Understanding International Accounting Standards IAS

Contents

Understanding International Accounting Standards

What Are International Accounting Standards?

International Accounting Standards (IAS) were replaced in 2001 by International Financial Reporting Standards (IFRS), which have now been adopted by most major financial markets worldwide. Both sets of standards were issued by the Independent International Accounting Standards Board (IASB) based in London.

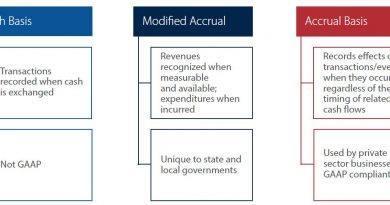

Notably, the United States, China, and Japan have not adopted IFRS. Instead, they follow Generally Accepted Accounting Principles (GAAP), as required by the U.S. Securities & Exchange Commission.

Key Takeaways

- International Accounting Standards were replaced in 2001 by International Financial Reporting Standards (IFRS)

- The United States, Japan, and China are the only major capital markets without an IFRS mandate

- The U.S. accounting standards body collaborates with the Financial Accounting Standards Board to improve and converge GAAP and IFRS

Understanding International Accounting Standards

International Accounting Standards (IAS) were the first global accounting standards issued by the International Accounting Standards Committee (IASC) in 1973. The aim then, as it remains today, was to facilitate comparisons between businesses, enhance financial reporting transparency, and stimulate international trade and investment.

Globally comparable accounting standards promote transparency, accountability, and efficiency in financial markets, enabling informed decision-making by investors and other market participants. They also reduce reporting and regulatory costs for multinational companies.

Moving Toward New Global Accounting Standards

Significant progress has been made in developing a single set of high-quality global accounting standards since the IASC was replaced by IASB. IFRS has been adopted by the European Union, leaving the United States, Japan (which allows voluntary adoption), and China (which is working towards IFRS) as the only major markets without an IFRS mandate.

As of 2022, 144 jurisdictions require IFRS for all or most publicly listed companies, and an additional 12 jurisdictions allow its use.

The United States is considering adopting international accounting standards. The Financial Accounting Standards Board (FASB) and the IASB have collaborated since 2002 to improve and converge GAAP and IFRS. However, progress has been delayed due to the complexity of implementing the Dodd-Frank Wall Street Reform and Consumer Protection Act.

The Securities and Exchange Commission (SEC), which regulates U.S. securities markets, supports high-quality global accounting standards. In the meantime, understanding the similarities and differences between U.S. GAAP and IFRS is crucial for U.S. investors and companies, as they frequently invest abroad. One notable difference is that IFRS is more principles-based, while GAAP is more rules-based.

The Securities and Exchange Commission (SEC), which regulates U.S. securities markets, supports high-quality global accounting standards. In the meantime, understanding the similarities and differences between U.S. GAAP and IFRS is crucial for U.S. investors and companies, as they frequently invest abroad. One notable difference is that IFRS is more principles-based, while GAAP is more rules-based.