Vostro Account Definition Purpose Services and Example

Betsy’s career began in international finance and has evolved into comprehensive journalism, drawing on her experience in academia and professional services.

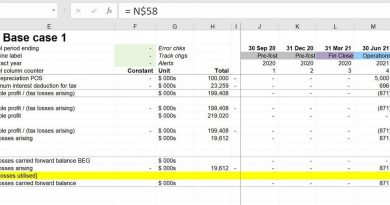

A vostro account is held by a correspondent bank on behalf of another bank. They are essential in correspondent banking, where the holding bank acts as custodian for a foreign counterpart. For example, if a Spanish life insurance company asks a U.S. bank to manage funds on their behalf, the account is considered a vostro account.

Key Takeaways:

– A vostro account is crucial in correspondent banking, with a foreign bank acting as an agent for a domestic bank.

– "Vostro" means "your" in Latin.

– Vostro accounts enable domestic banks to provide international banking services to clients withglobal banking needs.

– Services provided through vostro accounts include wire transfers, foreign exchange transactions, deposits and withdrawals, and international trade facilitation.

Vostro accounts are established to allow foreign correspondent banks to act as intermediaries or agents for domestic banks. They provide services including wire transfers, withdrawals, and deposits in countries where the domestic bank has no physical presence.

Foreign correspondent banks may also offer treasury services, foreign exchange transactions, and international trade facilitation on behalf of the domestic bank. The correspondent bank charges fees for these vostro account services.

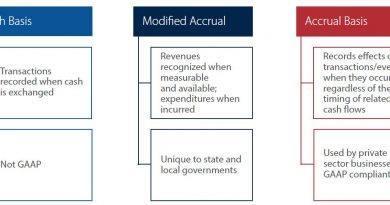

Vostro accounts are distinct from nostro accounts. While vostro means "your" in Latin and refers to funds held by a correspondent bank for other banks, nostro means "our" and refers to funds deposited by domestic banks with correspondent banks. Nostro accounts are denominated in the foreign currency of the correspondent bank.

Vostro accounts are typically used in various situations:

– International Trade: Vostro accounts facilitate transactions, currency conversions, and trade finance operations for importers and exporters.

– Payment Remittance: Vostro accounts are useful for quick and easy cross-border remittance transactions.

– Foreign Currency Transactions: Responding banks can hold money in foreign currencies for currency hedging or foreign exchange trading.

– Cost Mitigation: Vostro accounts help reduce transaction costs related to international transfers and currency conversions.

– Regulatory Compliance: Vostro accounts allow responding banks to comply with regional laws in international marketplaces.

Vostro accounts can also be used in agency relationships where domestic banks establish agreements with correspondent banks to serve customers with global banking needs. Correspondent banks act as fiduciaries and perform agreed-upon financial transactions.

In an intermediary relationship, correspondent banks act as financial intermediaries when wiring funds between domestic and foreign banks. The originator of the transfer sends funds to the vostro account held by the correspondent bank, which deducts fees and executes a domestic wire to the receiving bank. Correspondent banks provide regular reports to the respondent bank to monitor financial activities and maintain oversight.

A vostro account example involves a withdrawal transaction. The domestic bank deducts the withdrawal amount plus fees from the customer’s account and transfers it to the vostro account held by the correspondent bank. The funds are converted to the local currency and paid to the domestic bank’s customer, minus fees.

Vostro accounts benefit banks by expanding their global reach, providing services in foreign currencies, reducing transaction costs, mitigating currency risks, and offering access to local banking infrastructure in foreign markets.

Transactions conducted through vostro accounts include fund transfers, foreign currency exchanges, trade settlements, payment processing, and collection of local currency funds on behalf of respondent bank customers.

Banks holding vostro accounts must maintain detailed transaction records, comply with regulations, and report regularly to local regulatory authorities to prevent illegal activities and money laundering.

Vostro account balances are generally not insured by deposit insurance schemes, but coverage may vary by jurisdiction.

In conclusion, a vostro account is a bank account held by one bank on behalf of another bank, typically in a foreign currency. It enables respondent banks to offer services in foreign markets, leveraging the local banking infrastructure. Vostro accounts support international trade, correspondent banking relationships, foreign currency transactions, and access to local banking services.