Long-Term Capital Gains and Losses Definition and Tax Treatment

Contents

- 1 Long-Term Capital Gains and Losses: Definition and Tax Treatment

- 1.1 What Is a Long-Term Capital Gain or Loss?

- 1.2 Understanding Long-Term Capital Gain or Loss

- 1.3 Examples of Long-Term Capital Gains and Losses

- 1.4 Can You Deduct a Long-Term Capital Loss?

- 1.5 Is There a Limit on Long-Term Capital Losses?

- 1.6 Does the IRS Track Capital Loss Carryover?

- 1.7 The Bottom Line

Long-Term Capital Gains and Losses: Definition and Tax Treatment

What Is a Long-Term Capital Gain or Loss?

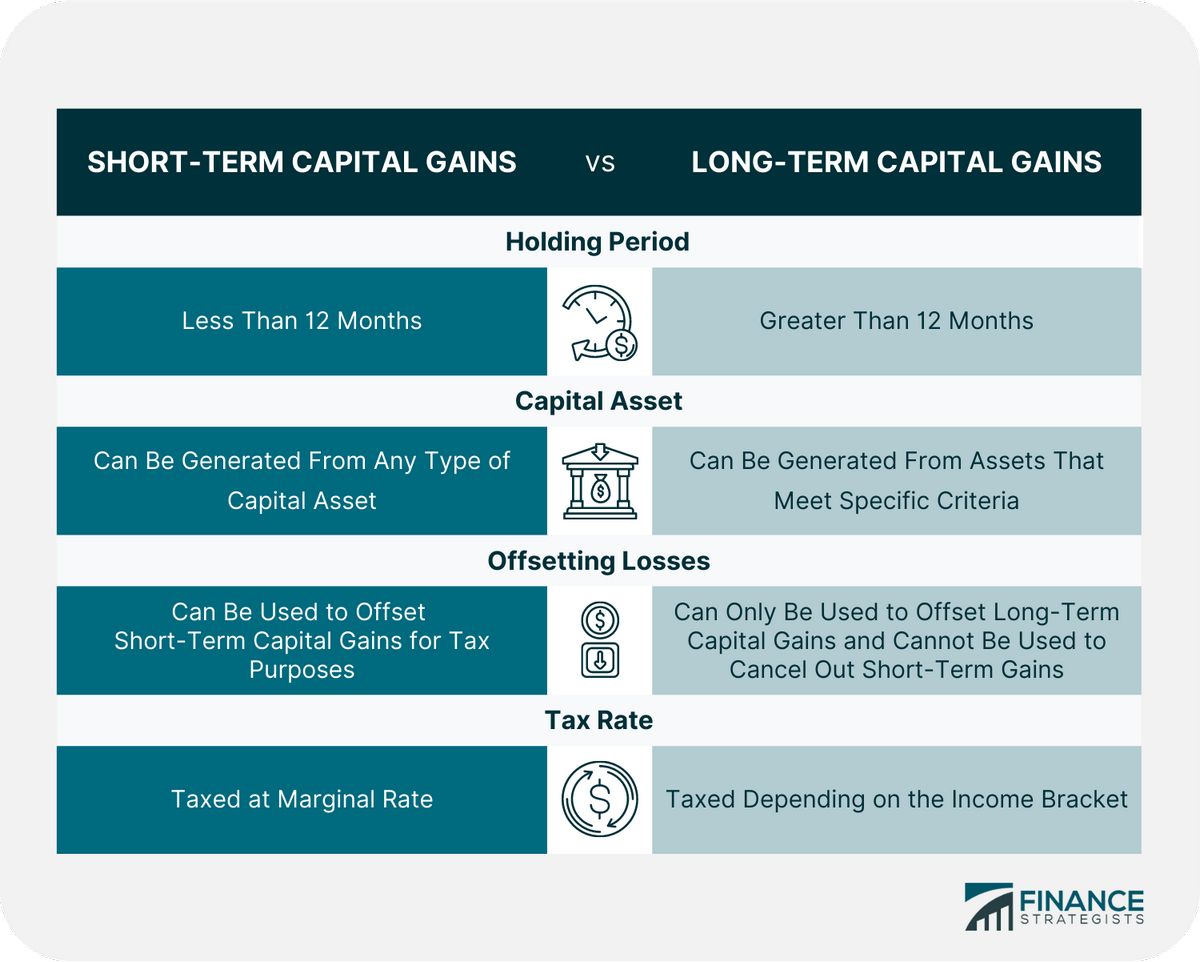

A long-term capital gain or loss is the gain or loss from the sale of a qualifying investment owned for longer than 12 months. This is contrasted with short-term gains or losses on investments disposed of in less than 12 months. Long-term capital gains often receive more favorable tax treatment than short-term gains.

Key Takeaways

- Long-term capital gains or losses apply to investments owned for 12 months or longer.

- Long-term capital gains are often taxed at a more favorable rate than short-term gains.

- Long-term losses can offset future long-term gains.

- For 2023 and 2024, the long-term capital gains tax stands at 0%–20%, depending on the tax bracket.

Understanding Long-Term Capital Gain or Loss

The long-term capital gain or loss is determined by the difference in value between the sale price and the purchase price. This is the net profit or loss from selling the asset. Short-term capital gains or losses are determined by the net profit or loss from selling an asset owned for less than 12 months. The Internal Revenue Service (IRS) assigns a lower tax rate to long-term capital gains.

A taxpayer must report their total capital gains for the year when filing taxes. The IRS considers short-term capital gains taxable income, while long-term capital gains are taxed at a lower rate. As of 2023 and 2024, this rate ranges from 0% to 20% based on the taxpayer’s tax bracket.

Both short-term and long-term losses are treated the same. However, it can take several years to fully deduct a significant capital loss, so it’s important to only sell an investment at a loss if you can make it up.

In each case, you sold one stock for a gain and one for a greater loss. The sum of the gain and loss of the two stocks owned for over a year is your net long-term capital loss. You also sum the gains and losses from the two stocks owned for less than a year for your net short-term capital loss. In both cases, you can add the losses together and deduct or carry over up to $3,000 per year on your tax returns.

Examples of Long-Term Capital Gains and Losses

Imagine Mellie Grant is filing her taxes and has a long-term capital gain from selling her shares of stock in TechNet Limited. Mellie purchased these shares during the initial offering period for $175,000 a few years ago and sells them now for $220,000. She experiences a long-term capital gain of $45,000, subject to the capital gains tax.

The sale of a primary home is taxed differently, even with gains on the sale. If you meet the eligibility requirements, you can exclude up to $500,000 of the home’s sale from gains.

Now assume she is also selling the vacation home she purchased less than a year ago for $80,000. She has not owned the property for very long, so she has not gathered much equity in it. When she sells it only a few months later, she receives $82,000. This presents her with a short-term capital gain of $2,000. Unlike the sale of her long-held shares of stock, this profit will be taxed as income, adding $2,000 to her annual income calculation.

If Mellie had instead sold her vacation home for $78,000, experiencing a short-term loss, she could have used that $2,000 to offset some of her tax liability for the $45,000 long-term capital gains she had experienced.

Can You Deduct a Long-Term Capital Loss?

The IRS lets you deduct and carry over any capital losses to the next tax year. However, you can only claim the lesser of $3,000 ($1,500 if married filing separately) or your total net loss.

Is There a Limit on Long-Term Capital Losses?

There is no limit on how much you can lose, but there is a limit on the capital loss deduction you can claim in one year. If you have a capital loss of more than $3,000, you can deduct $3,000 and carry over the remaining loss to the next tax year.

Does the IRS Track Capital Loss Carryover?

You’re allowed to deduct up to $3,000 in capital losses per year, carrying over any remaining losses into the following year. So, if you’ve experienced $9,000 in capital losses, each year for three years you can deduct $3,000 from your income to offset the loss.

The Bottom Line

Long-term capital gains and losses result from selling an investment owned for more than a year. The IRS provides a tax break for holding investments by reducing taxes on any gains made from a sale. You can deduct or carry over up to $3,000 in capital losses per year until you’ve claimed all the losses.

Long-term capital gains and losses result from selling an investment owned for more than a year. The IRS provides a tax break for holding investments by reducing taxes on any gains made from a sale. You can deduct or carry over up to $3,000 in capital losses per year until you’ve claimed all the losses.