Unsecured What It is How It Works Example

Contents

Unsecured: What It is, How It Works, Example

What Is Unsecured?

Unsecured refers to a debt or obligation not backed by collateral.

Collateral is property or valuable assets a borrower offers to secure a loan, found in secured debt. In an unsecured loan, the lender will loan funds based on other borrower qualifying factors, including credit history, income, work status, and existing debts.

Key Takeaways

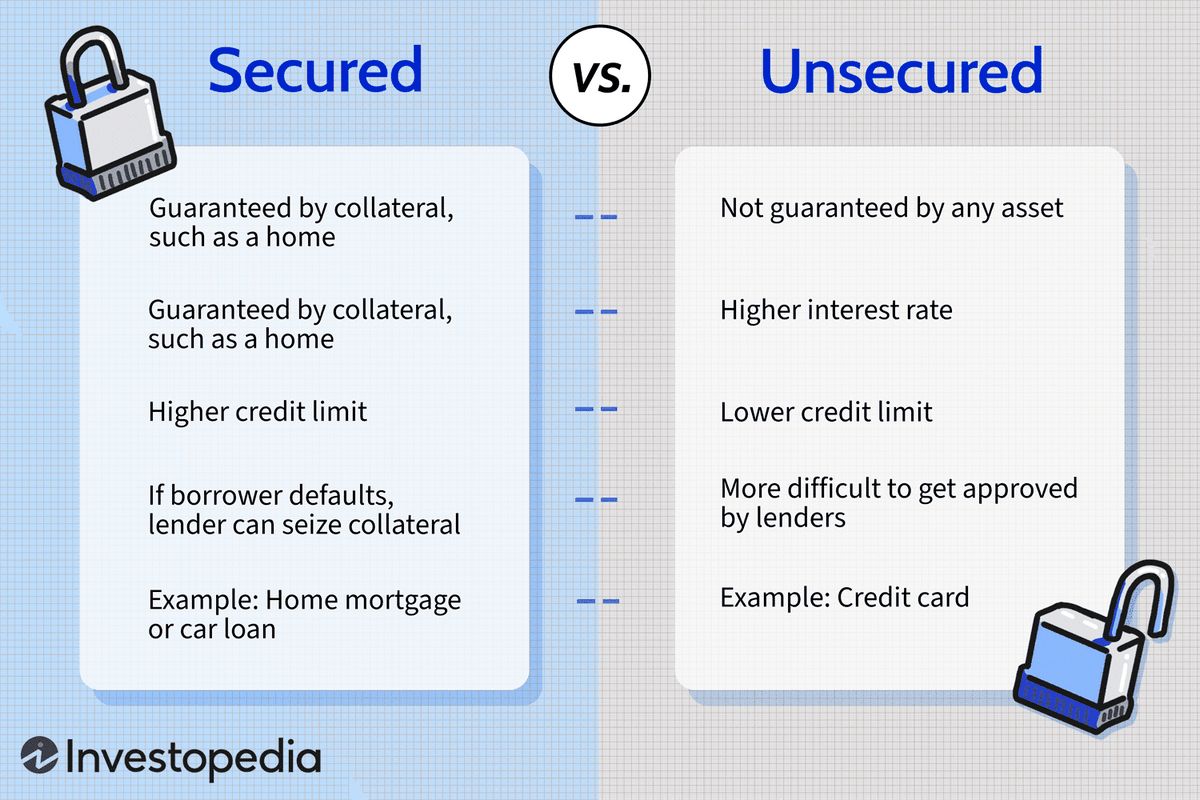

- Unsecured is when a debt is not backed (secured) by collateral, making them riskier than secured debts.

- In the event of default, these obligations must be repaid in other ways than seizing collateral.

- Because they are riskier, unsecured loans carry higher interest rates than secured loans.

- Many personal loans, lines of credit, credit cards, and some business loans or bonds are unsecured.

Understanding Unsecured

Unsecured loans present high risk to lenders. Because there is no collateral to take if the borrower defaults on the loan, the lender has nothing to claim against and cover their costs. Default happens when the debtor is unable to meet their legal obligations to pay a debt. Instead of demanding the collateral, the lender will need to turn to civil actions, including hiring a collection agency and filing a lawsuit to recoup unpaid balances.

Unsecured loans and lines of credit often have high-interest rates to insulate lenders against the risks of loss. The most common forms of unsecured funds are credit cards and personal loans.

Unsecured loans or lines of credit are loans where lending happens without equal value collateral.

Unsecured vs. Secured Loans

Many people are familiar with secured loans like mortgages and auto loans. In both cases, seizing the collateral can happen in the event of default. For mortgages, this is called foreclosure. Once a borrower has missed a payment, the default process has begun. The servicer will complete the legal requirements to reclaim the property that secured the mortgage.

In auto, boat, or other equipment loans, this process is repossession. In both foreclosure and repossession, the borrower will lose the item that secures the loan.

Secured loans or debt have limits set by the value of the collateral offered. For a home mortgage, a borrower may only receive a portion of the total fair market value of the property. Auto, boats, and other loans follow this pattern.

Example: Problems With Foreclosures

With the 2006 housing market crash, foreclosed properties flooded the market. This massive influx of homes drove the value of all houses downward. Before the crash, home values increased exponentially, creating a bubble. When the housing market bubble burst, the problem was two-fold.

First, the surplus of houses led to lower overall home values. More supply than demand forces prices down. This drop in value caused the second shoe to drop. Homeowners seeing the worth of their investment fall hoped to sell. Due to the amount of ready supply, they often found this difficult, if not impossible. They then began to default on their mortgages.

The banks reclaimed these properties but found they could not sell them either. Some banks went under as a result, showing how even secured loans can be risky business. Lending terms have changed dramatically since the 2006 housing crash, and banks are now more conservative as a result.