Monthly Income Plan MIP Definition Investments Taxes

Monthly Income Plan (MIP): Definition, Investments, Taxes

A monthly income plan (MIP) is a mutual fund that invests mainly in debt and equity securities, aiming to produce cash flows and preserve capital. Its objective is to provide a steady stream of income through dividends and interest payments, making it attractive to retirees who lack other significant sources of monthly income.

Key Takeaways:

– MIPs are mutual funds that generate stable income through dividend and interest cash flows.

– They invest in lower-risk securities like fixed-income instruments, preferred shares, and dividend stocks.

– MIPs are popular in India and most suitable for retirees seeking stable income instead of capital gains.

– Investors should consider their risk tolerance before investing in MIPs.

– Dividends paid through MIPs are taxed according to the issuing country.

Understanding Monthly Income Plans (MIPs):

A monthly income plan is a type of mutual fund that aims to preserve capital and generate cash flow by investing in a mix of debt and equity securities. It provides an alternative income stream to investors, especially retirees, in the form of dividends or interest payments.

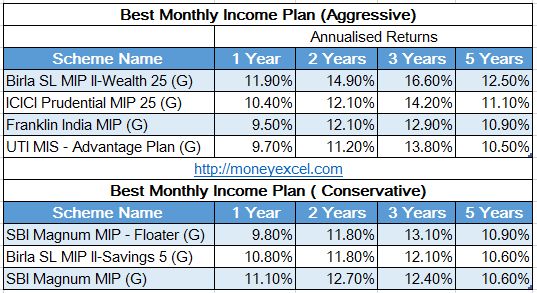

MIPs typically have a conservative investment mix, with a relatively low equity portion. The majority of investments are in debt securities, with a smaller portion dedicated to maximizing profits through equity exposure. This ratio is typically around 20% equity and 80% debt or similar.

Despite the name, MIPs do not guarantee a monthly income. The income stream depends on market conditions, and during bear markets, it may experience a downturn. The level of equity exposure is influenced by market volatility, with stock holdings being a limited portion of the fund. Fluctuations in interest rates can also affect the net asset values (NAVs) of MIPs.

Although MIPs are available to U.S. investors, they are more common in countries like India.

How Monthly Income Plans Invest:

Investors should assess their income needs and risk tolerance before deciding to invest in monthly income plans. It’s important to note that MIPs are not obligated to make monthly dividend payments and may skip them when profits are weak.

A monthly income plan can provide a stable income each month, enabling more accurate monthly budgeting and minimizing the risk of overspending. Different MIPs invest in various types of equities, such as small, medium, or large-sized companies, using a mixed approach.

The Securities and Exchange Board of India (SEBI) prohibits funds from promising returns unless guaranteed by the asset management company. Such guarantees must be disclosed in the offer documents.

Taxation of Monthly Income Plans:

United States:

MIP funds in the United States are taxed based on standard interest and dividend calculations. Short-term capital gains are counted as income and subject to the investor’s income tax rate if the assets are sold before one year. Long-term capital gains (for assets held over one year) are taxed at either 15% or 20% depending on taxable income.

India:

In India, monthly income plans are treated as debt funds for tax purposes. Dividends paid to investors are taxed as income at peak rates, which vary based on the investor’s age and income level. Capital gains tax rates are different for short-term and long-term gains, with short-term gains taxed at 15% and long-term gains generally taxed at 20%.

What Is the Goal of a Monthly Income Plan?

The goal of monthly income plans is to help investors preserve their capital while producing cash flows. These plans typically have a higher ratio of investments in debt securities and a smaller mix of equity-based investments. They are designed for older investors and retirees who desire a steady stream of income.

How Are Monthly Income Plans Taxed?

The taxation of monthly income plans depends on the country where they are offered. In the United States, standard calculations for interest and dividends apply. Short-term capital gains, generated from assets held for less than one year, are taxed as regular income. Long-term gains from investments held for more than one year are taxed at 15% or 20% based on the investor’s income threshold.

What Options Are Available to Investors for Monthly Income?

Investors have several options for monthly income, including mutual fund plans, annuities, government bonds, fixed deposits, dividend-paying stocks, rental properties, and real estate investment trusts (REITs). It is crucial to consult with a financial or investment professional to determine the best options that suit individual circumstances.

The Bottom Line:

Monthly income plans are an excellent way for investors, especially retirees, to ensure a steady income stream. By primarily investing in lower-risk assets like debt securities and balancing it with a smaller equity position, these plans provide dividends and interest income. Although popular in India, they can also be found in other countries like the U.S. As with any financial venture, it’s essential to assess whether MIPs align with individual needs and consider any applicable tax implications. If unsure, seek guidance from an investment or financial professional.