Lost Policy Release LPR What it is How it Works

Contents

Lost Policy Release (LPR): What it is, How it Works

What Is a Lost Policy Release (LPR)?

A lost policy release (LPR) is a statement that releases an insurance company from its liabilities. It is signed by the insured party and signifies that the policy in question has been lost, destroyed, or is being retained.

Historically, to cancel an insurance policy, the insured party had to produce the original insurance documents created by the insurance company during underwriting.

Key Takeaways

- A lost policy release (LPR) releases an insurance company from its liabilities.

- In most insurance cases, canceling a policy no longer requires mailing back original documents, so lost policy releases are not necessary.

- An auto insurer may have a policyholder sign a lost policy release when switching to a different auto insurance provider, but this transaction is likely to happen online.

If the policy was lost or misplaced, the insured would then have to demonstrate the intentional cancellation of the policy with a lost policy release.

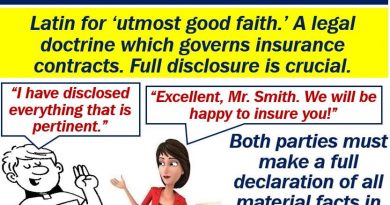

Understanding Lost Policy Releases (LPR)

Lost policy releases generally have standard language. They offer the option to release or cancel a policy, which are essentially the same.

In most modern insurance cases, lost policy releases are not necessary and do not require mailing back the original documents.

An exception may be an auto insurer that might have a policyholder sign a lost policy release when switching to a different provider. Once signed, the insurer is no longer liable for reimbursing losses, although this is typically done online.

Different Types of Cancellation/Lost Policy Releases

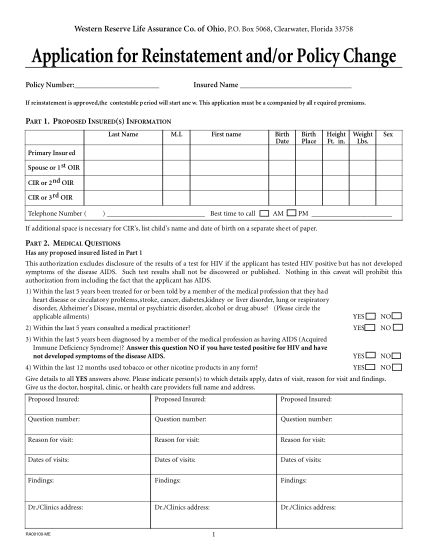

When filling out the lost policy release, also known as a "cancellation/lost policy release," the insured can choose between three types of cancellations: flat, pro-rata, and short rate.

Flat cancellations are used when the coverage never went into effect, and the premium is often refunded in full.

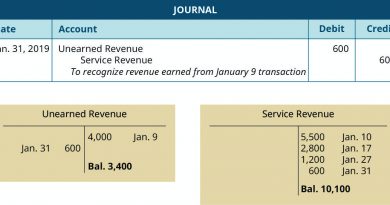

If an insurance policy is canceled before its expiration, the insured may be eligible to receive a portion or all of the remaining unearned premium held by the insurer. This is called a pro-rata cancellation. The unearned premium represents the money collected from the sale of the policy but set aside to cover the liability created during underwriting.

Short rate cancellations are used when the insured fails to pay premiums and the insurance company requests policy cancellation. Lost policy releases may also be used if an insurer issues a replacement policy. Once signed, the insurer is no longer responsible for any claims made after the cancellation date on the replaced policy. However, retaining old policy documents may be wise in case any issues arise regarding the replacement insurance policy.