Trading Dollars

Trading Dollars

Trading dollars refers to the breakeven point (BEP) for an investment or financial transaction. This is when the initial investment is fully recovered. It involves moving money from the credit column to the debit side, resulting in a net return of zero.

The concept of trading dollars is commonly found in personal and corporate investments, as well as different markets like the foreign exchange (forex) market.

Key Takeaways

– Trading dollars is the breakeven point on an investment or transaction.

– It is when the investor ends up at the same point as their initial investment.

– This results in a net return of zero, with no profit or loss.

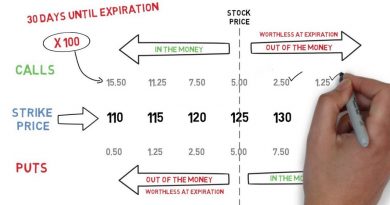

– It can apply to stocks, options, futures, and other trading positions.

Understanding Trading Dollars

The goal of any investment is to generate a return. Some investors make a profit, while others may experience a loss. Trading dollars refers to the breakeven point, where there is neither a profit nor a loss.

In forex trading, trading dollars occurs when gains equal losses. In business development, it happens when the company spends as much as it hopes to earn.

The breakeven point can help protect capital during a flat market, as sudden market movements can affect profitability.

Special Considerations

The idea of sinking money into projects with a flat return on investment is unappealing for most businesses. However, in Zimbabwe, the devaluation of the U.S. currency against itself caused trading dollars to occur at a premium.

Types of Trading Dollars

Trading dollars is applicable in various financial areas, including business development and different markets.

Trading Dollars in Foreign Exchange

In forex trading, gains and losses that cancel each other out are known as trading dollars. Traders use stops to implement a breakeven trading strategy for volatile currency pairs.

Trading Dollars in Business Development

In business development, trading dollars refers to ventures that break even, neither losing nor making money.

Examples of Trading Dollars

For example, a gold exploration company invests $10 million in a project but discovers only $10 million worth of gold. This represents the company’s trading dollars.