Mac Crawford Early Life and Education Career FAQs

Ann Behan, an experienced writer, specializes in editorial refinement and language efficiency. With over 10 years of experience, she has conducted extensive research, written and edited articles, white papers, and executed searches at the board level across various industries. Her expertise encompasses marketing content, biographies, personal finance, business, and life science.

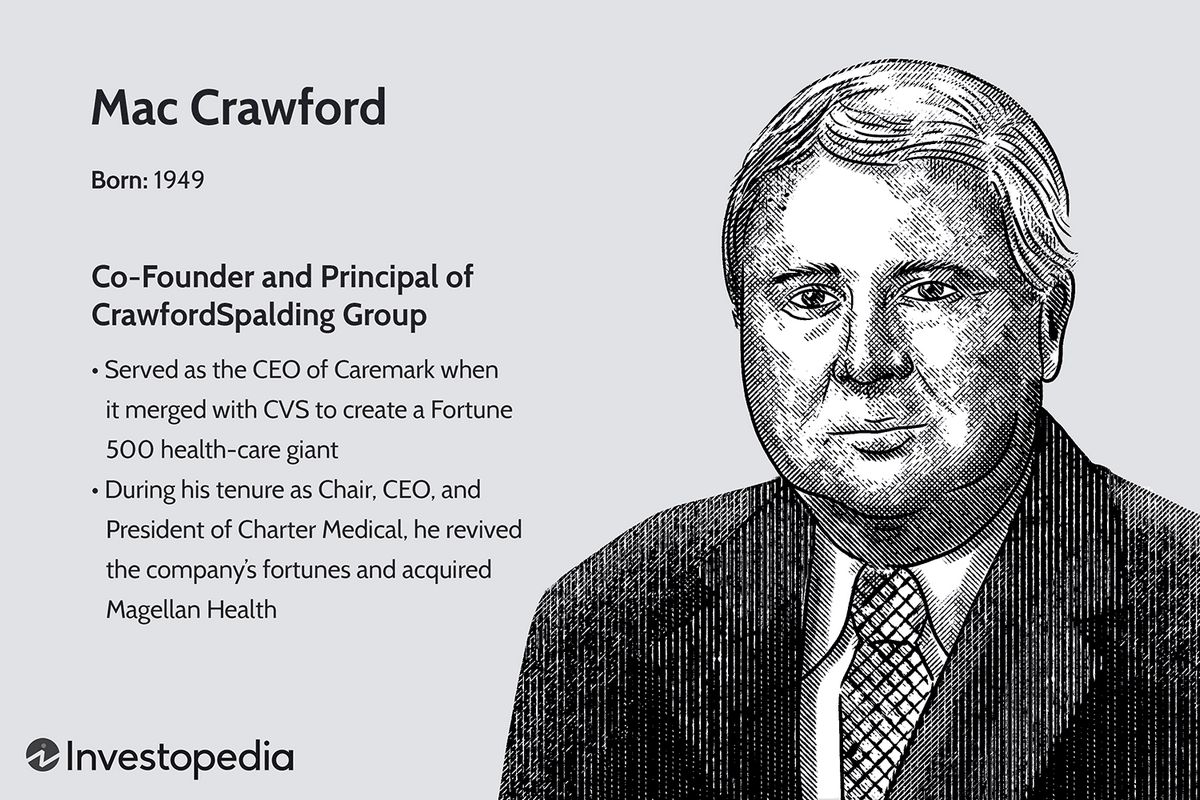

Edwin "Mac" Crawford is widely recognized as a highly successful turnaround CEO and M&A expert in the healthcare industry. He spent the first 15 years of his career (1971 to 1986) in the financial and industrial sectors, holding various roles such as certified public accountant (CPA), chief financial officer (CFO), and President.

In 1990, Crawford’s healthcare career took off when he was recruited to lead the turnaround of Charter Medical, a struggling owner and operator of psychiatric hospitals. During his seven-year tenure, he transformed Charter from bankruptcy to becoming the largest behavioral health services company in the U.S.

Crawford’s leadership was also instrumental in the transformation of MedPartners. He turned a mismanaged company with significant operating losses into Caremark Rx, one of the largest prescription benefits management (PBM) and mail-order pharmaceutical companies in the U.S. Under his guidance, MedPartners then orchestrated a $26.5 billion merger with CVS, resulting in the creation of CVS Caremark, a Fortune 20 company with a value of $75 billion.

After stepping down as Chair of CVS Caremark in 2007, Crawford became the Principal of CrawfordSpalding, an investment banking advisory firm focused on turning around distressed businesses. He has also partnered with JANA Partners, an activist hedge fund, on investments in underperforming healthcare companies.

Here are some key takeaways from Crawford’s career:

– He successfully transformed Charter Medical into the largest behavioral health services company in the U.S.

– He is known for turning around MedPartners and creating Caremark Rx, one of the largest PBM and mail-order pharmaceutical companies.

– He orchestrated the merger between MedPartners and CVS, resulting in the creation of CVS Caremark.

Education and Early Career:

– Edwin "Mac" Crawford earned a B.S. in Accounting from Auburn University in Alabama in 1971.

– He qualified as a certified public accountant (CPA) and worked at Arthur Young for 10 years honing his business and financial management skills.

– Crawford then held CFO roles at GTI, an accounting firm, and Oxylance Corporation, a machine manufacturer, before becoming the President of Mulberry Street Investment Company.

Charter Medical and Magellan Health (1990-1997):

– Crawford joined Charter Medical in 1990 as Executive Vice President of Hospital Operations when the company was experiencing serious financial and leadership challenges.

– He quickly developed and executed a strategy to turn Charter around by restructuring the company and focusing on cost-effective behavioral healthcare in outpatient and home-based settings.

– Crawford led the acquisition of Magellan Health Services, one of Charter’s competitors, and renamed the combined company Magellan Health Services, becoming its Chair, CEO, and President.

MedPartners and Caremark Rx (1998-2007):

– Crawford was appointed Chair and CEO of MedPartners in 1998, tasked with turning around the company after it experienced massive operating losses and debt obligations.

– Recognizing the growth potential of prescription benefit management (PBM) businesses, Crawford sold off MedPartners’ physician practice management (PPM) operations and focused on developing Caremark Rx.

– Under his leadership, Caremark Rx grew into one of the largest PBM and mail-order pharmaceutical companies in the U.S., with significant revenue growth and successful acquisitions.

CVS Caremark (2007):

– Crawford orchestrated the $26.5 billion sale of Caremark Rx to CVS, leading to the creation of CVS Caremark, a Fortune 20 company with annual revenue estimated at $75 billion.

– Following the merger, Crawford served as Chair of CVS Caremark before retiring from the Board later that year.

CrawfordSpalding Group (Since 2008):

– Crawford established CrawfordSpalding Group in 2008, an investment banking advisory firm focused on turning around distressed businesses.

– The firm offers strategic, management, and financial services and also invests in struggling client companies.

JANA Partners and WL Ross & Co. LLC:

– Crawford has worked on healthcare investments with JANA Partners, an activist hedge fund, since his retirement from CVS Caremark.

– He has served on boards of companies like Labcorp and Team Health Holdings.

– Crawford has also partnered with Wilbur Ross to co-invest in and restructure healthcare companies.

Crawford’s Impactful Quote:

– In a 2004 article, Crawford emphasized the value of cash flow in restructuring, stating, "Any time you’re doing a restructuring, you need cash flow. Cash is a valuable commodity."

Awards and Charitable Causes:

– Crawford was named the Top-Performing CEO in Healthcare Technology and Distribution by Institutional Investor for three consecutive years: 2005, 2006, and 2007.

– He established The Crawford Family Deanship at Washington and Lee University to support competitive salaries for the Dean and Faculty in the Williams School of Commerce, Economics, and Politics.

In conclusion, Edwin "Mac" Crawford’s successful career as a turnaround CEO and M&A expert in the healthcare industry is characterized by his ability to transform struggling companies and create significant value. From Charter Medical to MedPartners and Caremark Rx, and ultimately the merger with CVS, Crawford has left a lasting impact on the healthcare sector. Today, he continues his work in turning around distressed businesses through his firm CrawfordSpalding and his partnerships with JANA Partners and WL Ross & Co.