Modified Accrual Accounting Definition and How It Works

Modified Accrual Accounting: Definition and How It Works

Skylar Clarine is a fact-checker and expert in personal finance with experience in veterinary technology and film studies.

What Is Modified Accrual Accounting?

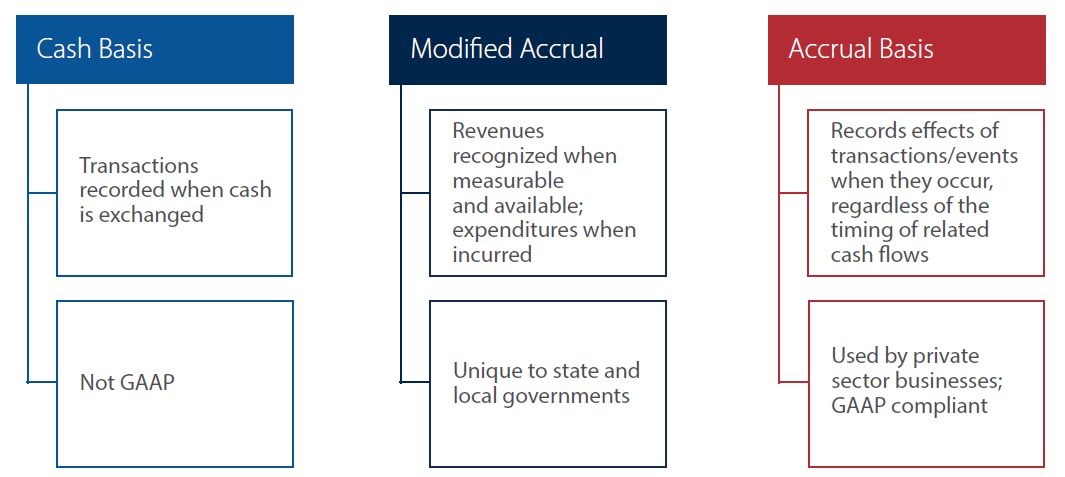

Modified accrual accounting combines accrual basis accounting with cash basis accounting. It recognizes revenues when they become available and measurable, and records expenditures when liabilities are incurred. This method is commonly used by government agencies.

Key Takeaways

– Modified accrual accounting combines accrual basis accounting with cash basis accounting.

– This system combines the simplicity of cash accounting with the ability of accrual accounting to match revenues with expenses.

– Modified accrual accounting borrows elements from both cash and accrual accounting depending on the terms of the assets.

– Public companies cannot use modified accrual accounting for financial statements due to non-compliance with International Financial Reporting Standards (IFRS) or generally accepted accounting principles (GAAP).

Understanding Modified Accrual Accounting

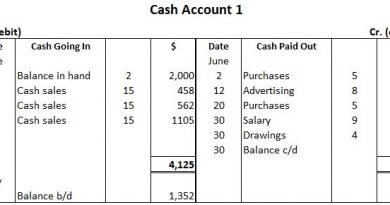

To understand how modified accrual accounting works, it is essential to break down traditional bookkeeping practices.

– Cash basis accounting recognizes transactions upon the exchange of cash. Expenses and revenue are recognized only when payment has been made.

– Accrual accounting recognizes expenses when incurred and revenue when a legal obligation has been created.

Modified accrual accounting borrows elements from both cash and accrual accounting, depending on the terms of the assets.

Recording Short-Term Events

The modified accrual practice follows the cash method of accounting when short-term economic events occur. This rule results in almost all items on the income statement being recorded using the cash basis, with accounts receivable and inventory not recorded on the balance sheet.

Recording Long-Term Events

Economic events expected to impact multiple reporting periods are recorded using rules similar to the accrual method. Fixed assets and long-term debt are documented and depreciated, depleted, or amortized over their lifespan. This systematic distribution improves comparability in future financial statements.

Special Considerations

Modified accrual accounting combines the simplicity of cash accounting with the ability of accrual accounting to match revenues with expenses. It is not commonly used by public companies due to non-compliance with IFRS or GAAP. Public companies that choose to use this method must convert transactions to accrual accounting for auditing.

Government Friendly

For governments, modified accrual accounting is different. The Government Accounting Standards Board (GASB) establishes modified accrual accounting standards for state and local governments. It enables government agencies to focus on current-year obligations and demonstrate whether resources are being used according to budgets. Companies may also use a modified cash basis method for internal record keeping.