W-4 Form

Contents

W-4 Form

Lea Uradu, J.D. is a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, and Tax Writer.

What Is a W-4 Form?

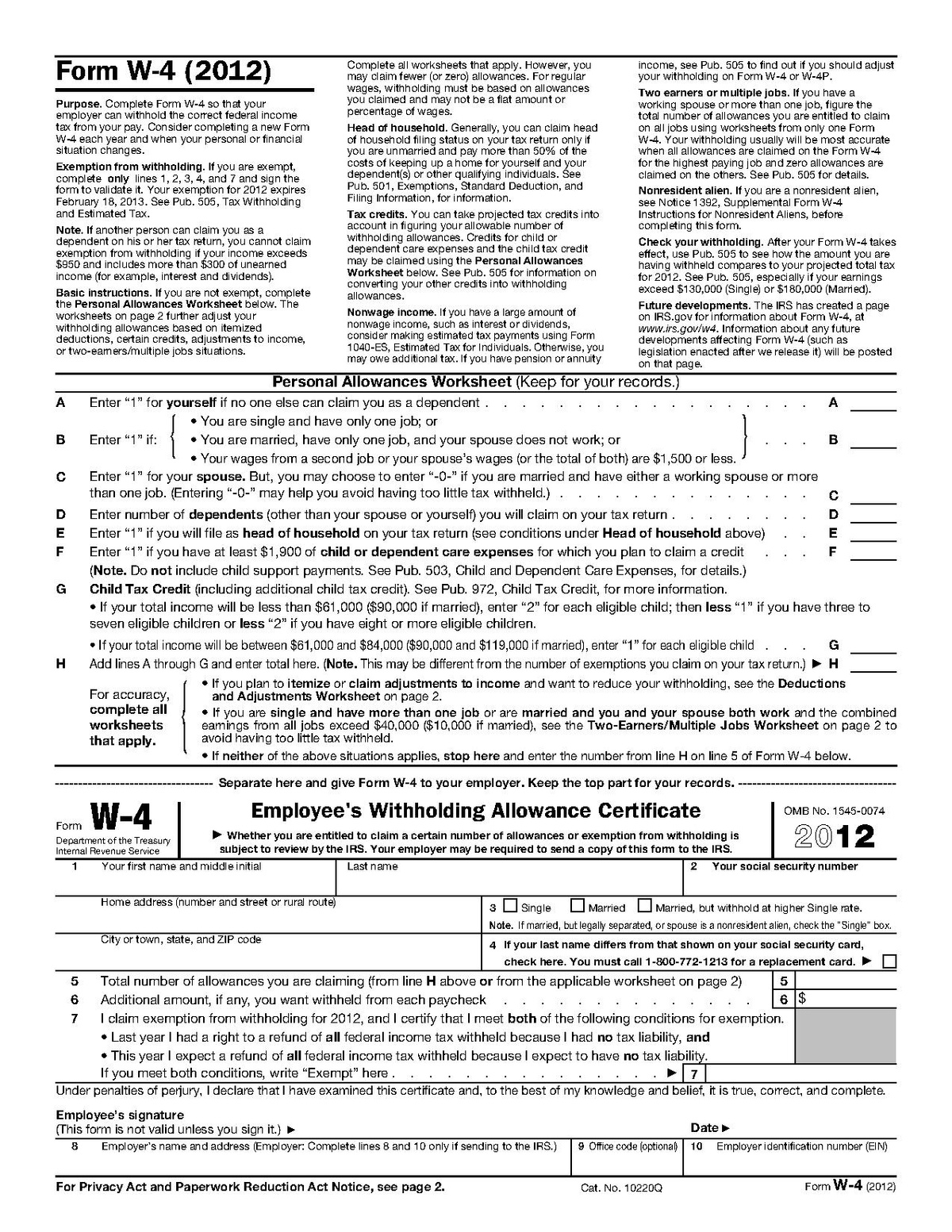

Form W-4 is an Internal Revenue Service (IRS) tax form that employees fill out to indicate their tax situation to their employer. The W-4 form tells the employer the amount of tax to withhold from an employee’s paycheck based on marital status, allowances, dependents, and other factors. The W-4 is also called an Employee’s Withholding Allowance Certificate.

Key Takeaways

- Employees fill out a W-4 form to inform employers about the amount of tax to withhold from their paycheck based on marital status, exemptions, and dependents.

- Increasing allowances on the form decreases the amount of money withheld from the paycheck.

- Taxpayers can file a new W-4 whenever their situation changes, such as marriage, divorce, or having a child, which may affect the amount of tax withheld.

Understanding the W-4 Form

The employee fills out seven lines on the W-4 form. The first few lines include the taxpayer’s name, address, and Social Security number. A worksheet estimates the number of allowances for tax withholding. Increasing allowances reduces the amount of money withheld. An exemption from withholding can be claimed if there was no liability during the previous year and zero tax liability expected in the next year.

The accompanying worksheet starts by allowing taxpayers to add one allowance if they can’t be claimed as a dependent on someone else’s tax return. Additional allowances can be claimed if the employee is single with one job, married with one job and the spouse doesn’t work or has wages less than $1,500 from a second job within the family.

On Jan. 1, 2018, the personal exemption federal tax break was suspended until Jan. 1, 2026, due to the Tax Cuts and Jobs Act.

Line E on the worksheet represents the child tax credit, where employees can claim allowances for eligible children based on income and the number of children.

Line F for the credit for other dependents asks employees to enter allowances for dependents claimed on their tax return. IRS Publication 501 outlines the qualification criteria. There are income limitations for this credit.

For other credits like the earned income credit (EITC), line G is filled out. Worksheets 1-6 in IRS Publication 505 can help calculate additional allowances. The total of all numbers from the previous lines is added on line H.

The worksheet includes additional pages for complex tax situations, such as itemizing deductions instead of taking the standard deduction.

The employer calculates the amount to withhold based on the allowances indicated on the W-4 form. The withheld money is sent to the IRS after each paycheck.

Special Considerations for the W-4 Form

Taxpayers can file a new W-4 whenever their situation changes, such as marriage, divorce, having a child, or the death of a dependent. A change in status can result in the employer withholding more or less tax. The elimination of the personal exemption for tax years 2018–2025 could also affect the number of allowances to be taken.

Taxpayers can file a new W-4 whenever their situation changes, such as marriage, divorce, having a child, or the death of a dependent. A change in status can result in the employer withholding more or less tax. The elimination of the personal exemption for tax years 2018–2025 could also affect the number of allowances to be taken.