Managed Futures Account Meaning Pros and Cons Fees

Contents

- 1 Managed Futures Account: Meaning, Pros and Cons, Fees

- 1.1 What Is a Managed Futures Account?

- 1.2 Understanding Managed Futures Accounts

- 1.3 Advantages and Disadvantages of Managed Futures Accounts

- 1.4 Fees Associated With Managed Futures Accounts

- 1.5 How to Invest in a Managed Futures Account

- 1.6 Special Considerations

- 1.7 What Is Notional Funding?

- 1.8 What Is the Difference Between Managed Futures and Hedge Funds?

- 1.9 What Are Common Managed Futures Strategies?

Managed Futures Account: Meaning, Pros and Cons, Fees

What Is a Managed Futures Account?

A managed futures account is an alternative investment vehicle that focuses on futures contracts and derivative products. It is similar in structure to a mutual fund.

Managed futures accounts in the United States are regulated by the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA).

Key Takeaways

- A managed futures account holds futures, options, and derivatives.

- Regulated by the CFTC and NFA, investment managers of these accounts face additional oversight.

- The demand for managed futures accounts has grown, with assets under management (AUM) approaching $340 billion as of 2021.

- Institutional investors are the target market, but retail investors can invest through mutual funds.

- Managed futures accounts offer diversification due to their low correlation with traditional assets.

Understanding Managed Futures Accounts

Managed futures accounts hold derivatives, such as commodity futures, stock options, and interest rate swaps. Unlike mainstream investment funds, they can leverage their transactions and take both long and short positions.

These accounts are managed by specialized investment managers called Commodity Trading Advisors (CTAs). CTAs have the authority to trade in derivative securities. Commodity Pool Operators (CPOs) invest in derivatives on behalf of a group of investors.

Proponents argue that managed futures accounts reduce portfolio volatility, offer capital efficiency, and provide diversification through exposure to various market sectors. Detractors raise concerns about the lack of long-term performance data and the high fees associated with these accounts.

1949

The year that the first publicly managed futures fund, Futures, Inc., was started.

Advantages and Disadvantages of Managed Futures Accounts

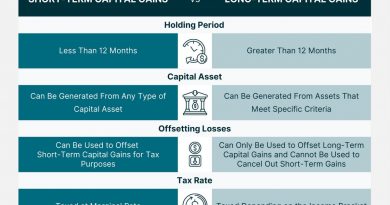

Managed futures accounts are used by institutions to diversify portfolios and have a low correlation with traditional assets. They can take advantage of both rising and falling markets.

However, these accounts are more speculative and have higher fees compared to other funds.

Pros/Cons of Managed Futures Accounts

- Low correlation with stock and bond markets.

- Diversification against risk and volatility for institutional investors.

- Can profit from falling markets.

- High fees compared to other funds.

- Performance bias due to self-reported numbers.

- More speculative than other funds.

Fees Associated With Managed Futures Accounts

Managed futures accounts have higher fees than retail funds. There are two fees to consider: management fees, typically up to about 3% of total assets, and performance fees, where the CTA keeps a share of profit gains.

How to Invest in a Managed Futures Account

Although mainly targeted at institutional investors, retail investors can access managed futures accounts through mutual funds or ETFs.

It is important to compare expense ratios and performance history before investing.

Special Considerations

CTAs and CPOs must register with the CFTC and pass background checks. They also need to file disclosure documents and audited financial statements reviewed by the NFA.

The total funds managed by the CTA industry were reported at $340 billion in the first quarter of 2021.

Derivative markets globally have a total notional value of over $582 trillion.

What Is Notional Funding?

Notional funding leverages the value of a managed futures account by allowing investors to meet minimum requirements with less capital. It increases risk and potential returns.

What Is the Difference Between Managed Futures and Hedge Funds?

Hedge funds trade in various securities, while managed futures accounts only trade in exchange-cleared futures, options, and forward markets.

What Are Common Managed Futures Strategies?

Some common strategies include market-neutral positions within a particular industry and trend trading based on market signals and indicators.