Triple-Tax-Free What It Is How It Works

Contents

Triple-Tax-Free: What It Is, How It Works

Cierra Murry is an experienced banking consultant, loan signing agent, arbitrator, and expert in banking, credit cards, investing, loans, mortgages, and real estate. With over 15 years of experience in financial analysis, underwriting, loan documentation, loan review, banking compliance, and credit risk management.

What is Triple-Tax-Free?

Triple-tax-free, or "triple tax-exempt", describes an investment, usually a municipal bond, where the interest payments are exempt from taxes at the municipal, state, and federal levels.

Key Takeaways

- Triple-tax-free municipal bonds incentivize residents to invest in infrastructure improvements.

- These investments usually offer lower returns than taxed investments, exposing bondholders to inflation risk.

Understanding Triple-Tax-Free

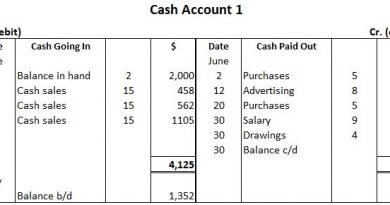

A triple-tax-free municipal bond is a debt security issued by a state, municipality, or county to generate capital for infrastructure projects like schools, bridges, hospitals, or highways. Tax incentives are provided to encourage residents to invest in community-benefiting infrastructure improvements. Triple-tax-free municipal bonds can be general obligation bonds or revenue bonds.

These bonds function similarly to other bond investments. The principal is paid back at maturity, while interest payments are made to bondholders. Being backed by the issuing government, triple-tax-free municipal bonds are considered low-risk investments.

Tax-exempt interest payments are offered to investors due to constitutional limitations on the federal government’s taxation of interest earned on loans to municipalities and states. Many states also exempt interest income from state income tax, further encouraging investment in local communities.

Limitations of Triple-Tax-Free

While there are definite tax benefits to owning these investments, they come with some limitations. Triple-tax-free municipal bonds typically offer lower returns than corporate bonds or taxed investments, potentially exposing bondholders to inflation risk. This occurs when inflation outpaces the interest earned, resulting in a negative rate of return.

The impact of these limitations varies depending on an individual’s tax obligation. Higher-income earners benefit more from tax-free investments, and investors in areas with high state or municipal tax rates find them appealing.