Wealth Tax Definition Examples Pros Cons

Wealth Tax: Definition, Examples, Pros & Cons

What Is a Wealth Tax?

A wealth tax is a tax on the market value of assets owned by a taxpayer. Some developed countries choose to tax wealth, although the United States has traditionally relied on taxing annual income for revenue.

Recently, the immense disparity in wealth in the United States prompted politicians like Sen. Bernie Sanders and Sen. Elizabeth Warren to propose a wealth tax in addition to the income tax. In March 2021, Warren introduced S.510 to impose a tax on the net worth of very wealthy individuals.

Key Takeaways

– A wealth tax is a tax on the net fair market value of a taxpayer’s assets.

– It applies to various asset types held by a taxpayer, including cash, bank deposits, shares, fixed assets, personal cars, real property, pension plans, money funds, owner-occupied housing, and trusts.

– France, Norway, Spain, and Switzerland have wealth taxes.

– U.S. politicians have proposed a wealth tax to distribute the tax burden more fairly.

Understanding Wealth Taxes

A wealth tax, also called capital tax or equity tax, is imposed on individuals’ wealth. It usually applies to a person’s net worth, which is assets minus liabilities. These assets include cash, bank deposits, shares, fixed assets, personal cars, real property, pension plans, money funds, owner-occupied housing, and trusts.

An ad valorem tax on real estate and an intangible tax on financial assets are examples of a wealth tax. Countries that impose wealth taxes also typically impose income and other taxes.

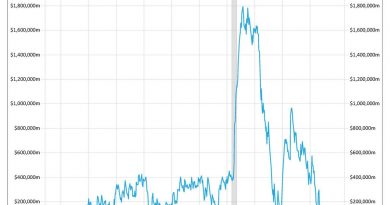

Only four OECD countries currently levy a wealth tax: France, Norway, Spain, and Switzerland. The popularity of this form of taxation is diminishing.

In the United States, federal and state governments do not impose wealth taxes. Instead, the U.S. imposes annual income and property taxes. However, some consider property tax a form of wealth tax. The U.S. also imposes an estate tax on high-value estates, but it contributes relatively little to total tax revenues.

Examples of a Wealth Tax

A wealth tax impacts the net value of a taxpayer’s assets at the end of each tax year. An income tax, on the other hand, impacts the flow of additions to a taxpayer’s value during the year.

Let’s look at an example. Assume a single taxpayer earns $120,000 annually and falls in the 24% tax bracket. That individual’s liability for the year will be $28,800. If the government taxes wealth instead of income, and the taxpayer’s assessed net worth is $450,000, the tax debt for the year will be $108,000.

Annual wealth tax rates are lower than income tax rates. In France, for example, the wealth tax only applies to real estate assets worth more than €800,000. The rates continue to rise at graduated thresholds until real estate assets over €10,000,000 are taxed at 1.5%. A wealth tax cap limits total taxes to 75% of income.

If a taxpayer is not a resident of a particular country, the wealth tax generally only applies to holdings in that country.

S.510: Sen. Warren’s Wealth Tax

Sen. Warren’s proposal for the 2023 tax year includes:

– Taxpayers subject to the wealth tax: those with net assets valued over $50 million

– Tax rates: 2% on net assets valued over $50 million and up to $1 billion; 3% on net assets in excess of $1 billion

– Assets subject to tax: all types of assets owned by the wealthy, including stock, real estate, boats, art, and more

– Revenue effect: estimated to raise up to $3 trillion over 10 years and apply to approximately 100,000 households

The bill had several Senate and House co-sponsors, all of whom are Democrats.

Pros and Cons of a Wealth Tax

Proponents of wealth taxes believe it is more equitable than an income tax alone. They argue that taxing both income and net assets promotes fairness and equality by considering taxpayers’ overall economic status and their ability to pay tax.

Critics allege that wealth taxes discourage wealth accumulation and are difficult to administer. They emphasize challenges in determining the fair market value of assets and concerns of tax evasion.

The administration and enforcement of a wealth tax present challenges not typically seen with income taxes. It also has the potential to drive the wealthy away from countries that impose it. Taxing illiquid assets and addressing administrative and cash flow issues are additional challenges.

Does the United States have a wealth tax?

The United States does not currently have a general wealth tax but may change in the future. Sen. Warren and others are pushing a bill that would tax households and trusts worth over $50 million a percentage of their net worth each year.

What is good about a wealth tax?

Proponents see it as a way to boost public spending by taking extra money from the wealthiest. They argue that the tax will have little impact on their quality of life.

What is the downside of a wealth tax?

A wealth tax is difficult to administer, encourages tax evasion, and can drive the wealthy away from countries that enforce it. These challenges, along with debates about fair implementation, explain why few countries impose such a tax on their residents.