Mature Economy What it Means How it Works

Mature Economy: What it Means, How it Works

What Is Mature Economy?

A mature economy is a nation with a stable population and slowing economic growth. A population stabilizes or declines when the birth rate equals or is less than the mortality rate.

Key Takeaways

– A mature economy is one with a stable population and slowing economic growth.

– These economies have reached an advanced stage of development, characterized by slowing GDP growth, decreased infrastructure spending, and increased consumer spending.

– Countries with mature economies include the United States, Canada, Australia, Japan, and several Western European nations.

Understanding Mature Economy

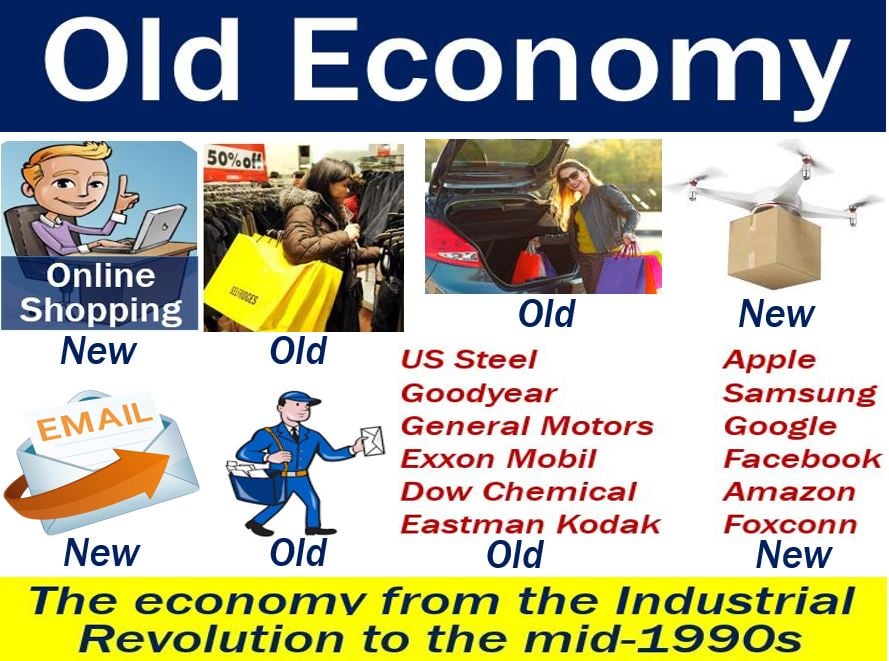

A mature economy has reached an advanced stage of development, as shown by slowing GDP growth, decreased infrastructure spending, and increased consumer spending.

Low population growth and inflation alleviate pressure to create new jobs, as workforce and cost of living do not increase significantly. Simultaneously, a mature economy should have enough growth to financially support retirees as they age and require more care.

Countries with mature economies, also known as the developed world, include the United States, Canada, Australia, Japan, and several Western European nations.

Mature economy status is not permanent. In 2013, Greece became the first developed nation to be downgraded to an emerging market economy after index providers determined that few of the country’s stocks met the criteria. Similarly, frontier markets can upgrade to emerging markets, as was the case for Qatar and Argentina.

Mature Economy vs. Emerging Market Economy

In a mature economy, both population and economic growth have stabilized. Investment focuses more on consumption and quality of life rather than infrastructure and fixed asset growth projects.

In contrast, an emerging market economy refers to a nation progressing toward advanced development through rapid growth and industrialization. These countries play an expanding global role economically and politically.

They often export goods to mature economies and serve as important bases for global manufacturing operations due to lower costs. Emerging market economies may have looser regulations, lower tax rates, inexpensive rents, and labor costs, making them popular business destinations.

Emerging market economies have lower per-capita incomes, higher unemployment rates, more political instability, and lower levels of business activity compared to mature economies. They must make up ground and, as a result, typically display higher economic growth rates.

There is no consensus on which countries are emerging markets, but generally, these less-developed nations can be found in Asia, Africa, Eastern Europe, and Latin America.

Important

The human development index (HDI) evaluates a country’s education, literacy, and health levels, providing a single index to assess its level of development.

Companies in mature economies often seek to take advantage of the growth potential and low operating costs in emerging market economies. They establish manufacturing facilities to boost profits and develop strategies to sell more goods in these nations with large populations, generating higher revenues.

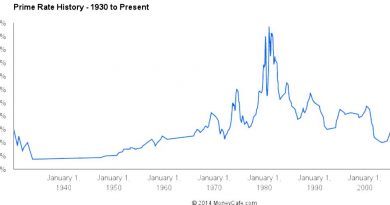

Faster economic growth in emerging economies has attracted the attention of retail investors, but higher returns come with risks. Stocks in emerging economies are more volatile than in mature economies, with risks ranging from inflationary pressures to rising interest rates and signs of a global economic downturn. Additionally, political instability, corruption, currency fluctuations, and changes in regulatory policy are other unique risks for emerging market investments.