are important for financial institutions.

– LGD is an essential component of Basel II, a set of international banking regulations.

Understanding Loss Given Default (LGD)

Banks and financial institutions determine credit losses by analyzing actual loan defaults. Quantifying losses can be complex and require an analysis of several variables. How credit losses are accounted for on a company’s financial statements includes determining an allowance for credit losses and an allowance for doubtful accounts.

Consider if Bank A lends $2 million to Company XYZ, and the company defaults. Bank A’s loss is not necessarily $2 million. Other factors must be considered, such as collateral, installment payments, and court systems. With these factors considered, Bank A may have sustained a smaller loss than the initial loan.

Determining the amount of loss is important and a common parameter in most risk models. LGD is an essential component of Basel II as it is used in calculating economic capital, expected loss, and regulatory capital. The expected loss is calculated as a loan’s LGD multiplied by both its probability of default (PD) and the financial institution’s exposure at default (EAD).

Loans with collateral, known as secured debt, benefit both the lender and borrower through lower interest rates.

How to Calculate LGD

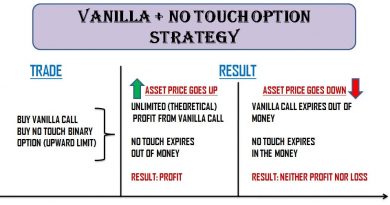

There are different ways to calculate LGD.

One variation considers exposure at risk and recovery rate. Exposure at default predicts the amount of loss a bank may experience when a debtor defaults on a loan. The recovery rate is a risk-adjusted measure to right-size the default based on the likelihood of the outcome.

LGD (in dollars) = exposure at risk (EAD) * (1 – recovery rate)

Another variation compares potential net collectible proceeds to outstanding debt. This formula provides a general ratio of the expected portion of debt to be lost:

LGD (as percentage) = 1 – (potential sale proceeds / outstanding debt)

The first formula is commonly used as it reflects the maximum potential loss. Assessing potential sale proceeds can be difficult, considering collateral assets, disposition costs, timing of payments, and liquidity of each asset.

Loss Given Default (LGD) vs. Exposure at Default (EAD)

Exposure at default is the total value of a loan that a bank is exposed to when a borrower defaults. When analyzing default risk, banks calculate the EAD to predict the amount they will be exposed to when a borrower defaults. Exposure at default changes as a borrower pays down their loan.

LGD takes into consideration any recovery on the default. EAD is the more conservative measurement as it represents a higher figure. LGD relies on multiple assumptions and is often the best-case scenario.

Example of Loss Given Default (LGD)

A borrower takes out a $400,000 loan for a condo. After making installment payments for a few years, the borrower faces financial difficulties. The borrower has an 80% chance of default, and the recovery rate is 20%. The outstanding loan balance is $300,000, and the bank can sell the condo for $200,000 upon foreclosure.

To calculate LGD in dollars:

LGD (in dollars omitting collateral) = $300,000 * (1 – 0.20) = $240,000

LGD can also be calculated as a percentage that incorporates the value of collateral:

LGD (as percentage including collateral) = 1 – ($200,000 / $300,000) = 33.33%

What Does Loss Given Default Mean?

Loss given default is the amount of money a financial institution loses when a borrower defaults on a loan, after considering any recovery, represented as a percentage of total exposure at the time of loss.

What Are PD and LGD?

LGD is the amount of money a bank loses when a borrower defaults on a loan. PD is the probability of default, which measures the likelihood that a borrower will default on their loan.

What Is the Difference Between EAD and LGD?

EAD is the value of a loan that a bank is at risk of losing when a borrower defaults. LGD is the value of a loan that a bank is at risk of losing, after taking into account proceeds from the sale of the asset, represented as a percentage of total exposure.

Can Loss Given Default Be Zero?

LGD can theoretically be zero if a full recovery on the loan is possible. However, this is usually not the case.

What Is Usage Given Default?

Usage given default is another term for exposure at default, which is the total value left on a loan when the borrower defaults.

The Bottom Line

Banks evaluate borrowers and determine the risk factors of lending to them, including the probability of default and potential losses. Calculations like LGD, PD, and EAD help banks quantify their potential losses.