Mortgage Participation Certificate What It is How it Works

A mortgage participation certificate is a security that groups together mortgages held by Freddie Mac, a government-sponsored enterprise. These certificates are guaranteed by Freddie Mac and are taxable. They are also known as pass-through securities because the interest and principal payments are passed to investors from debtors after service fee deductions.

Key Takeaways:

– Mortgage participation certificates are securities made up of mortgages held by Freddie Mac.

– They are guaranteed by Freddie Mac and are considered safe investments.

– These certificates are known as pass-through securities as the payments are passed to investors, minus service fees.

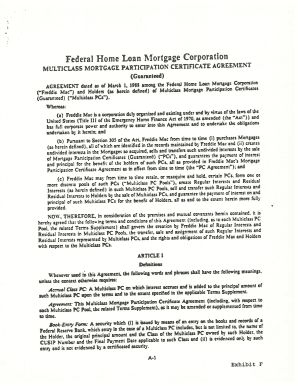

Mortgage participation certificates have been important to Freddie Mac since its founding in 1970. Freddie Mac buys mortgages from banks to increase liquidity and then resells them on the secondary market. Payment delays for PC investors changed after the FIRREA in 1989, and Freddie Mac introduced the Gold program, which pays investors on the 45th day.

Most mortgage participation certificates are for 15- and 30-year mortgages on single-family homes, but certificates for adjustable-rate mortgages are also issued. The minimum pool size is $1 million. While these certificates are generally exchanged for new mortgages, they can also be sold for cash.

Mortgage participation certificates are taxable at all levels of government.

While these certificates are considered safe investments, there are some risks involved. The new Federal Housing Finance Agency has control over Freddie Mac’s financial operations, which could impact the guarantees. Additionally, the secondary market for PCs could be affected if Freddie Mac reduces its mortgage investment portfolio.