Marginal Tax Rate What It Is and How to Calculate It With Examples

Marginal Tax Rate: A Concise Overview and Calculation Examples

David is an experienced writer specializing in editorial refinement and language efficiency. Having worked as a Dotdash fact checker since 2020, he has validated over 1,100 articles on various financial and investment topics.

Definition: The marginal tax rate refers to the tax rate paid on the highest dollar of income. In the United States, the federal marginal tax rate for individuals increases as their income rises. This progressive taxation method aims to tax individuals based on their earnings, with lower-income earners taxed at a lower rate than higher-income earners.

Key Takeaways:

– The marginal tax rate is paid on the highest dollar of income.

– The progressive income tax method increases the marginal tax rate as income increases.

– Marginal tax rates are divided into seven tax brackets based on income levels.

Understanding the Marginal Tax Rate:

Taxpayers fall into different tax brackets under the marginal tax rate system. The brackets determine the rates applied to different increments of taxable income. As income increases, the last dollar earned is taxed at a higher rate than the first dollar earned. This means that different income ranges fall into different tax brackets.

Note: Tax laws can change and impact marginal tax rates. The Tax Cuts and Jobs Act in the United States, effective since Jan. 1, 2018, revised the seven-bracket structure and adjusted the tax rate percentages and income levels.

Marginal Tax Rate vs. Flat Tax:

In addition to the marginal tax rate system, some states implement a flat tax rate for state income taxes. Unlike the marginal tax rate, the flat tax rate taxes individuals at the same rate regardless of their income level. Flat tax systems typically do not allow for deductions and are often found in countries with growing economies. Supporters argue that it promotes fairness, while opponents believe it favors high-income taxpayers.

Marginal Tax Rate Example:

The table below displays the rates and income levels for three taxpayer types (single, married filing jointly, and heads of household) filing in 2024 for tax year 2023.

Rate Single Married Filing Jointly Heads of Household

10% $0 $0 $0

12% $11,000 $22,000 $15,700

22% $44,725 $89,450 $59,850

24% $95,375 $190,750 $95,350

32% $182,100 $364,200 $182,100

35% $231,250 $462,500 $231,250

37% $578,125 $693,750 $578,100

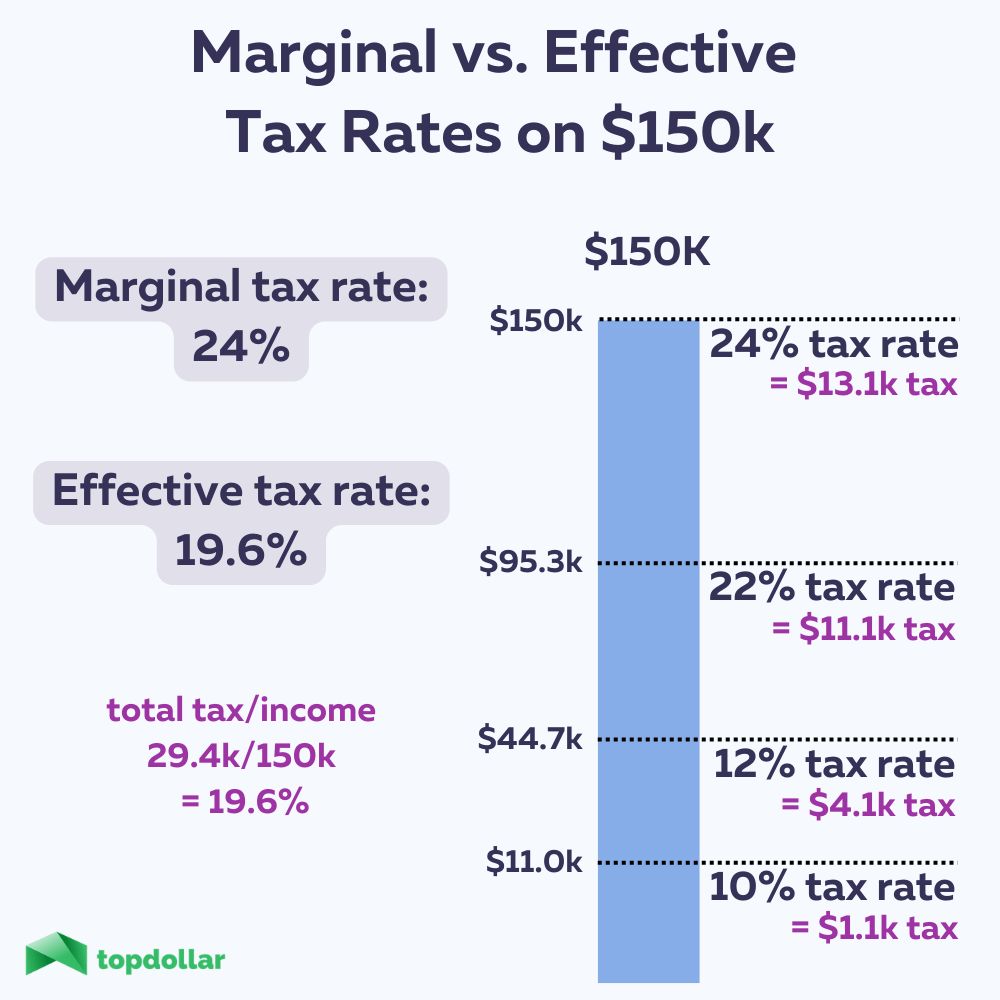

For a single taxpayer with $150,000 taxable income in 2023:

– 10% Bracket: ($11,000 – $0) x 10% = $1,100

– 12% Bracket: ($44,725 – $11,000) x 12% = $4,047

– 22% Bracket: ($95,375 – $44,725) x 22% = $11,143

– 24% Bracket: ($150,000 – $95,375) x 24% = $13,110

– 32% Bracket: Not applicable

– 35% Bracket: Not applicable

– 37% Bracket: Not applicable

The total tax liability for this individual would be $29,400, resulting in an average or effective tax rate of 19.6% ($29,400 divided by total income of $150,000).

Important Note: Marginal tax brackets remain constant regardless of filing status, but the income ranges for each bracket may vary. These ranges are subject to annual adjustments to account for inflation (indexed to the tax code provision).

Effective Tax Rate:

The effective tax rate represents the overall percentage of income that individuals or corporations pay in taxes. For individuals, it considers the average rate at which earned and unearned income is taxed. The effective tax rate for corporations accounts for the average rate at which pre-tax profits are taxed.

Difference Between Effective and Marginal Tax Rates:

The effective tax rate provides a more accurate representation of an individual’s or corporation’s overall tax liability compared to the marginal tax rate, which denotes the highest tax bracket the income falls into. In progressive income tax systems like that of the United States, different rates apply to different income thresholds. As a result, individuals or companies with the same upper marginal tax bracket may have different effective tax rates based on how much of their income falls in that bracket.

Flat Tax:

A flat tax, also known as a regressive tax, applies the same tax rate to all taxpayers, regardless of income bracket. Flat tax systems typically do not tax income from investments such as dividends, distributions, or capital gains. Some view this system as fair since everyone is taxed equally, while others argue it allows high-income taxpayers to pay less than their fair share.

In summary, the United States operates on a marginal tax rate system with tax brackets increasing as income rises. Tax rates are applied to specific income ranges, with progressively larger amounts subject to higher rates. Understanding the difference between marginal and effective tax rates is crucial, as is recognizing the concept of a flat tax system.