What Is a Bond Option

A bond option is a contract in which the underlying asset is a bond. Like other option contracts, investors can take positions through bond call or put options. Bond options, like all options, allow investors to bet on the direction of underlying asset prices or hedge asset risks in a portfolio.

Key Takeaways:

– A bond option is a contract with a bond as the underlying asset.

– Individuals can buy or sell bond call or put options in the secondary market. Bond option derivatives are more limited than stock or other options contracts.

– Bond issuers incorporate bond call or put options into bond contract provisions.

Types of Options:

Options come in two forms: call options and put options. Call options give the holder the right to buy an underlying asset at a specific price. Put options give the holder the right to sell an underlying asset at a specific price. Most U.S. options allow exercise at any time up to the expiration date.

Market participants use bond options strategically in their portfolios. Hedgers use them to protect existing bond portfolios against adverse interest rate movements. Speculators trade bond options in the hope of making a profit on short-term price movements. Arbitrageurs use bond options to profit from price discrepancies or identify bond market mispricings.

Bond Call Option:

A bond call option gives the holder the right to buy a bond by a specific date for a predetermined price. A secondary market buyer of a bond call option expects a decline in interest rates and an increase in bond prices. If interest rates decline, the investor may exercise their right to buy the bonds.

Consider an investor who buys a bond call option with a strike price of $950. The underlying bond security has a par value of $1,000. Over the term of the contract, interest rates decrease, pushing the bond’s value up to $1,050. The option holder will exercise their right to purchase the bond for $950. If interest rates had increased, pushing the bond’s value below the strike price, the buyer would likely let the bond option expire.

There is an inverse relationship between bond prices and interest rates since prices increase when interest rates decline and vice versa.

Bond Put Option:

The buyer of a bond put option expects an increase in interest rates and a decrease in bond prices. A put option gives the buyer the right to sell a bond at the strike price of the contract. For example, an investor purchases a bond put option with a strike price of $950. The underlying bond security has a par value of $1,000.

If interest rates increase and the bond’s price falls to $930, the put buyer will exercise their right to sell the bond at the $950 strike price. If rates decrease and prices rise past $950, the bond put option holder will let the contract expire and sell the bond at the higher market price.

Embedded Options:

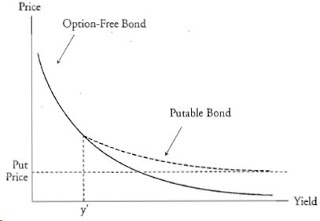

Bond call and put options also refer to option-like features of some bonds. A callable bond has an embedded call option that allows the issuer to buy back its existing bonds before maturity when interest rates decline. The bondholder has effectively sold a call option to the issuer. A puttable bond has a put option that gives bondholders the right to sell the bond back to the issuer at a specified price before maturity.

Another bond with an embedded option is a convertible bond. It has an option that allows the holder to convert bonds into the stock of the issuer at a predetermined price in the future.

Risks Associated With Bond Options:

As with all options, the contract holder is not obligated to exercise. However, non-exercise will result in a loss of the contract’s purchase value and fees. Buyers of call or put options have a maximum loss equal to the purchase value of the option. Selling options creates unlimited loss potential. The option seller is obligated to fulfill their position when the contract holder exercises. Therefore, the buyer and seller hope for two entirely different outcomes.

Where Do Investors Trade Bond Options?

Bond options are less easily found on secondary markets compared to stocks. Most bond options trade over the counter. U.S. Treasury bonds offer secondary market bond options. Investors can also look to options on bond exchange-traded funds (ETFs). Many bond options are embedded with a bond and can be exercised at the request of either the issuer or investor, depending on the embedded bond option provision.

How Are Bond Options Priced?

The top models used in pricing bond options are the Black-Derman-Toy Model and the Black Model. The variables used in both models are primarily the same. The key variables involved in bond option pricing include the spot price, forward price, volatility, time to expiration, and interest rates.

The Bottom Line:

A bond option is a contract in which the underlying asset is a bond. A call option gives the holder the right to buy the bond at a specific price, while a put option gives the holder the right to sell the bond at a specific price. The contract holder is not obligated to exercise the option.