Risk Discount What It is How It Works Examples

Contents

- 1 Risk Discount: What It is, How It Works, Examples

- 1.1 What Is a Risk Discount?

- 1.2 Understanding a Risk Discount

- 1.3 Risk Premium vs. Risk Discount

- 1.4 Risk Premiums as Return Drivers

- 1.5 Examples of Risk Discounts

- 1.6 Special Considerations

- 1.7 What Is Risk Tolerance?

- 1.8 How Do You Find the Risk Discount Rate?

- 1.9 How Do You Calculate the Risk Premium?

- 1.10 How Do I Reduce Risk in My Portfolio?

Risk Discount: What It is, How It Works, Examples

What Is a Risk Discount?

A risk discount refers to an investor willing to accept a lower expected return in exchange for lower risk or volatility. The degree to which an individual or firm is willing to trade risk for return depends on their risk tolerance and investment goals.

Key Takeaways

- Risk discount refers to an investor accepting lower expected returns in exchange for lower risk.

- A risk premium is the risk taken above the risk-free rate with the expectation of higher returns.

- The difference between the expected returns of an investment and the risk-free rate is called the risk premium or risk discount.

- Risks that drive higher returns and investors towards risk discounts include equity risk, duration risk, and credit risk.

- Investors choose investments with risk premiums or risk discounts based on their risk tolerance.

Understanding a Risk Discount

The risk premium refers to the minimum expected return an investor will accept to hold an investment with a risk above the risk-free rate. This is the investor’s willingness to accept risk in exchange for return. Those who choose a risk discount tend to be risk-averse.

For example, an investor who takes a risk discount may purchase a high-grade corporate bond with a yield to maturity of 5%, instead of a lower-rated bond from another firm with a yield to maturity of 5.5%. The investor sacrifices the higher return of the second bond for the safety of the first high-rated bond. This is referred to as the risk discount.

Risk Premium vs. Risk Discount

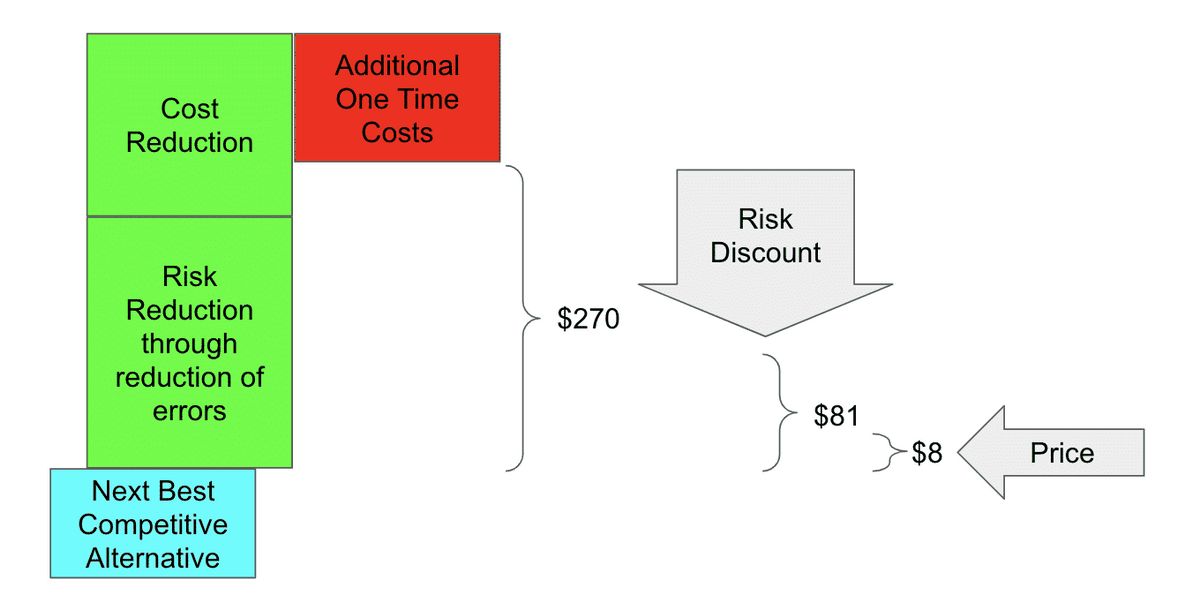

In finance, the risk premium is often measured against Treasury bills, the safest and lowest-yielding investment. The difference between the expected returns of an investment and the risk-free rate is called the risk premium or risk discount, depending on whether the expected returns are above or below the risk-free rate.

In fixed income, the difference between a Treasury bond and another debt instrument of the same maturity but different quality is known as the credit spread.

For stocks, the expected return is measured by combining dividend yields and capital returns. This expected return is not an observable quantity as it is with bonds, though it is believed to exist and is referred to as the equity premium.

A stock would not have a risk discount because it is uncertain which direction the stock’s price will move over a certain period of time. Its price depends on a multitude of factors, so it would be difficult for an investor to gauge their return. Stocks are riskier than bonds or investments with risk-free rates.

One of the safest assets is the U.S. Treasury bill. Because they are low risk, T-bills offer a low rate of return.

Risk Premiums as Return Drivers

The expected returns of investments are driven by varying risks. Investors expect to be compensated for the risks they take, and the sources of those risks vary. Different risk sources, sometimes called return drivers, include equity risk, duration risk, and credit risk.

Investors try to minimize overall risk in their portfolio by constructing one that generates its return from multiple, balanced sources of risk. Those investors who can take on more risk will opt for investments providing higher returns, whereas those who cannot take on significant risks will opt for investments with a risk discount.

The risk discount does not account for the length of time money must be locked up in an investment.

Examples of Risk Discounts

For example, a billionaire may invest $500,000 in an oil pipeline in a war-torn country where, if successful, they would reap millions of dollars in returns. However, if unsuccessful, the billionaire would lose the entire $500,000 without much damage to their other finances.

On the other hand, a single mother of two children working as a waitress might invest $50 a month into a certificate of deposit (CD) with a return of 0.7% annually, instead of investing $100 in a corporate bond of a mediocre company expected to return 8% annually. The mother opts for the safer, lower-yielding investment, whereas the billionaire is comfortable with a risky, possibly high-yielding investment.

Special Considerations

A risk discount does not take into account the time value of money or the length of time that an investment will be locked up. This is expressed by the risk-adjusted discount rate, a metric that measures the value of future payoffs in present-day dollars. The risk-adjusted discount rate places greater discount on long-term investments than on shorter ones, and a greater discount on low-risk investments than on risky ones.

For example, a long-term certificate of deposit needs to pay a higher interest rate than shorter-term CDs because of the length of time that the depositor’s funds are unavailable. Likewise, investors require lower interest rates from highly-rated corporate bonds than they expect from junk bonds. The risk-adjusted discount rate accounts for both the length and risk of an investment.

What Is Risk Tolerance?

Risk tolerance refers to an investor or company’s willingness to undertake high-risk ventures for the chance to earn higher profits. Certain industries, such as venture capital, have extremely high rates of failure, although in rare cases their investments may prove extremely profitable. Conversely, many banks will only lend money to highly predictable business ventures, and their returns are comparatively low as a result.

How Do You Find the Risk Discount Rate?

The risk discount rate is the difference between an investment’s return and the risk-free rate of return. If an investment has a lower return than the risk-free rate, this difference is referred to as the risk discount; otherwise, it is called the risk premium.

How Do You Calculate the Risk Premium?

The risk premium is the additional return of an investment, in excess of the returns on an investment with no risk. This is usually calculated by subtracting the investment’s returns from the interest rate of an extremely low-risk asset, like the U.S. treasury bond. For example, if an investment pays 2% interest and a treasury pays 0.5% interest, the risk premium on that investment is 1.5%.

How Do I Reduce Risk in My Portfolio?

One of the simplest ways to reduce risk is through diversification, spreading out a portfolio among many different companies and types of assets. Since it is extremely unlikely that all of these assets will fail, a well-diversified portfolio will have fewer severe risks than a highly concentrated one.