Merger Arbitrage Definition and How It Works to Manage Risk

Merger Arbitrage: Definition and How It Works to Manage Risk

What Is Merger Arbitrage?

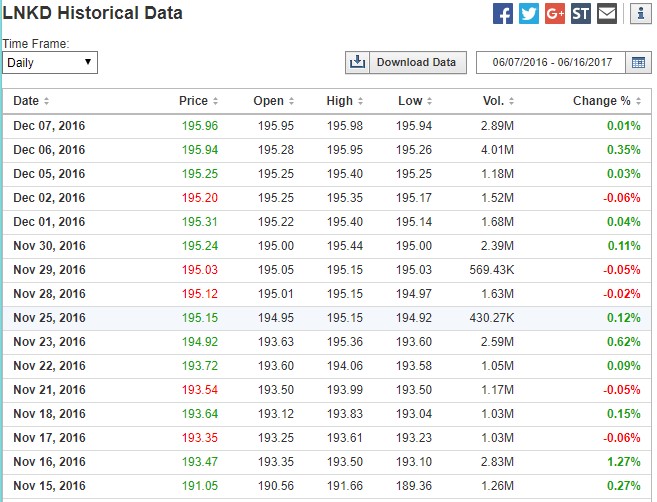

Merger arbitrage, a hedge fund strategy, involves purchasing and selling the stock of two merging companies to create "riskless" profits. Due to uncertainty about the deal’s completion, the target company’s stock price typically sells below the acquisition price. A merger arbitrageur reviews the likelihood of a merger not closing on time or at all and then purchases the stock, expecting a profit when the merger completes.

Key Takeaways

– Merger arbitrage is an investment strategy where an investor simultaneously purchases the stock of merging companies.

– Merger arbitrage takes advantage of market inefficiencies surrounding mergers and acquisitions.

– Merger arbitrage, also known as risk arbitrage, is a subset of event-driven investing or trading, which involves exploiting market inefficiencies before or after a merger or acquisition.

Understanding Merger Arbitrage

Merger arbitrage, also known as risk arbitrage, is a subset of event-driven investing or trading, which involves exploiting market inefficiencies before or after a merger or acquisition. A portfolio manager focuses on the profitability of the merged entity, while merger arbitrageurs focus on the deal’s approval probability and timeline. Merger arbitrage is a strategy that focuses on the merger event itself rather than the stock market’s overall performance.

Special Considerations

When a corporation plans to acquire another corporation, the acquiring company’s stock price decreases, and the target company’s stock price increases. To secure the target company’s shares, the acquiring firm must offer more than their current value. The acquiring firm’s stock price declines due to market speculation about the target firm. However, the target company’s stock price typically remains below the announced acquisition price, reflecting the deal’s uncertainty. In an all-cash merger, investors generally take a long position in the target firm.

If a merger arbitrageur expects a merger deal to break, they may short shares of the target company’s stock. In case of a broken deal, the target company’s share price typically falls to its pre-announcement level. Mergers may break due to various reasons, such as regulations, financial instability, or unfavorable tax implications.

Types of Merger Arbitrage

There are two main types of corporate mergers—cash and stock mergers. In a cash merger, the acquiring company purchases the target company’s shares for cash. In a stock-for-stock merger, the acquiring company’s stock is exchanged for the target company’s stock. In a stock-for-stock merger, a merger arbitrageur typically buys the target company’s stock while shorting the acquiring company’s stock. If the deal is completed, the target company’s stock is converted into the acquiring company’s stock, and the merger arbitrageur can use it to cover the short position.

Additionally, a merger arbitrageur can replicate this strategy using options by purchasing the target company’s stock and purchasing put options on the acquiring company’s stock.