W-8BEN When to Use It and Other Types of W-8 Tax Forms

W-8BEN: When to Use It and Other Types of W-8 Tax Forms

What Are W-8 Forms?

W-8 forms are IRS forms that foreign individuals and businesses must file to verify their country of residence for tax purposes and qualify for a lower rate of tax withholding.

Key Takeaways

– W-8 forms are used to claim exempt status from certain withholdings.

– There are five W-8 forms: W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY.

– Form W-8IMY is used by intermediaries that receive withholding payments on behalf of a foreigner or as a flow-through entity.

– Determining which form to use depends on whether you’re an individual or entity, the type of income you receive, and whether you qualify for special tax treatment.

– All W-8 forms are valid for the year they are signed and three full calendar years after that.

Who Can File W-8 Forms?

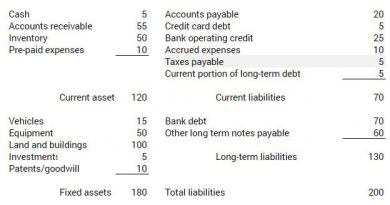

W-8 forms are filled out by foreign individuals or entities without U.S. citizenship or residency but have earned income in the U.S. This applies to foreign-domiciled businesses and non-resident aliens.

For example, a nonresident foreigner who earns interest or dividends from U.S.-issued securities would file a W-8BEN, while a foreign nonprofit with operations in the U.S. might need to file W-8ECI. Former U.S. residents who earn retirement income or occasionally perform freelance work for U.S. clients might also have to submit the form to reduce their tax withholdings. A U.S. citizen or resident alien never has to complete a W-8 form.

Foreign individuals or businesses that earn income in the U.S. must pay a 30% tax on certain income types. The W-8 form collects information on the individual or business, their origin, and the types of income earned.

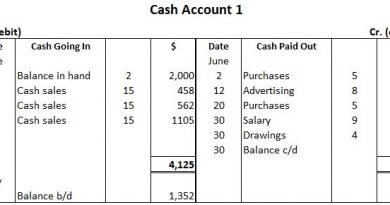

How to File W-8 Forms

There are five W-8 forms, which are requested by payers or withholding agents and kept on file with them, not filed with the IRS.

The W-8 series of forms require basic information such as name, origin country, and taxpayer identification number (TIN). They also ask for income source information. A professional is often consulted to assist in completing these forms.

W-9 forms are also used to provide or confirm a person’s name, address, and TIN, but they are required for U.S. citizens, resident aliens, or U.S. entities.

Types of W-8 Forms

Form W-8BEN

Form W-8BEN is submitted by foreign persons who receive certain types of income in the U.S. It establishes that the individual is a foreign person and the owner of the business in question.

Foreign individuals are subject to a 30% tax rate on specific types of income and capital gains they receive from U.S. payers. The form also helps claim a reduction or exemption from U.S. tax withholding if residing in a country with an income tax treaty with the U.S.

Form W-8BEN is required for nonbusiness income, while W-8BEN-E is used by foreign entities.

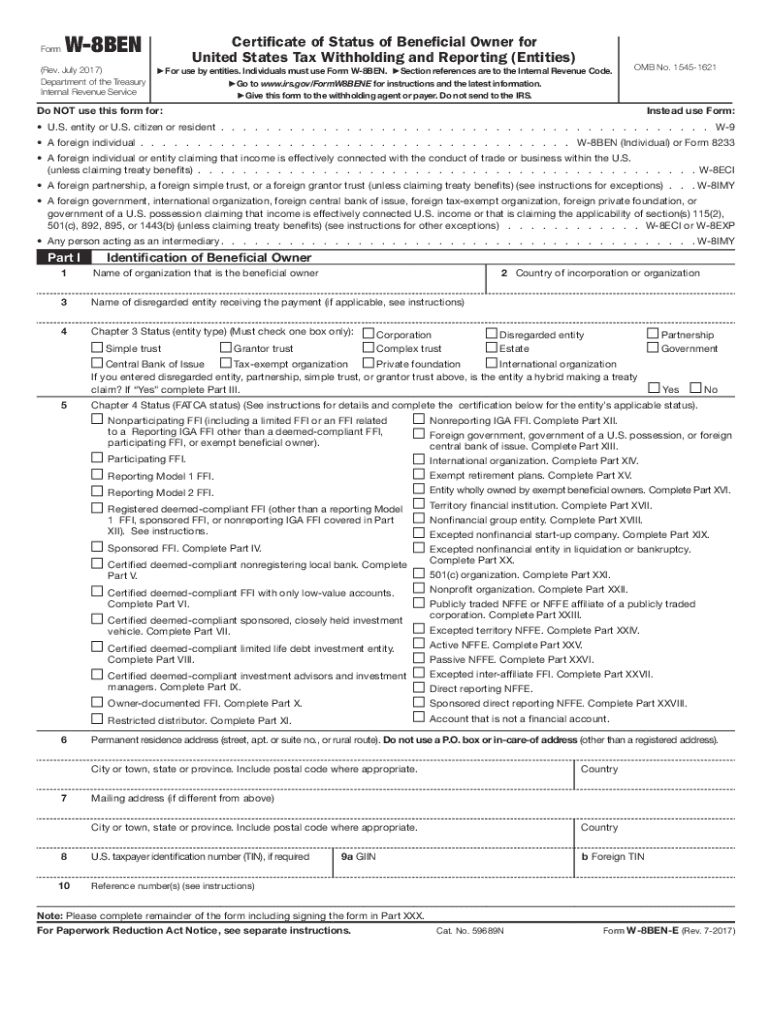

Form W-8BEN-E

Form W-8BEN-E is filed by foreign entities to claim a reduction in taxes if their country of residence has a tax treaty with the U.S. The form is similar to W-8BEN but for businesses rather than individuals.

Form W-8ECI

Form W-8ECI is filed by foreign individuals who engage in a trade or business in the U.S. and receive income from U.S. sources. This income, known as effectively connected income (ECI), is taxed differently from nonbusiness income. ECI is taxed at the graduated rate that U.S. citizens and resident aliens pay, or at the lowest rate under a U.S. treaty.

Form W-8EXP

Form W-8EXP is used by certain payees to claim a tax withholding reduction or exclusion. This includes foreign governments, foundations, tax-exempt organizations, and more. If not eligible for the exemptions, the payee must file either a W-8BEN or W-8ECI.

Form W-8IMY

Form W-8IMY is filed by intermediaries to certify that they received withholdable payments on behalf of a foreigner or as a flow-through entity.

What Is a W-8BEN?

Form W-8BEN is submitted by foreign individuals who receive income in the U.S. It establishes the person’s foreign status as an individual and owner of a business.

Who Needs to Fill Out Form W-8BEN?

Form W-8BEN is used by foreign individuals who receive income from U.S. sources. U.S. persons do not file this form.

How Do I Get My W-8BEN?

Form W-8BEN is sent by the paying company to the individual. It should be returned to the company, not the IRS, before the first payment.

Why Is a W-8BEN-E Required?

The W-8BEN-E is required for foreign businesses to claim a reduced tax rate, just like individuals. It helps establish eligibility for reduced rates.

In conclusion, W-8 forms are essential for foreign individuals and entities to verify their residency and qualify for lower tax withholding rates in the U.S. There are specific forms to be used based on individual or business status and the type of income earned. Proper completion of these forms ensures compliance with tax regulations.