Loan-to-Value LTV Ratio What It Is How to Calculate Example

Loan-to-Value (LTV) Ratio: What It Is, How to Calculate, Example

What Is the Loan-to-Value (LTV) Ratio?

The loan-to-value (LTV) ratio is a risk assessment tool used by financial institutions and lenders to evaluate mortgage applications. Loans with high LTV ratios are considered riskier and will have higher interest rates. In some cases, borrowers with high LTV ratios may be required to purchase private mortgage insurance (PMI) to offset the lender’s risk.

Key Takeaways

– LTV is a ratio used in mortgage lending to determine the down payment required and the lender’s willingness to extend credit.

– Lower LTVs are preferred by lenders but require larger down payments.

– Lenders offer the lowest interest rates for LTV ratios at or below 80%.

– Higher LTV ratios result in more expensive mortgages.

– Certain programs allow for higher LTV ratios with mortgage insurance.

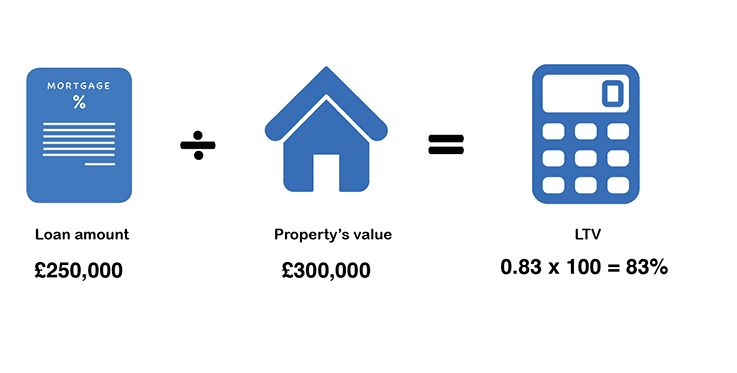

How to Calculate the Loan-to-Value Ratio

To calculate the LTV ratio, divide the loan amount by the appraised value of the property. For example, if you buy a home appraised at $100,000 and make a $10,000 down payment, you will borrow $90,000, resulting in an LTV ratio of 90%.

Understanding the Loan-to-Value (LTV) Ratio

Calculating the LTV ratio is essential in mortgage underwriting. It helps lenders determine the level of risk they are taking on when approving a loan. Higher LTV ratios indicate a greater chance of default because there is little equity built up in the property.

Factors that impact LTV ratios include the down payment, sales price, and appraised value. Higher down payments and lower sales prices result in lower LTV ratios.

How LTV Is Used by Lenders

LTV ratios play a role in determining the interest rates offered to borrowers. Lenders offer the lowest rates when the LTV ratio is at or below 80%. Higher LTV ratios may still result in loan approval but with higher interest rates. LTV ratios above 80% often require private mortgage insurance (PMI).

Mortgage Example of LTV

For example, if you buy a home appraised at $100,000 and make a $10,000 down payment, your LTV ratio is 80%. Increasing the down payment to $15,000 would result in an LTV ratio of 75%.

Variations on LTV Ratio Rules

Different loan types may have different LTV ratio requirements. FHA loans allow an initial LTV ratio of up to 96.5%, but require mortgage insurance. VA and USDA loans do not require mortgage insurance even with an LTV ratio of 100%. Fannie Mae and Freddie Mac programs allow an LTV ratio of 97%, but also require mortgage insurance until the ratio falls to 80%.

LTV vs Combined LTV (CLTV)

While LTV ratios consider only the primary mortgage, the combined loan-to-value (CLTV) ratio includes all secured loans on a property. This includes second mortgages, home equity loans or lines of credit, and other liens. CLTV ratios are used to assess a borrower’s risk when multiple loans are involved.

What Is a Good LTV?

Most lenders consider an LTV ratio of 80% or below to be good. Borrowing costs and loan approval become more challenging as the LTV ratio increases.

Disadvantages of Loan-to-Value

The main drawback of the LTV ratio is that it only considers the primary mortgage and not other borrower obligations, such as second mortgages or home equity loans. The combined loan-to-value (CLTV) ratio provides a more comprehensive measure of a borrower’s ability to repay a home loan.

What Does a 70% LTV Mean?

A 70% LTV ratio indicates that the loan amount is equal to 70% of the asset’s value. For a mortgage, this would mean a 30% down payment and financing the rest.

How Is LTV Calculated?

To calculate the LTV ratio, divide the loan amount by the value of the collateral. For a mortgage, this would be the mortgage amount divided by the property’s value.