Money Factor Definition Uses Calculation and Conversion to APR

Money Factor: Definition, Uses, Calculation, and Conversion to APR

Money factor determines financing charges on a lease with monthly payments. It can be converted to an annual percentage rate (APR) by multiplying it by 2,400.

Money factor is also known as "lease factor," "lease fee," or "lease money factor."

Key Takeaways:

– Money factor is the financing charge on a lease.

– It is similar to the interest rate on a loan and is based on a customer’s credit score.

– It is depicted as a small decimal (i.e., 0.00#).

– Multiplying the money factor by 2,400 gives the equivalent APR.

– A lower money factor is more favorable and negotiable.

How the Money Factor Is Used:

A leased car’s monthly payments include depreciation, taxes, and interest. The money factor is used to determine the interest portion of the payments.

Unlike APR, the money factor is expressed as a decimal. The interest rate and money factor can be obtained from the car dealer or credit union.

Important:

The money factor is determined by a customer’s credit score. Higher credit scores result in lower money factors.

Calculating the Money Factor:

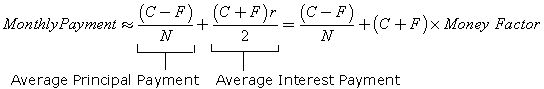

The money factor can be calculated in two ways: through the APR or by using leasing information.

The APR method involves converting the money factor to APR or vice versa using a conversion factor of 2,400.

The leasing information method uses the lease charge, capitalized cost, residual value, and lease term to calculate the money factor.

Special Considerations:

The money factor may be presented as a factor of 1,000. It can still be converted to APR by multiplying it by 2.4.

The money factor is lower than the APR and is affected by the borrower’s credit history, financing company’s rates, and dealer’s markup.

What Is a Good Money Factor?

A lower money factor is more favorable, and a good money factor depends on borrower credit and market conditions. A money factor of 0.0025 and below results in a 6% APR.

How Is Money Factor Calculated?

Money factor can be calculated by multiplying it by 2,400 or using the formula: Money Factor = Lease Charge / (Capitalized Cost * Residual Value) * Lease Term.

Can You Negotiate Money Factor?

The negotiation of money factor depends on the dealer. Some are not negotiable, while others align it with market interest rates.

What Is a High Money Factor?

A money factor of at least 0.0035 results in an 8.4% APR and is considered high by many.

Is Money Factor Based on Credit?

Money factor is largely based on the borrower’s credit score. Higher credit scores result in lower money factors, while lower credit scores result in higher money factors.